Targeted science, Tailored solutions for people with autoimmune disease 42nd Annual J.P. Morgan Healthcare Conference January 9, 2024 Exhibit 99.1

Forward-looking statements 2 This presentation contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. The use of words such as "can," “may,” “might,” “will,” “would,” “should,” “expect,” “believe,” “estimate,” “design,” “plan,” "intend," and other similar expressions are intended to identify forward-looking statements. Such forward looking statements include Immunovant’s expectations regarding patient enrollment, timing, design, and results of clinical trials of its product candidates and indication selections; Immunovant's plan to develop batoclimab and IMVT-1402 across a broad range of autoimmune indications; expectations with respect to for these planned clinical trials; the size and growth of the potential markets for Immunovant's product candidates and indication selections; Immunovant’s plan to explore in subsequent study periods follow-on treatment with alternative dosing regimens; Immunovant's beliefs regarding the potential benefits of batoclimab’s and IMVT-1402's unique product attributes and first-in-class or best-in-class potential, as applicable; whether, if approved, batcolimab or IMVT-1402 will be successfully distributed, marketed or commercialized; and Immunovant's expectations regarding the issuance and term of any pending patents. All forward-looking statements are based on estimates and assumptions by Immunovant’s management that, although Immunovant believes to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that Immunovant expected. Such risks and uncertainties include, among others: initial results or other preliminary analyses or results of early clinical trials may not be predictive of final trial results or of the results of later clinical trials; results of animal studies may not be predictive of results in humans; the timing and availability of data from clinical trials; the timing of discussions with regulatory agencies, as well as regulatory submissions and potential approvals; the continued development of Immunovant’s product candidates, including the timing of the commencement of additional clinical trials; Immunovant’s scientific approach, clinical trial design, indication selection, and general development progress; future clinical trials may not confirm any safety, potency, or other product characteristics described or assumed in this presentation; any product candidate that Immunovant develops may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; Immunovant's pending composition of matter patent for IMVT-1402 may not be issued; Immunovant’s product candidates may not be beneficial to patients, or even if approved by regulatory authorities, successfully commercialized; the effect of global factors such as the post-COVID-19 environment, geopolitical tensions, and adverse macroeconomic conditions on Immunovant’s business operations and supply chains, including its clinical development plans and timelines; Immunovant’s business is heavily dependent on the successful development, regulatory approval and commercialization of batoclimab and IMVT-1402; Immunovant is at an early stage in development for IMVT-1402 and in various stages of clinical development for batoclimab; and Immunovant will require additional capital to fund its operations and advance batoclimab and IMVT-1402 through clinical development. These and other risks and uncertainties are more fully described in Immunovant’s periodic and other reports filed with the Securities and Exchange Commission (SEC), including in the section titled “Risk Factors” in Immunovant’s most recent Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on November 9, 2023, and Immunovant’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Immunovant undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All trademarks, trade names, service marks, and copyrights appearing in this presentation are the property of their respective owners.

Our Company

Our vision: Normal lives for people with autoimmune disease 4 Love Trailblazing All Voices Bolder, Faster What we do: We are developing targeted therapies that are designed to address the complex and variable needs of people with autoimmune diseases.

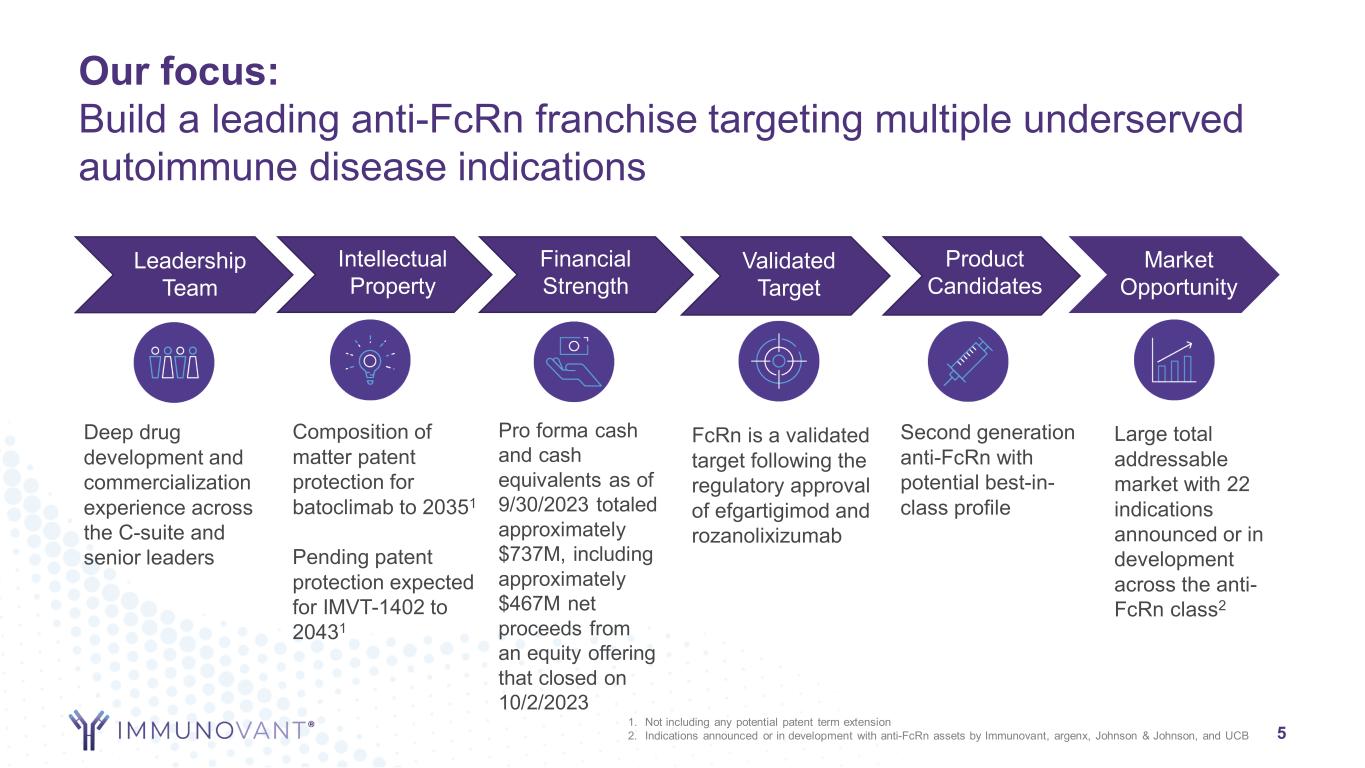

Our focus: Build a leading anti-FcRn franchise targeting multiple underserved autoimmune disease indications 5 Leadership Team Intellectual Property Financial Strength Validated Target Product Candidates Market Opportunity Deep drug development and commercialization experience across the C-suite and senior leaders Pro forma cash and cash equivalents as of 9/30/2023 totaled approximately $737M, including approximately $467M net proceeds from an equity offering that closed on 10/2/2023 FcRn is a validated target following the regulatory approval of efgartigimod and rozanolixizumab Second generation anti-FcRn with potential best-in- class profile Large total addressable market with 22 indications announced or in development across the anti- FcRn class2 Composition of matter patent protection for batoclimab to 20351 Pending patent protection expected for IMVT-1402 to 20431 1. Not including any potential patent term extension 2. Indications announced or in development with anti-FcRn assets by Immunovant, argenx, Johnson & Johnson, and UCB

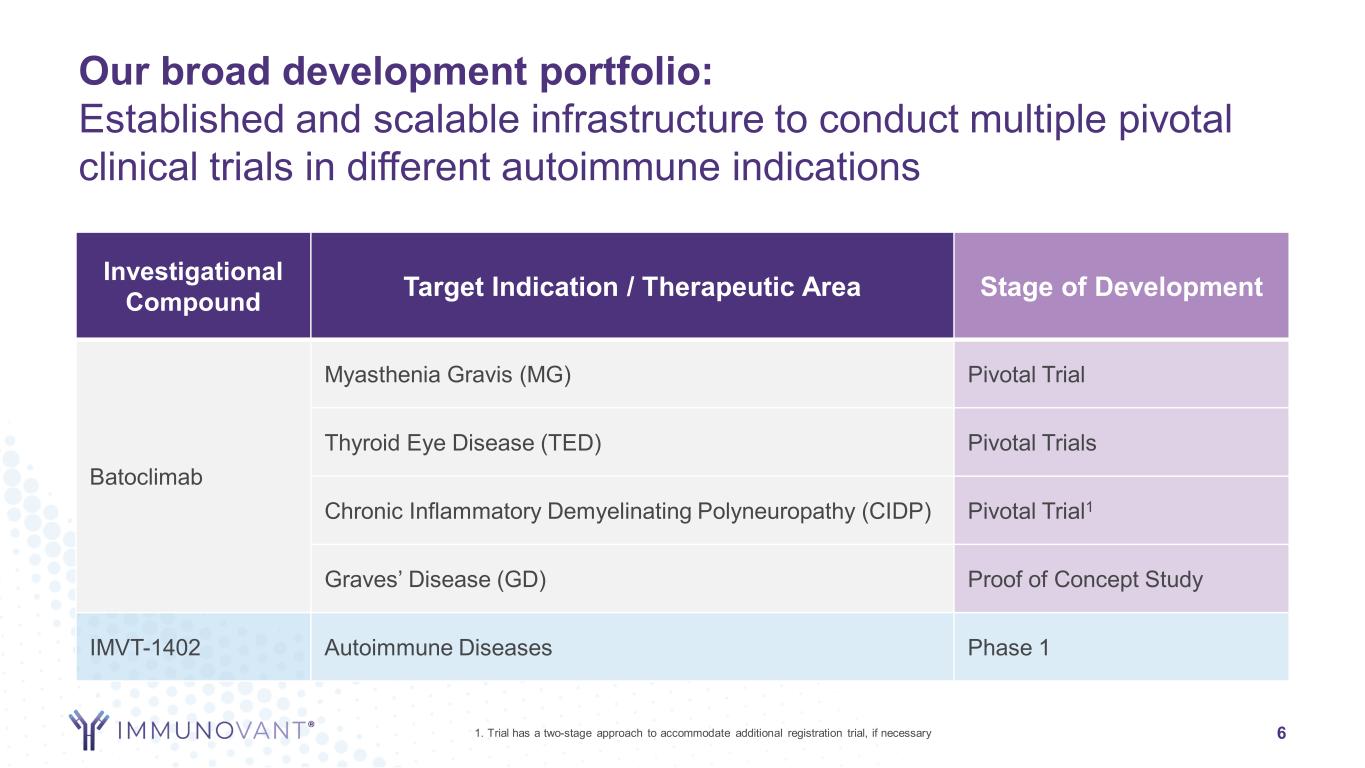

Our broad development portfolio: Established and scalable infrastructure to conduct multiple pivotal clinical trials in different autoimmune indications 6 Investigational Compound Target Indication / Therapeutic Area Stage of Development Batoclimab Myasthenia Gravis (MG) Pivotal Trial Thyroid Eye Disease (TED) Pivotal Trials Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) Pivotal Trial1 Graves’ Disease (GD) Proof of Concept Study IMVT-1402 Autoimmune Diseases Phase 1 1. Trial has a two-stage approach to accommodate additional registration trial, if necessary

Our Market

We believe the anti-FcRn market is unique in terms of biomarker strength and potential indication breadth 8 FcRn inhibition is a validated mechanism with approvals in MG1,2 and 21 other indications in clinical trials We believe a majority of indications in development across the class each has blockbuster potential (>$1BN annual sales) Autoantibody driven diseases are generally treated with older, broad spectrum immunosuppressants or IVIg IgG reduction is a well-established biomarker, which we believe has the potential to accelerate development programs 1. https://www.accessdata.fda.gov/drugsatfda_docs/label/2021/761195s000lbl.pdf; 2. https://www.accessdata.fda.gov/drugsatfda_docs/label/2023/761286s000lbl.pdf

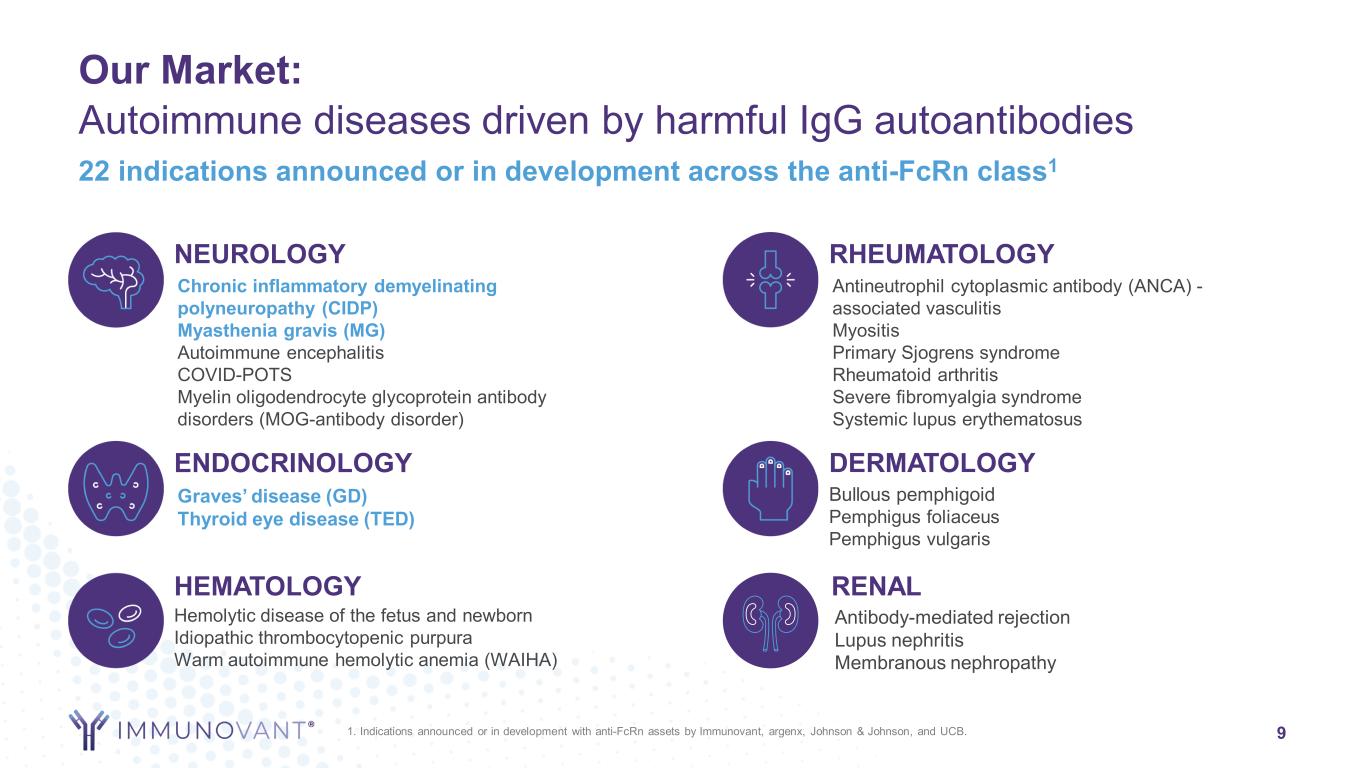

9 22 indications announced or in development across the anti-FcRn class1 ENDOCRINOLOGY Graves’ disease (GD) Thyroid eye disease (TED) NEUROLOGY Chronic inflammatory demyelinating polyneuropathy (CIDP) Myasthenia gravis (MG) Autoimmune encephalitis COVID-POTS Myelin oligodendrocyte glycoprotein antibody disorders (MOG-antibody disorder) HEMATOLOGY Hemolytic disease of the fetus and newborn Idiopathic thrombocytopenic purpura Warm autoimmune hemolytic anemia (WAIHA) RHEUMATOLOGY Antineutrophil cytoplasmic antibody (ANCA) - associated vasculitis Myositis Primary Sjogrens syndrome Rheumatoid arthritis Severe fibromyalgia syndrome Systemic lupus erythematosus DERMATOLOGY Bullous pemphigoid Pemphigus foliaceus Pemphigus vulgaris RENAL Antibody-mediated rejection Lupus nephritis Membranous nephropathy 1. Indications announced or in development with anti-FcRn assets by Immunovant, argenx, Johnson & Johnson, and UCB. Our Market: Autoimmune diseases driven by harmful IgG autoantibodies

Our Differentiation

11 Simple subcutaneous injection To enable self-administration at home Tailored dosing To help alleviate symptoms across disease stage and severity Rapid & deep IgG reduction Strong correlation between deep IgG reduction and increased clinical efficacy Our differentiated value proposition: Three potentially unique attributes to address unmet patient needs

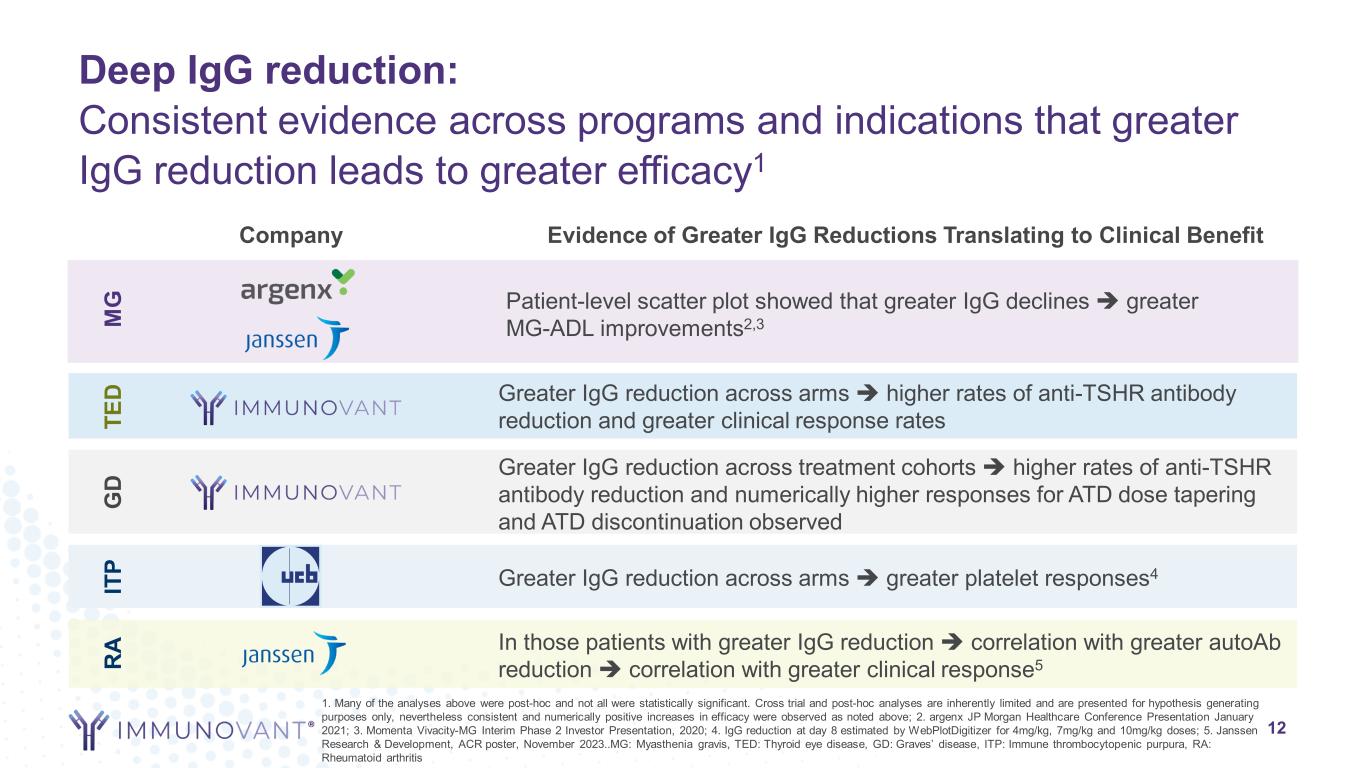

Deep IgG reduction: Consistent evidence across programs and indications that greater IgG reduction leads to greater efficacy1 Company Evidence of Greater IgG Reductions Translating to Clinical Benefit IT P Greater IgG reduction across arms greater platelet responses4 M G Patient-level scatter plot showed that greater IgG declines greater MG-ADL improvements2,3 TE D Greater IgG reduction across arms higher rates of anti-TSHR antibody reduction and greater clinical response rates 12 RA In those patients with greater IgG reduction correlation with greater autoAb reduction correlation with greater clinical response5 1. Many of the analyses above were post-hoc and not all were statistically significant. Cross trial and post-hoc analyses are inherently limited and are presented for hypothesis generating purposes only, nevertheless consistent and numerically positive increases in efficacy were observed as noted above; 2. argenx JP Morgan Healthcare Conference Presentation January 2021; 3. Momenta Vivacity-MG Interim Phase 2 Investor Presentation, 2020; 4. IgG reduction at day 8 estimated by WebPlotDigitizer for 4mg/kg, 7mg/kg and 10mg/kg doses; 5. Janssen Research & Development, ACR poster, November 2023..MG: Myasthenia gravis, TED: Thyroid eye disease, GD: Graves’ disease, ITP: Immune thrombocytopenic purpura, RA: Rheumatoid arthritis G D Greater IgG reduction across treatment cohorts higher rates of anti-TSHR antibody reduction and numerically higher responses for ATD dose tapering and ATD discontinuation observed

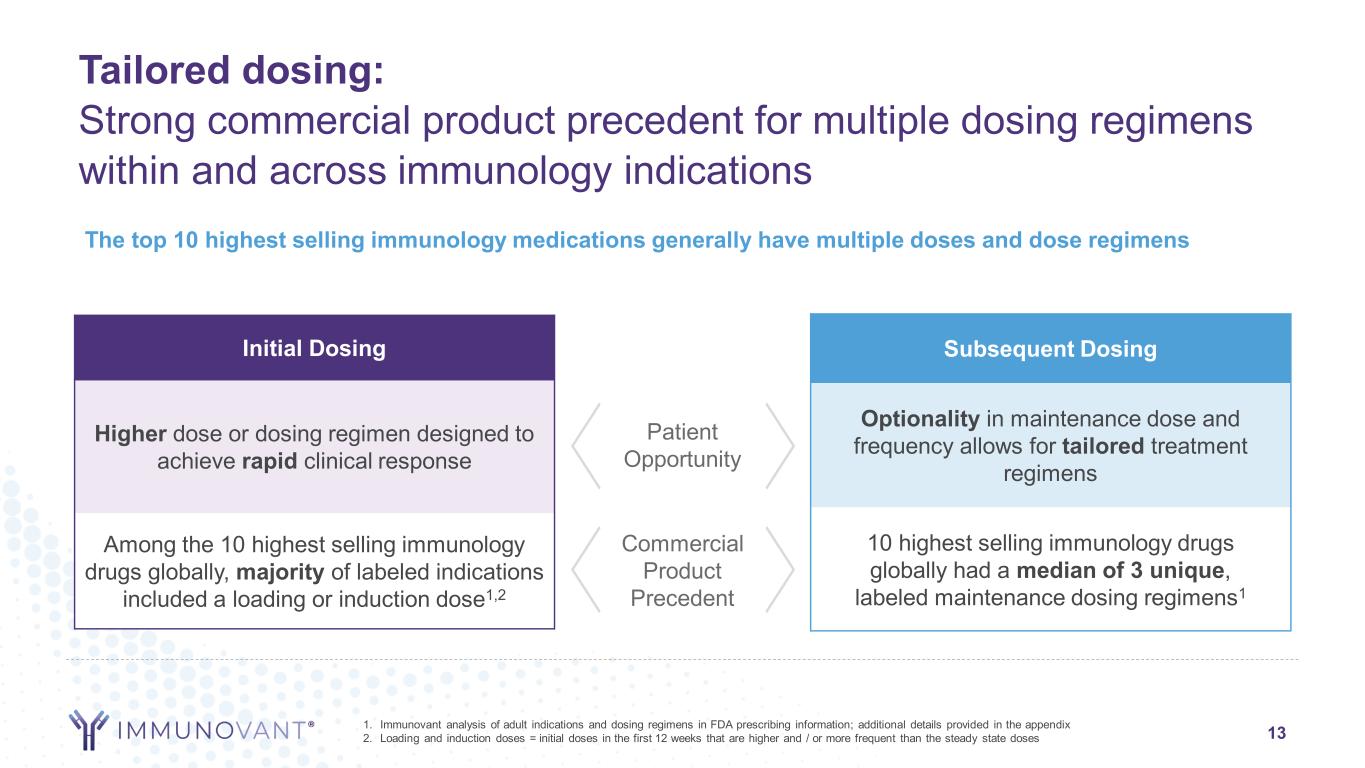

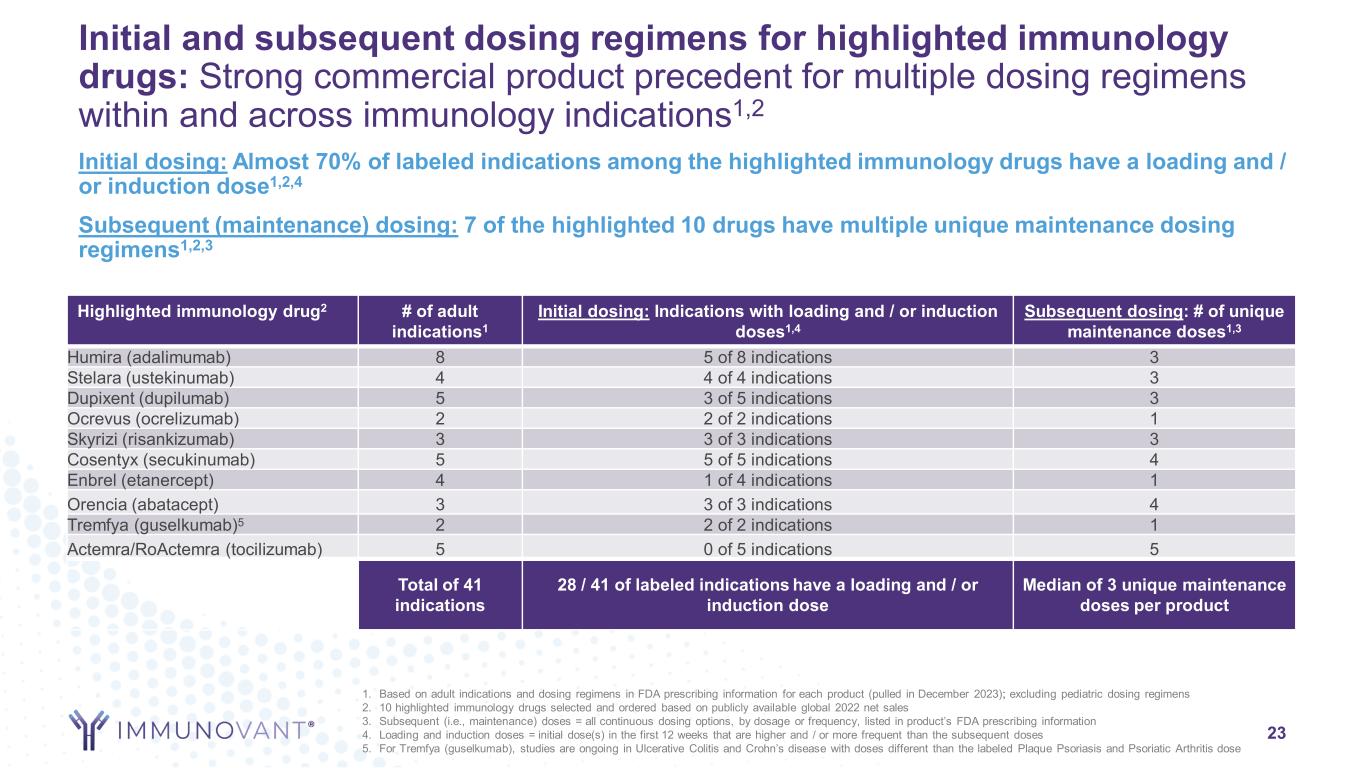

13 Tailored dosing: Strong commercial product precedent for multiple dosing regimens within and across immunology indications 1. Immunovant analysis of adult indications and dosing regimens in FDA prescribing information; additional details provided in the appendix 2. Loading and induction doses = initial doses in the first 12 weeks that are higher and / or more frequent than the steady state doses Subsequent Dosing Optionality in maintenance dose and frequency allows for tailored treatment regimens 10 highest selling immunology drugs globally had a median of 3 unique, labeled maintenance dosing regimens1 Patient Opportunity Commercial Product Precedent The top 10 highest selling immunology medications generally have multiple doses and dose regimens Initial Dosing Higher dose or dosing regimen designed to achieve rapid clinical response Among the 10 highest selling immunology drugs globally, majority of labeled indications included a loading or induction dose1,2

Our Programs

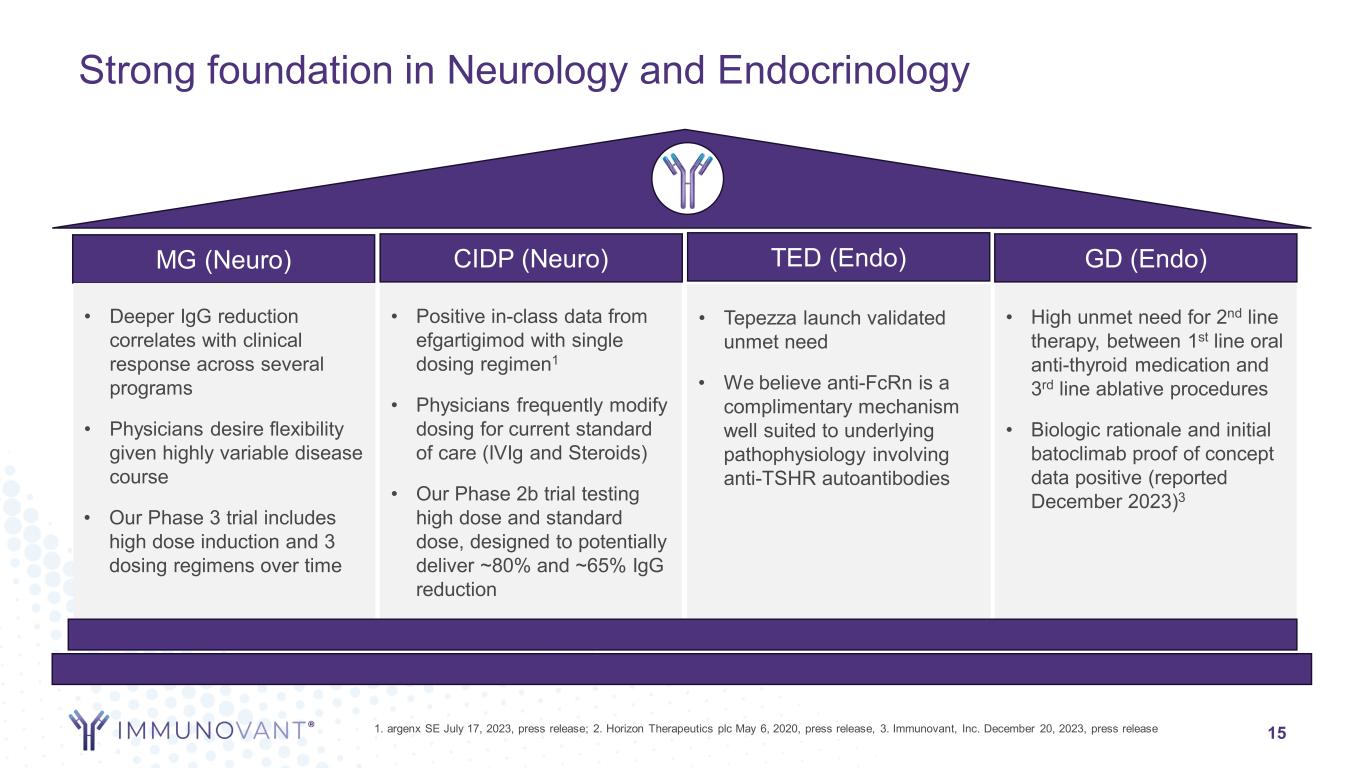

Strong foundation in Neurology and Endocrinology 15 MG (Neuro) TED (Endo)CIDP (Neuro) GD (Endo) • Deeper IgG reduction correlates with clinical response across several programs • Physicians desire flexibility given highly variable disease course • Our Phase 3 trial includes high dose induction and 3 dosing regimens over time • Positive in-class data from efgartigimod with single dosing regimen1 • Physicians frequently modify dosing for current standard of care (IVIg and Steroids) • Our Phase 2b trial testing high dose and standard dose, designed to potentially deliver ~80% and ~65% IgG reduction • Tepezza launch validated unmet need • We believe anti-FcRn is a complimentary mechanism well suited to underlying pathophysiology involving anti-TSHR autoantibodies • High unmet need for 2nd line therapy, between 1st line oral anti-thyroid medication and 3rd line ablative procedures • Biologic rationale and initial batoclimab proof of concept data positive (reported December 2023)3 1. argenx SE July 17, 2023, press release; 2. Horizon Therapeutics plc May 6, 2020, press release, 3. Immunovant, Inc. December 20, 2023, press release

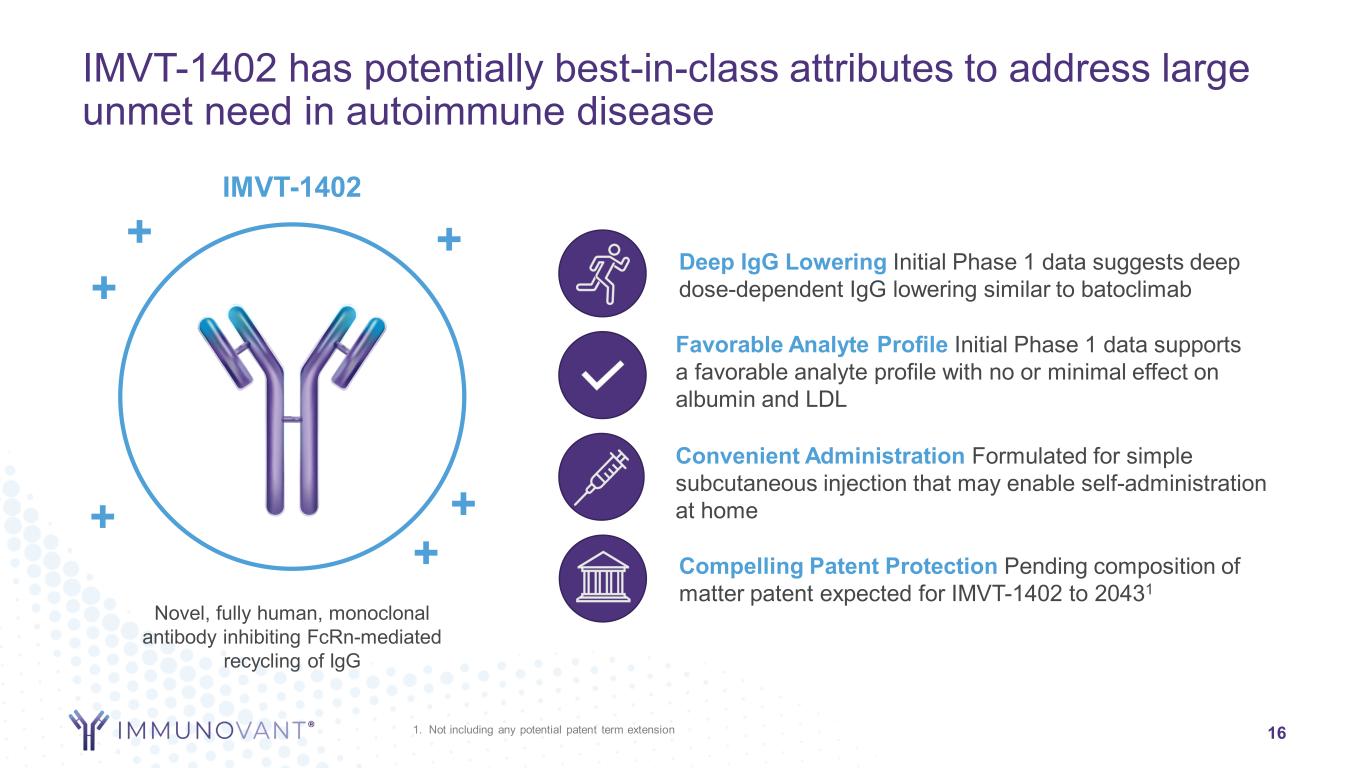

Favorable Analyte Profile Initial Phase 1 data supports a favorable analyte profile with no or minimal effect on albumin and LDL 1. Not including any potential patent term extension 16 IMVT-1402 has potentially best-in-class attributes to address large unmet need in autoimmune disease Novel, fully human, monoclonal antibody inhibiting FcRn-mediated recycling of IgG + IMVT-1402 ++ + + + Convenient Administration Formulated for simple subcutaneous injection that may enable self-administration at home Compelling Patent Protection Pending composition of matter patent expected for IMVT-1402 to 20431 Deep IgG Lowering Initial Phase 1 data suggests deep dose-dependent IgG lowering similar to batoclimab

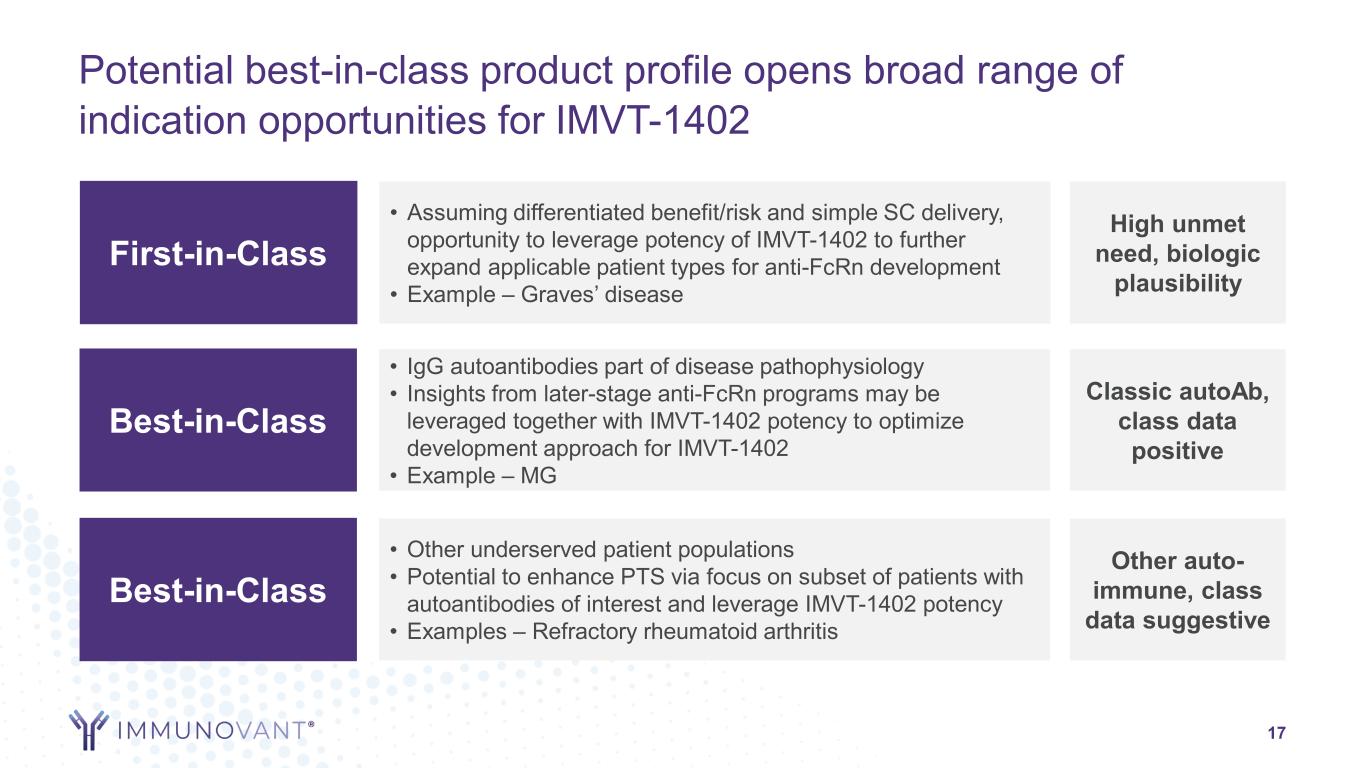

Potential best-in-class product profile opens broad range of indication opportunities for IMVT-1402 17 Best-in-Class • Other underserved patient populations • Potential to enhance PTS via focus on subset of patients with autoantibodies of interest and leverage IMVT-1402 potency • Examples – Refractory rheumatoid arthritis Other auto- immune, class data suggestive First-in-Class • Assuming differentiated benefit/risk and simple SC delivery, opportunity to leverage potency of IMVT-1402 to further expand applicable patient types for anti-FcRn development • Example – Graves’ disease High unmet need, biologic plausibility Best-in-Class • IgG autoantibodies part of disease pathophysiology • Insights from later-stage anti-FcRn programs may be leveraged together with IMVT-1402 potency to optimize development approach for IMVT-1402 • Example – MG Classic autoAb, class data positive

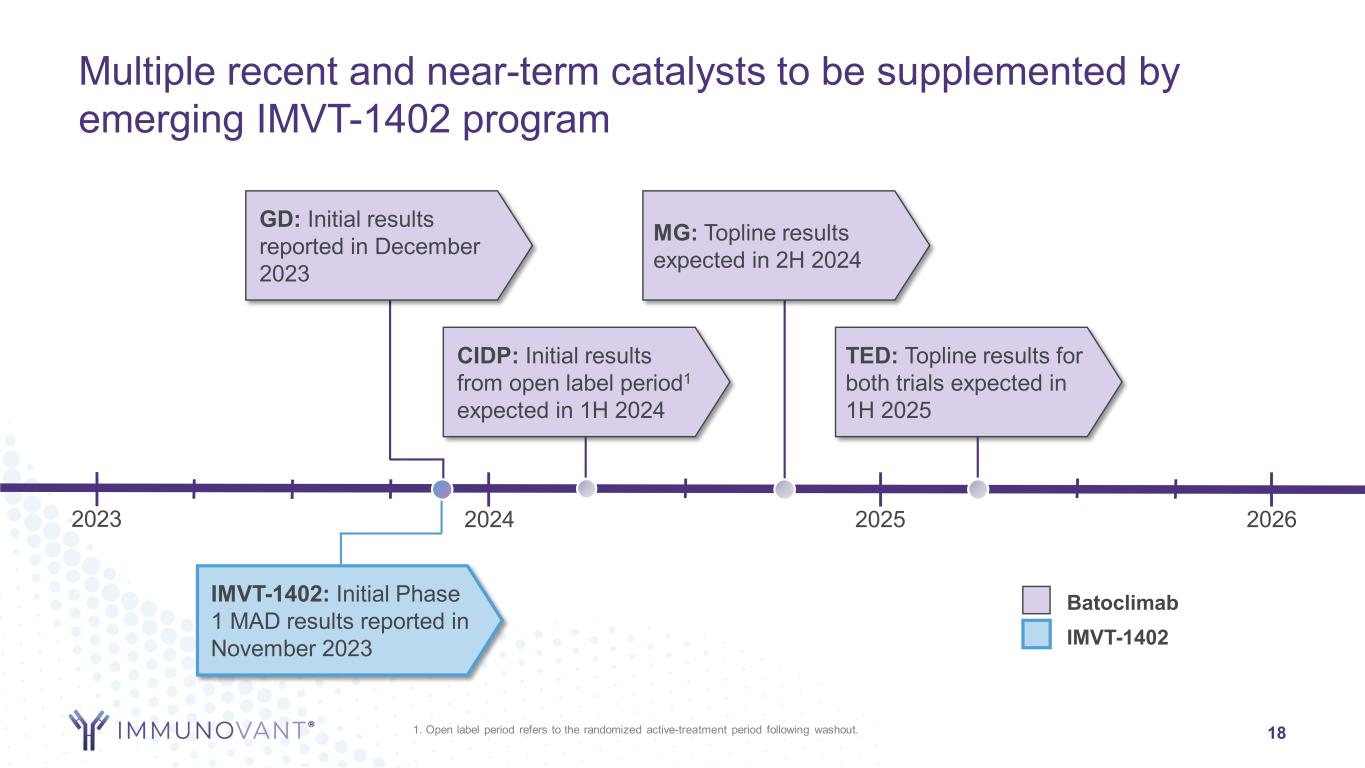

2023 Multiple recent and near-term catalysts to be supplemented by emerging IMVT-1402 program 18 GD: Initial results reported in December 2023 MG: Topline results expected in 2H 2024 2024 2025 TED: Topline results for both trials expected in 1H 2025 CIDP: Initial results from open label period1 expected in 1H 2024 2026 Batoclimab IMVT-1402 IMVT-1402: Initial Phase 1 MAD results reported in November 2023 1. Open label period refers to the randomized active-treatment period following washout.

Concluding Thoughts

A trailblazer in anti-FcRn technology at inflection point for growth 20 Very exciting class based on unmet patient need, indication breadth and strong biomarkers 2nd generation asset with potential best-in- class profile and opportunity for biomarker accelerated development path Late-stage clinical company with existing infrastructure to conduct multiple pivotal clinical trials

Thank you

Appendix

Initial and subsequent dosing regimens for highlighted immunology drugs: Strong commercial product precedent for multiple dosing regimens within and across immunology indications1,2 Highlighted immunology drug2 # of adult indications1 Initial dosing: Indications with loading and / or induction doses1,4 Subsequent dosing: # of unique maintenance doses1,3 Humira (adalimumab) 8 5 of 8 indications 3 Stelara (ustekinumab) 4 4 of 4 indications 3 Dupixent (dupilumab) 5 3 of 5 indications 3 Ocrevus (ocrelizumab) 2 2 of 2 indications 1 Skyrizi (risankizumab) 3 3 of 3 indications 3 Cosentyx (secukinumab) 5 5 of 5 indications 4 Enbrel (etanercept) 4 1 of 4 indications 1 Orencia (abatacept) 3 3 of 3 indications 4 Tremfya (guselkumab)5 2 2 of 2 indications 1 Actemra/RoActemra (tocilizumab) 5 0 of 5 indications 5 Total of 41 indications 28 / 41 of labeled indications have a loading and / or induction dose Median of 3 unique maintenance doses per product 23 Initial dosing: Almost 70% of labeled indications among the highlighted immunology drugs have a loading and / or induction dose1,2,4 Subsequent (maintenance) dosing: 7 of the highlighted 10 drugs have multiple unique maintenance dosing regimens1,2,3 1. Based on adult indications and dosing regimens in FDA prescribing information for each product (pulled in December 2023); excluding pediatric dosing regimens 2. 10 highlighted immunology drugs selected and ordered based on publicly available global 2022 net sales 3. Subsequent (i.e., maintenance) doses = all continuous dosing options, by dosage or frequency, listed in product’s FDA prescribing information 4. Loading and induction doses = initial dose(s) in the first 12 weeks that are higher and / or more frequent than the subsequent doses 5. For Tremfya (guselkumab), studies are ongoing in Ulcerative Colitis and Crohn’s disease with doses different than the labeled Plaque Psoriasis and Psoriatic Arthritis dose