UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_____________________________________

Filed by the Registrant £

Filed by a Party other than the Registrant £

Check the appropriate box:

|

£ |

Preliminary Proxy Statement |

|

|

£ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

S |

Definitive Proxy Statement |

|

|

£ |

Definitive Additional Materials |

|

|

£ |

Soliciting Material under §240.14a-12 |

HEALTH SCIENCES ACQUISITIONS CORPORATION

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

£ |

No fee required. |

|||

|

£ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

|||

|

Common stock, par value $0.0001 per share |

||||

|

(2) |

Aggregate number of securities to which transaction applies: |

|||

|

43,000,000 shares of Common Stock |

||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

|

The proposed maximum aggregate value of the transaction was calculated based on $9.96 per share (the average of the high and low prices reported on the Nasdaq Capital Market on September 25, 2019). |

||||

|

(4) |

Proposed maximum aggregate value of transaction: |

|||

|

$428,280,000 |

||||

|

(5) |

Total fee paid: |

|||

|

$55,590.74 |

||||

|

S |

Fee paid previously with preliminary materials. |

|||

|

£ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

|

|

||||

|

(2) |

Form, Schedule or Registration Statement No.: |

|||

|

|

||||

|

(3) |

Filing Party: |

|||

|

|

||||

|

(4) |

Date Filed: |

|||

|

|

||||

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

OF HEALTH SCIENCES ACQUISITIONS CORPORATION

Proxy Statement dated November 27, 2019

and first mailed to stockholders on or about November 29, 2019

Dear Stockholders:

You are cordially invited to attend the special meeting of the stockholders of Health Sciences Acquisitions Corporation (“HSAC”). HSAC is a Delaware blank check company established for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities, which we refer to as a “target business.”

Holders of shares of HSAC’s common stock (“HSAC Shares”) will be asked to approve, among other things, the share exchange agreement, dated as of September 29, 2019 (the “Share Exchange Agreement”), by and among HSAC, Immunovant Sciences Ltd., a Bermuda exempted limited company (“Immunovant”), the stockholders of Immunovant (the “Sellers”) and Roivant Sciences Ltd., a Bermuda exempted limited company, as representative of the Sellers, and the other related proposals. As of the date of the Share Exchange Agreement, the Sellers owned 100% of the issued and outstanding common shares of Immunovant (“Immunovant Shares”).

Upon the closing of the transactions contemplated in the Share Exchange Agreement, HSAC will acquire 100% of the issued and outstanding Immunovant Shares, in exchange for approximately 42,180,277 HSAC Shares, and Immunovant will become a wholly owned subsidiary of HSAC. Upon closing of the transactions, HSAC will change its name to “Immunovant, Inc.” The transactions contemplated under the Share Exchange Agreement relating to the business combination are referred to in this proxy statement as the “Business Combination” and the combined company after the Business Combination is referred to in this proxy statement as the “Combined Company.”

The Sellers are entitled to receive up to an additional 20,000,000 HSAC Shares (the “Earnout Shares”) after the closing of the Business Combination if the volume-weighted average price of the HSAC Shares equals or exceeds the following prices for any 20 trading days within any 30 trading-day period (the “Trading Period”) following the closing: (1) during any Trading Period prior to March 31, 2023, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $17.50 per share; and (2) during any Trading Period prior to March 31, 2025, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $31.50 per share. In the event that after closing of the Business Combination and prior to March 31, 2025, (i) there is a change of control of HSAC, (ii) any liquidation, dissolution or winding up of HSAC is initiated, (iii) any bankruptcy, dissolution or liquidation proceeding is instituted by or against HSAC, or (iv) HSAC makes an assignment for the benefit of creditors or consents to the appointment of a custodian, receiver or trustee for all or substantial part of its assets or properties, then any Earnout Shares that have not been previously issued by HSAC (whether or not previously earned) shall be deemed earned and due by HSAC to the Sellers, unless in a change of control, the value of the consideration to be received in exchange for a HSAC Share is lower than the share price thresholds described above.

As of September 30, 2019, there was approximately $116,024,698 in HSAC’s trust account (the “Trust Account”). On November 20, 2019, the record date for the special meeting of stockholders, the last sale price of the HSAC Shares was $10.35.

Each stockholder’s vote is very important. Whether or not you plan to attend the HSAC special meeting in person, please submit your proxy card without delay. Stockholders may revoke proxies at any time before they are voted at the meeting. Voting by proxy will not prevent a shareholder from voting in person if such shareholder subsequently chooses to attend the HSAC special meeting.

We encourage you to read this proxy statement carefully. In particular, you should review the matters discussed under the caption “Risk Factors” beginning on page 19.

HSAC’s board of directors unanimously recommends that HSAC stockholders vote “FOR” approval of each of the proposals.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Business Combination or otherwise, or passed upon the adequacy or accuracy of this proxy statement. Any representation to the contrary is a criminal offense.

|

/s/ Roderick Wong |

||

|

Roderick Wong, M.D. |

||

|

Chief Executive Officer |

||

|

Health Sciences Acquisitions Corporation |

||

|

November 27, 2019 |

HOW TO OBTAIN ADDITIONAL INFORMATION

This proxy statement incorporates important business and financial information about HSAC that is not included or delivered herewith. If you would like to receive additional information or if you want additional copies of this document, agreements contained in the appendices or any other documents filed by HSAC with the Securities and Exchange Commission, such information is available without charge upon written or oral request. Please contact the following:

412 West 15th Street, Floor 9

New York, NY 10011

Telephone: (646) 593-7999

If you would like to request documents, please do so no later than December 11, 2019 to receive them before HSAC’s special meeting. Please be sure to include your complete name and address in your request. Please see “Where You Can Find Additional Information” to find out where you can find more information about HSAC and Immunovant. You should rely only on the information contained in this proxy statement in deciding how to vote on the Business Combination. Neither HSAC nor Immunovant has authorized anyone to give any information or to make any representations other than those contained in this proxy statement. Do not rely upon any information or representations made outside of this proxy statement. The information contained in this proxy statement may change after the date of this proxy statement. Do not assume after the date of this proxy statement that the information contained in this proxy statement is still correct.

HEALTH SCIENCES ACQUISITIONS CORPORATION

412 West 15th Street, Floor 9

New York, NY 10011

Telephone: (646) 593-7999

NOTICE OF SPECIAL MEETING OF

HEALTH SCIENCES ACQUISITIONS CORPORATION STOCKHOLDERS

To Be Held on December 16, 2019

To Health Sciences Acquisitions Corporation (“HSAC”) Stockholders:

A special meeting of stockholders of HSAC will be held at Loeb & Loeb LLP, 345 Park Avenue, New York, NY 10154, on December 16, 2019, at 10:00 a.m., for the following purposes:

• To approve the transactions contemplated under the Share Exchange Agreement, dated as of September 29, 2019 (the “Share Exchange Agreement”), by and among HSAC, Immunovant Sciences Ltd., a Bermuda exempted limited company, the stockholders of Immunovant (the “Sellers”) and Roivant Sciences Ltd., a Bermuda exempted limited company, as representative of the Sellers (the “Business Combination”). This proposal is referred to as the “Business Combination Proposal” or “Proposal No. 1.”

• To approve separate proposals to amend HSAC’s current Amended and Restated Certificate of Incorporation as set forth in the Second Amended and Restated Certificate of Incorporation of HSAC appended to this proxy statement as Annex B (the “Amended Charter”) to adopt certain material changes to be in effect upon the consummation of the Business Combination. These proposals are collectively referred to as the “Amendment Proposal” or “Proposal No. 2.”

• To approve the issuance of more than 20% of the issued and outstanding shares of HSAC’s common stock (“HSAC Shares”) pursuant to the terms of the Share Exchange Agreement, which will result in a change of control, as required by Nasdaq Listing Rules 5635(a), (b) and (d). This proposal is referred to as the “Nasdaq Proposal” or “Proposal No. 3.”

• To approve the 2019 HSAC Equity Incentive Plan. This proposal is referred to as the “Equity Incentive Plan Proposal” or “Proposal No. 4.”

• To approve the adjournment of the special meeting for the purpose of soliciting additional proxies in favor of the approval of the Business Combination in the event HSAC does not receive the requisite shareholder vote to approve the Business Combination. This proposal is called the “Business Combination Adjournment Proposal” or “Proposal No. 5.”

Proposals Nos. 1 through 5 are collectively referred to herein as the “Proposals.”

As of November 20, 2019, there were 14,375,000 HSAC Shares issued and outstanding and entitled to vote. Only HSAC stockholders who hold HSAC Shares of record as of the close of business on November 20, 2019 are entitled to vote at the special meeting or any adjournment of the special meeting. This proxy statement is first being mailed to HSAC stockholders on or about November 29, 2019. Approval of the Business Combination Proposal, the Nasdaq Proposal, the Equity Incentive Plan Proposal and the Business Combination Adjournment Proposal will each require the affirmative vote of the holders of a majority of the issued and outstanding HSAC Shares present and entitled to vote at the special meeting or any adjournment thereof. Approval of the Amendment Proposal will require the affirmative vote of a majority of the issued and outstanding HSAC Shares. Attending the special meeting either in person or by proxy and abstaining from voting will have the same effect as voting against all the Proposals and, assuming a quorum is present, broker non-votes will have no effect on the Proposals other than the Amendment Proposal, for which it will have the same effect as voting against the proposal.

Holders of HSAC Shares will not be entitled to appraisal rights under Delaware law in connection with the Business Combination.

Whether or not you plan to attend the special meeting in person, please submit your proxy card without delay. Voting by proxy will not prevent you from voting your HSAC Shares in person if you subsequently choose to attend the special meeting. If you fail to return your proxy card and do not attend the meeting in person, the effect will be that your HSAC Shares will not be counted for purposes of determining whether a quorum is present at the special meeting. You may revoke a proxy at any time before it is voted at the special meeting by executing and returning a proxy card dated later than the previous one, by attending the special meeting in person and casting your vote by ballot or by submitting a written revocation to Health Sciences Acquisitions Corporation, 412 West 15th Street, Floor 9, New York, NY 10011, (646) 593-7999, that is received by us before we take the vote at the special meeting. If you hold your HSAC Shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

HSAC’s board of directors unanimously recommends that HSAC stockholders vote “FOR” approval of each of the Proposals.

By order of the Board of Directors,

|

/s/ Roderick Wong |

||

|

Roderick Wong, M.D. |

||

|

Chief Executive Officer |

||

|

Health Sciences Acquisitions Corporation |

||

|

November 27, 2019 |

TABLE OF CONTENTS

i

Unless otherwise stated in this proxy statement, the terms, “we,” “us,” “our” or “HSAC” refer to Health Sciences Acquisitions Corporation, a Delaware corporation. Further, in this document:

• “Board” means the board of directors of HSAC.

• “Business Combination” means the business combination pursuant to the Share Exchange Agreement.

• “Code” means the Internal Revenue Code of 1986, as amended.

• “Combined Company” means the combined company after the Business Combination.

• “Exchange Act” means the Securities Exchange Act of 1934, as amended.

• “GAAP” means accounting principles generally accepted in the United States of America.

• “HSAC Shares” means the shares of common stock, par value $0.0001 per share, of HSAC and, as context requires, the 10,000 shares of Series A Preferred Stock, par value $0.0001 per share, of HSAC to be issued to RSL upon closing of the Business Combination.

• “HSAC Units” means the units that were issued in the IPO, each consisting of one HSAC Share and one HSAC Warrant.

• “HSAC Warrant” means one redeemable warrant exercisable for one-half of an HSAC Share, at a price of $11.50 per whole HSAC Share.

• “Immunovant” means Immunovant Sciences Ltd., a Bermuda exempted limited company.

• “Immunovant, Inc.” means Immunovant, Inc., a Delaware corporation and wholly owned subsidiary of Immunovant, which subsidiary will change its name prior to the closing of the Business Combination in connection with the Combined Company changing its name to Immunovant, Inc.

• “Immunovant Shares” means the common shares, par value $0.0001 per share, of Immunovant.

• “IPO” refers to the initial public offering of 11,500,000 units of HSAC consummated on May 14, 2019.

• “Private Warrants” means the warrants issued simultaneously with the closing of the IPO in a private placement to the Sponsor, each warrant being identical to the HSAC Warrants, except that such warrants are non-redeemable and may be exercised on a cashless basis.

• “Roivant” and “RSL” mean Roivant Sciences Ltd., a Bermuda exempted limited company.

• “SEC” means the U.S. Securities and Exchange Commission.

• “Securities Act” means the Securities Act of 1933, as amended.

• “Sellers” means the stockholders of Immunovant.

• “Sellers’ Representative” means Roivant Sciences Ltd., a Bermuda exempted limited company.

• “Share Exchange Agreement” means that certain share exchange agreement, dated as of September 29, 2019, by and among HSAC, Immunovant, the Sellers and the Sellers’ Representative.

• “Sponsor” means Health Sciences Holdings, LLC, the three directors of which are Roderick Wong, M.D., our Chief Executive Officer and President, Naveen Yalamanchi, M.D., our Chief Financial Officer and Executive Vice President, and Alice Lee, our Vice President of Operations and Secretary & Treasurer.

1

QUESTIONS AND ANSWERS ABOUT THE PROPOSALS FOR HSAC stockholders

Q: What is the purpose of this document?

A: HSAC, Immunovant, the Sellers and the Sellers’ Representative, have agreed to the Business Combination under the terms of the Share Exchange Agreement, which is attached to this proxy statement as Annex A, and is incorporated into this proxy statement by reference. This proxy statement contains important information about the proposed Business Combination and the other matters to be acted upon at the special meeting of HSAC stockholders. You are encouraged to carefully read this proxy statement, including the section titled “Risk Factors” and all the annexes hereto.

HSAC stockholders are being asked to consider and vote upon a proposal to approve the Business Combination, pursuant to which HSAC will acquire all of the issued and outstanding Immunovant Shares from the Sellers, and related proposals.

HSAC stockholders (except for initial stockholders or officers or directors of HSAC) will be entitled to redeem their HSAC Shares for a pro rata share of HSAC’s trust account (the “Trust Account”) (currently anticipated to be no less than approximately $10.00 per share), net of taxes payable.

The HSAC Units, HSAC Shares, and HSAC Warrants are currently listed on the Nasdaq Stock Market.

This proxy statement contains important information about the proposed Business Combination and the other matters to be acted upon at the special meeting of HSAC stockholders. You should read it carefully.

Q: What is being voted on?

A: Below are the proposals on which HSAC stockholders are being asked to vote:

• To approve the Business Combination. This proposal is referred to as the “Business Combination Proposal” or “Proposal No. 1.”

• To approve the Amended Charter appended to this proxy statement as Annex B to effect the following amendments to (collectively, the “Amendment Proposal” or “Proposal No. 2”):

(a) change the name of the Combined Company to “Immunovant, Inc.” from “Health Sciences Acquisitions Corporation”;

(b) increase the authorized number of shares of common stock from 30,000,000 shares to 500,000,000 shares;

(c) authorize the issuance of up to 10,000,000 shares of “blank check” preferred stock, the rights, preferences and privileges of which may be designated from time to time by the Combined Company’s board of directors to increase the number of outstanding shares and discourage a takeover attempt;

(d) authorize the issuance of up to 10,000 shares of Series A Preferred Stock (the “Series A Preferred Stock”) and designate the rights, preferences and privileges of the Series A Preferred Stock, including that the holder(s) of a majority of the outstanding shares of Series A Preferred Stock will be entitled to elect: (1) four directors (the “Series A Preferred Directors”), as long as the holder(s) of Series A Preferred Stock hold 50% or more of the voting power of all then-outstanding shares of capital stock of the Combined Company entitled to vote generally at an election of directors, (2) three Series A Preferred Directors, as long as the holder(s) of Series A Preferred Stock hold 40% or more but less than 50% of the voting power of all then-outstanding shares of capital stock of the Combined Company entitled to vote generally at an election of directors, and (3) two Series A Preferred Directors, as long as the holder(s) of Series A Preferred Stock hold 25% or more but less than 40% of the voting power of all then-outstanding shares of capital stock of the Combined Company entitled to vote generally at an election of directors;

(e) provide that the number of directors constituting the board of directors of the Combined Company will be fixed at no less than seven;

2

(f) provide that directors may be removed with or without cause by the affirmative vote of the holders of at least 66 2/3% of the voting power of all then-outstanding shares of the Combined Company’s capital stock entitled to vote generally at an election of directors; provided that the Series A Preferred Directors may be removed without cause only by the holder(s) of Series A Preferred Stock;

(g) declassify the Combined Company’s board of directors and provide that each director will serve for a one-year term, until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal;

(h) provide that, as long as the Combined Company is a “controlled company,” as such term is defined under the rules of the exchange on which the Combined Company’s securities are listed, the chairperson of the board of directors of the Combined Company will be entitled to a casting vote and be entitled to two votes on any matter or resolution presented to the full board of directors or any committee on which he or she then serves for which a majority vote cannot be obtained;

(i) provide that from and after such time as the Combined Company is no longer a “controlled company,” as such term is defined under the rules of the exchange on which the Combined Company’s securities are listed, no action shall be taken by the stockholders of the Combined Company except at an annual or special meeting of stockholders called in accordance with the Combined Company’s bylaws, and no action shall be taken by the stockholders by written consent or electronic transmission; provided that the holder(s) of Series A Preferred Stock may at all times act by written consent or electronic transmission to exercise the right to elect or remove the Series A Preferred Directors or otherwise act as permitted pursuant to the proposed Amended Charter;

(j) provide that the Combined Company opts out of Section 203 of the Delaware General Corporation Law;

(k) provide that, from and after such time as the Combined Company is no longer a “controlled company,” as such term is defined under the rules of the exchange on which the Combined Company’s securities are listed, any amendment to the Combined Company’s bylaws will require the approval of the holders of at least 66 2/3% of the Combined Company’s then-outstanding shares of capital stock entitled to vote generally at an election of directors;

(l) provide that, from and after such time as the Combined Company is no longer a “controlled company,” as such term is defined under the rules of the exchange on which the Combined Company’s securities are listed, any amendment to certain provisions of the Amended Charter will require the approval of the holders of at least 66 2/3% of the Combined Company’s then-outstanding shares of capital stock entitled to vote generally at an election of directors; provided that the Combined Company shall not amend any provision of its Amended Charter in a manner that adversely affects the powers, preferences or rights of the Series A Preferred Stock without the approval of the holder(s) of a majority of the Series A Preferred Stock;

(m) remove various provisions related to its operations as a blank check company prior to the consummation of an initial business combination; and

(n) provide that the federal district courts of the United States of America will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act.

• To approve the issuance of more than 20% of the issued and outstanding HSAC Shares pursuant to the terms of the Share Exchange Agreement, which will result in a change of control, as required by Nasdaq Listing Rules 5635(a), (b) and (d). This proposal is referred to as the “Nasdaq Proposal” or “Proposal No. 3.”

• To approve the 2019 HSAC Equity Incentive Plan. This proposal is referred to as the “Equity Incentive Plan Proposal” or “Proposal No. 4.”

• To approve the adjournment of the special meeting for the purpose of soliciting additional proxies in favor of the approval of the Business Combination in the event HSAC does not receive the requisite shareholder vote to approve the Business Combination. This proposal is called the “Business Combination Adjournment Proposal” or “Proposal No. 5.”

3

Proposal Nos. 1 through 5 are collectively referred to herein as the “Proposals.”

Approval of each of the Proposals other than the Amendment Proposal will each require the affirmative vote of the holders of a majority of the issued and outstanding HSAC Shares present and entitled to vote at the special meeting. The Amendment Proposal requires the affirmative vote of a majority of the issued and outstanding HSAC Shares. As of November 20, 2019, the record date for the special meeting of stockholders of HSAC (the “Record Date”), 2,875,000 shares held by HSAC’s initial stockholders, or approximately 20% of the outstanding HSAC Shares, would be voted in favor of each of the Proposals, and 1,672,000 shares owned by certain other of HSAC’s stockholders have agreed to vote in favor of each of the Proposals.

Q: What is the consideration being paid to Immunovant securityholders?

A: The Sellers will receive approximately 42,180,277 HSAC Shares, subject to reduction for indemnification claims as described in the section titled “The Share Exchange Agreement.”

In addition, the Sellers are entitled to receive up to an additional 20,000,000 HSAC Shares (the “Earnout Shares”) after the closing of the Business Combination if the volume-weighted average price of the HSAC Shares equals or exceeds the following prices for any 20 trading days within any 30 trading-day period (the “Trading Period”) following the closing:

a. during any Trading Period prior to March 31, 2023, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $17.50 per share; and

b. during any Trading Period prior to March 31, 2025, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $31.50 per share (each, a “Milestone”).

In addition, in the event that after closing of the Business Combination and prior to March 31, 2025, (i) there is a change of control of HSAC, (ii) any liquidation, dissolution or winding up of HSAC is initiated, (iii) any bankruptcy, dissolution or liquidation proceeding is instituted by or against HSAC, or (iv) HSAC makes an assignment for the benefit of creditors or consents to the appointment of a custodian, receiver or trustee for all or substantial part of its assets or properties, then any Earnout Shares that have not been previously issued by HSAC (whether or not previously earned) shall be deemed earned and due by HSAC to the Sellers, unless in a change of control, the value of the consideration to be received in exchange for a HSAC Share is lower than the applicable Milestone share price thresholds described above.

Upon the closing of the Business Combination, assuming there are no redemptions of HSAC Shares for cash, HSAC’s current public stockholders will own approximately 21.0% of the HSAC Shares, HSAC’s current directors, officers and affiliates will own approximately 2.0% of the HSAC Shares and the Sellers will own approximately 77.0% of the HSAC Shares. Assuming redemption by holders of 4,578,600 outstanding HSAC Shares, the maximum number of shares that may be redeemed, HSAC public stockholders will own approximately 13.8% of the HSAC Shares, HSAC’s current directors, officers and affiliates will own approximately 2.1% of the HSAC Shares, and the Sellers will own approximately 84.1% of the HSAC Shares.

Upon the closing of the Business Combination, the Combined Company will have an equity value of $556 million provided that the HSAC Shares are valued at $10.00 per HSAC Share and no HSAC stockholders redeem their HSAC Shares.

Q: Do any of HSAC’s directors or officers have interests that may conflict with my interests with respect to the Business Combination?

A: HSAC’s directors and officers may have interests in the Business Combination that are different from your interests as a HSAC stockholder. You should keep in mind the following interests of HSAC’s directors and officers:

In December 2018, HSAC issued an aggregate of 2,875,000 HSAC Shares to the Sponsor, which we refer to herein as “insider shares,” for an aggregate purchase price of $25,000. The insider shares included an aggregate of up to 375,000 HSAC Shares subject to forfeiture by the Sponsor to the extent that the underwriters’ over-allotment was not exercised in full or in part, so that the Sponsor would own 20% of the issued and outstanding HSAC Shares after the IPO. The underwriters’ over-allotment option was exercised in full on April 4, 2019. As such, no insider shares were forfeited. Simultaneously with the closing of the IPO, the Sponsor purchased 10,000,000 Private Warrants at a price of $0.50 per Private Warrant, generating total proceeds of

4

$5,000,000. Pursuant to the Share Exchange Agreement, all of the Private Warrants will be cancelled and up to 1,800,000 Sponsor shares will be subject to vesting and cancellation as described in the section titled “The Share Exchange Agreement — Related Agreements — Sponsor Restricted Stock Agreement.”

On December 28, 2018, RTW Master Fund, Ltd. and RTW Innovation Master Fund, Ltd. (the “RTW Entities”), entities controlled by officers and directors of HSAC, purchased 2,604,166 Immunovant Shares, which represented at the time of investment approximately 3% interest in Immunovant, in exchange for approximately $10.0 million. On August 1, 2019, the RTW Entities made an additional $25.0 million investment in Immunovant in exchange for two promissory notes (the “Promissory Notes”), which automatically convert immediately prior to the consummation of the Business Combination into Immunovant Shares exchangeable for an aggregate of 2,500,000 HSAC Shares upon the closing of the Business Combination. The Promissory Notes bear interest at a rate of 5% per year, which interest will be waived and cancelled immediately prior to the closing of the Business Combination. On September 26, 2019, $2.5 million aggregate principal amount of the Promissory Notes issued to the RTW Entities was repaid, and the accrued interest on such principal amount was forgiven. In the event that the Business Combination is not consummated, the Promissory Notes will be convertible into Immunovant Shares in connection with certain qualified equity financings or other strategic transactions that Immunovant may enter into in the future.

If HSAC does not consummate the Business Combination by the date that is 24 months from the closing of the IPO, or May 14, 2021, HSAC will be required to dissolve and liquidate and the securities held by HSAC’s insiders will be worthless because such holders have agreed to waive their rights to any liquidation distributions.

Approval of the Business Combination Proposal, the Nasdaq Proposal, the Equity Incentive Plan Proposal and the Business Combination Adjournment Proposal will require the affirmative vote of the holders of a majority of the issued and outstanding HSAC Shares present and entitled to vote at the special meeting. Approval of the Amendment Proposal will require the approval of a majority of the issued and outstanding HSAC Shares. As of the Record Date, 2,875,000 shares held by HSAC’s initial stockholders, or approximately 20% of the outstanding HSAC Shares, would be voted in favor of each of the Proposals.

In addition, the exercise of HSAC’s directors’ and officers’ discretion in agreeing to changes or waivers in the terms of the Business Combination may result in a conflict of interest when determining whether such changes or waivers are appropriate and in HSAC stockholders’ best interests.

Q: When and where is the special meeting of HSAC’s stockholders?

A: The special meeting of HSAC stockholders will take place at Loeb & Loeb LLP, 345 Park Avenue, New York, NY 10154, on December 16, 2019, at 10:00 a.m.

Q: Who may vote at the special meeting of stockholders?

A: Only holders of record of HSAC Shares as of the close of business on November 20, 2019 may vote at the special meeting of stockholders. As of November 20, 2019, there were 14,375,000 HSAC Shares outstanding and entitled to vote. Please see “Special Meeting of HSAC Stockholders — Record Date; Who is Entitled to Vote” for further information.

Q: What is the quorum requirement for the special meeting of stockholders?

A: Stockholders representing a majority of the HSAC Shares issued and outstanding as of the Record Date and entitled to vote at the special meeting must be present in person or represented by proxy in order to hold the special meeting and conduct business. This is called a quorum. HSAC Shares will be counted for purposes of determining if there is a quorum if the shareholder (i) is present and entitled to vote at the meeting, or (ii) has properly submitted a proxy card. In the absence of a quorum, stockholders representing a majority of the votes present in person or represented by proxy at such meeting, may adjourn the meeting until a quorum is present.

Q: What vote is required to approve the Proposals?

A: Approval of the Business Combination Proposal, the Nasdaq Proposal, the Equity Incentive Plan Proposal and the Business Combination Adjournment Proposal will require the affirmative vote of the holders of a majority of the issued and outstanding HSAC Shares present and entitled to vote at the special meeting. Approval of the Amendment Proposal will require the approval of a majority of the issued and outstanding HSAC Shares. Attending

5

the special meeting either in person or by proxy and abstaining from voting will have the same effect as voting against all the Proposals and, assuming a quorum is present, broker non-votes will have no effect on the Proposals other than the Amendment Proposal, for which it will have the same effect as voting against the Proposal.

With respect to the Nasdaq Proposal, the Equity Incentive Plan Proposal, the Amendment Proposal and the Business Combination Adjournment Proposal, assuming all issued and outstanding HSAC Shares are present at the special meeting, there must be 7,187,501 HSAC Shares voted in favor of each the Nasdaq Proposal, the Equity Incentive Plan Proposal, the Amendment Proposal and the Business Combination Adjournment Proposal for each to be approved. Assuming only a quorum is present at the special meeting, there must be 3,593,751 HSAC Shares voted in favor of each the Nasdaq Proposal, the Equity Incentive Plan Proposal, and the Business Combination Adjournment Proposal for each to be approved, while the Amendment Proposal would require all shares present at the meeting to vote in favor for it to pass.

As of the Record Date, HSAC had entered into voting agreements with the holders of 4,547,000 HSAC Shares pursuant to which such stockholders, including but not limited to the RTW Entities, Perceptive Advisors, Adage Capital Management, Cormorant Asset Management, and Eventide Asset Management, LLC, had agreed to vote in favor of the transactions contemplated by the Share Exchange Agreement and to not redeem or sell their shares. In addition, our Sponsor and other pre-IPO stockholders agreed in connection with our initial public offering to vote the 2,875,000 founder shares they own in favor of the transactions contemplated by the Share Exchange Agreement. Combined, such groups account for a majority of our outstanding shares, and, accordingly, assuming everyone votes as they agreed, no additional shares are required to vote in favor of the Proposals for them to be approved.

Q: How will the initial stockholders vote?

A: HSAC’s initial stockholders, who as of November 20, 2019 owned 2,875,000 HSAC Shares, or approximately 20% of the outstanding HSAC Shares, have agreed to vote their respective HSAC Shares acquired by them prior to the IPO in favor of the Business Combination Proposal and related proposals. HSAC’s initial stockholders have also agreed that they will vote any shares they purchase in the open market in or after the IPO in favor of each of the Proposals.

Q: Am I required to vote against the Business Combination Proposal in order to have my HSAC Shares redeemed?

A: No. You are not required to vote against the Business Combination Proposal in order to have the right to demand that HSAC redeem your HSAC Shares for cash equal to your pro rata share of the aggregate amount then on deposit in the Trust Account (before payment of deferred underwriting commissions and including interest earned on their pro rata portion of the Trust Account, net of taxes payable). These rights to demand redemption of HSAC Shares for cash are sometimes referred to herein as redemption rights. If the Business Combination is not completed, then holders of HSAC Shares electing to exercise their redemption rights will not be entitled to receive such payments. You may not elect to redeem your HSAC Shares prior to the completion of the Business Combination and you may only elect to redeem your HSAC Shares in connection with the Business Combination.

Q: How do I exercise my redemption rights?

A: If you are a public stockholder and you seek to have your HSAC Shares redeemed, you must (i) demand, no later than 5:00 p.m., Eastern time on December 12, 2019 (at least two business days before the special meeting), that HSAC redeem your shares into cash; and (ii) submit your request in writing to HSAC’s transfer agent, at the address listed at the end of this section and deliver your shares to HSAC’s transfer agent physically or electronically using The Depository Trust Company’s (“DTC”) DWAC (Deposit/Withdrawal at Custodian) System at least two business days before the special meeting.

Any corrected or changed written demand of redemption rights must be received by HSAC’s transfer agent two business days before the special meeting. No demand for redemption will be honored unless the holder’s shares have been delivered (either physically or electronically) to the transfer agent at least two business days before the special meeting.

Public stockholders may seek to have their shares redeemed regardless of whether they vote for or against the Business Combination and whether or not they are holders of HSAC Shares as of the Record Date. Any public stockholder who holds shares of HSAC Shares on or before December 12, 2019 (two business days before the special meeting) will have the right to demand that his, her or its shares be redeemed for a pro rata share

6

of the aggregate amount then on deposit in the trust account, less any taxes then due but not yet paid, at the consummation of the Business Combination).

Any request for redemption, once made, may be withdrawn at any time up to the date of the special meeting of HSAC stockholders. The actual per share redemption price will be equal to the aggregate amount then on deposit in the trust account (before payment of deferred underwriting commissions and including interest earned on their pro rata portion of the trust account, net of taxes payable), divided by the number of shares of common stock sold in the IPO. Please see the section titled “Special Meeting of HSAC Stockholders — Redemption Rights” for the procedures to be followed if you wish to redeem your HSAC Shares for cash.

Q: How can I vote?

A: If you were a holder of record of HSAC Shares on November 20, 2019, the record date for the special meeting of HSAC stockholders, you may vote with respect to the applicable proposals in person at the special meeting of HSAC stockholders, or by submitting a proxy by mail so that it is received prior to 9:00 a.m. on December 16, 2019, in accordance with the instructions provided to you under “Extraordinary Meeting of HSAC Stockholders.” If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or other nominee, your broker or bank or other nominee may provide voting instructions (including any telephone or Internet voting instructions). You should contact your broker, bank or nominee in advance to ensure that votes related to the shares you beneficially own will be properly counted. In this regard, you must provide the record holder of your shares with instructions on how to vote your shares or, if you wish to attend the special meeting of HSAC stockholders and vote in person, obtain a proxy from your broker, bank or nominee.

Q: If my shares are held in “street name” by my bank, brokerage firm or nominee, will they automatically vote my shares for me?

A: No. Under the rules of various national and regional securities exchanges, your broker, bank or nominee cannot vote your shares with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee. HSAC believes the Proposals are non-discretionary and, therefore, your broker, bank or nominee cannot vote your shares without your instruction. Broker non-votes will not be considered present for the purposes of establishing a quorum and will have no effect on the Proposals. If you do not provide instructions with your proxy, your bank, broker or other nominee may submit a proxy card expressly indicating that it is NOT voting your shares; this indication that a bank, broker or nominee is not voting your shares is referred to as a “broker non-vote.” Your bank, broker or other nominee can vote your shares only if you provide instructions on how to vote. You should instruct your broker to vote your HSAC Shares in accordance with directions you provide.

Q: What if I abstain from voting or fail to instruct my bank, brokerage firm or nominee?

A: HSAC will count a properly executed proxy marked “ABSTAIN” with respect to a particular Proposal as present for the purposes of determining whether a quorum is present at the special meeting of HSAC stockholders. For purposes of approval, an abstention on any Proposals will have the same effect as a vote “AGAINST” such Proposal. Additionally, failure to elect to exercise your redemption rights will preclude you from having your HSAC Shares redeemed for cash. In order to exercise your redemption rights, you must make an election on the applicable proxy card to redeem such HSAC Shares or submit a request in writing to HSAC’s transfer agent at the address listed on page 210, and deliver your shares to HSAC’s transfer agent physically or electronically through DTC prior to the special meeting of HSAC stockholders.

Q: Can I change my vote after I have mailed my proxy card?

A: Yes. You may change your vote at any time before your proxy is voted at the special meeting. You may revoke your proxy by executing and returning a proxy card dated later than the previous one, or by attending the special meeting in person and casting your vote by ballot or by submitting a written revocation stating that you would like to revoke your proxy that we receive prior to the special meeting. If you hold your shares through a bank, brokerage firm or nominee, you should follow the instructions of your bank, brokerage firm or nominee regarding the revocation of proxies. If you are a record holder, you should send any notice of revocation or your completed new proxy card, as the case may be, to:

412 West 15th Street, Floor 9

New York, NY 10011

Telephone: (646) 593-7999

7

Q: Should I send in my share certificates now?

A: HSAC stockholders who intend to have their common stock redeemed should send their certificates to HSAC’s transfer agent at least two business days before the special meeting. Please see “Special Meeting of HSAC Stockholders — Redemption Rights” for the procedures to be followed if you wish to redeem your HSAC Shares for cash.

Q: When is the Business Combination expected to occur?

A: Assuming the requisite shareholder approvals are received, HSAC expects that the Business Combination will occur no later than December 31, 2019.

Q: May I seek statutory appraisal rights or dissenter rights with respect to my shares?

A: No. Appraisal rights are not available to holders of HSAC Shares in connection with the proposed Business Combination. For additional information, see the section titled “Special Meeting of HSAC Stockholders — Appraisal Rights.”

Q: What happens if the Business Combination is not consummated?

A: If HSAC does not consummate the Business Combination by the date that is 24 months from the closing of the IPO, or May 14, 2021, then pursuant to Article VI of its Amended and Restated Certificate of Incorporation, HSAC’s officers must take all actions necessary in accordance with the Delaware General Corporation Law to dissolve and liquidate HSAC as soon as reasonably practicable. Following dissolution, HSAC will no longer exist as a company. In any liquidation, the funds held in the Trust Account, plus any interest earned thereon (net of taxes payable), together with any remaining out-of-trust net assets, will be distributed pro-rata to holders of HSAC Shares who acquired such HSAC Shares in the IPO or in the aftermarket. The estimated consideration that each HSAC Share would be paid at liquidation would be approximately $10.09 per share for stockholders based on amounts on deposit in the Trust Account as of September 30, 2019. The closing price of HSAC Shares on the Nasdaq Stock Market as of November 20, 2019 was $10.35. HSAC’s initial stockholders waived the right to any liquidation distribution with respect to any HSAC Shares held by them.

Q: What happens to the funds deposited in the Trust Account following the Business Combination?

A: Following the closing of the Business Combination, funds in the Trust Account will be released to HSAC. Holders of HSAC Shares exercising redemption rights will receive their per share redemption price. The balance of the funds will be utilized to fund the Business Combination. As of September 30, 2019, there was approximately $116,024,698 in the Trust Account. Approximately $10.09 per outstanding share issued in the IPO will be paid to the public investors. Any funds remaining in the Trust Account after such uses will be used for future working capital and other corporate purposes of the combined entity.

DELIVERY OF DOCUMENTS TO HSAC’s stockholders

Pursuant to the rules of the Securities and Exchange Commission, HSAC and services that it employs to deliver communications to its stockholders are permitted to deliver to two or more stockholders sharing the same address a single copy of the proxy statement, unless HSAC has received contrary instructions from one or more of such stockholders. Upon written or oral request, HSAC will deliver a separate copy of the proxy statement to any shareholder at a shared address to which a single copy of the proxy statement was delivered and who wishes to receive separate copies in the future. Stockholders receiving multiple copies of the proxy statement may likewise request that HSAC deliver single copies of the proxy statement in the future. Stockholders may notify HSAC of their requests by contacting HSAC as follows:

412 West 15th Street, Floor 9

New York, NY 10011

Telephone: (646) 593-7999

8

SUMMARY OF THE PROXY STATEMENT

This summary highlights selected information from this proxy statement but may not contain all of the information that may be important to you. Accordingly, HSAC encourages you to read carefully this entire proxy statement, including the Share Exchange Agreement attached as Annex A. Please read these documents carefully as they are the legal documents that govern the Business Combination and your rights in the Business Combination.

Unless otherwise specified, all share calculations assume no exercise of the redemption rights by HSAC’s stockholders.

The Parties to the Business Combination

Health Sciences Acquisitions Corporation

HSAC was incorporated as a blank check company on December 6, 2018, under the laws of the state of Delaware, for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities, which HSAC refers to as a “target business.” Although HSAC’s efforts to identify a prospective target business were not to be limited to any particular industry or geographic location, HSAC intended to focus on businesses in the healthcare and healthcare-related industries in North America or Europe.

On May 14, 2019, HSAC consummated the IPO of 11,500,000 HSAC Units, which included full exercise of the underwriters’ over-allotment option. The HSAC Units were sold at an offering price of $10.00 per HSAC Unit, generating total gross proceeds of $115,000,000.

Simultaneously with the closing of the IPO, HSAC consummated a private placement with the Sponsor of 10,000,000 Private Warrants at a price of $0.50 per Private Warrant, generating total proceeds of $5,000,000. The issuance was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

In accordance with HSAC’s Amended and Restated Certificate of Incorporation, the amounts held in the Trust Account may only be used by HSAC upon the consummation of a business combination, except that there can be released to HSAC, from time to time, any interest earned on the funds in the Trust Account that it may need to pay its tax obligations. The remaining interest earned on the funds in the Trust Account will not be released until the earlier of the completion of a business combination and HSAC’s liquidation. HSAC executed the Share Exchange Agreement on September 29, 2019 and it must liquidate unless a business combination is consummated by the date that is 24 months from the closing of the IPO.

After deducting the underwriting discounts, offering expenses, and commissions from the IPO and the sale of the Private Warrants, a total of $115,000,000 was deposited into the Trust Account, and the remaining proceeds became available to be used to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses. As of November 20, 2019, HSAC had approximately $1,117,659.68 of unused net proceeds that were not deposited into the Trust Account to pay future general and administrative expenses. The net proceeds deposited into the Trust Account remain on deposit in the Trust Account earning interest. As of September 30, 2019, there was $116,024,698 held in the Trust Account (including $1,024,698 of accrued interest which HSAC can withdraw to pay taxes).

The HSAC Units, HSAC Shares, and HSAC Warrants are currently listed on the Nasdaq Stock Market, under the symbols “HSACU,” “HSAC,” and “HSACW,” respectively. The HSAC Units commenced trading on the Nasdaq Stock Market on May 9, 2019. The HSAC Shares and HSAC Warrants commenced trading on the Nasdaq Stock Market on June 21, 2019.

HSAC’s principal executive offices are located at 412 West 15th Street, Floor 9, New York, NY 10011, and its telephone number is (646) 593-7999.

Immunovant Sciences Ltd.

Immunovant is a Bermuda exempted limited company formed in July 2018. Immunovant’s principal office and mailing address is Suite 1, 3rd Floor, 11-12 St. James’s Square, London, SW1Y 4LB, United Kingdom, its registered office is Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, its telephone number is +44 207 400 3347

9

and its website is www.immunovant.com. The information contained on, or accessible through, Immunovant’s website is not incorporated by reference into this proxy statement, and you should not consider any information contained on, or that can be accessed through, Immunovant’s website as part of this proxy statement or in deciding how to vote your HSAC Shares.

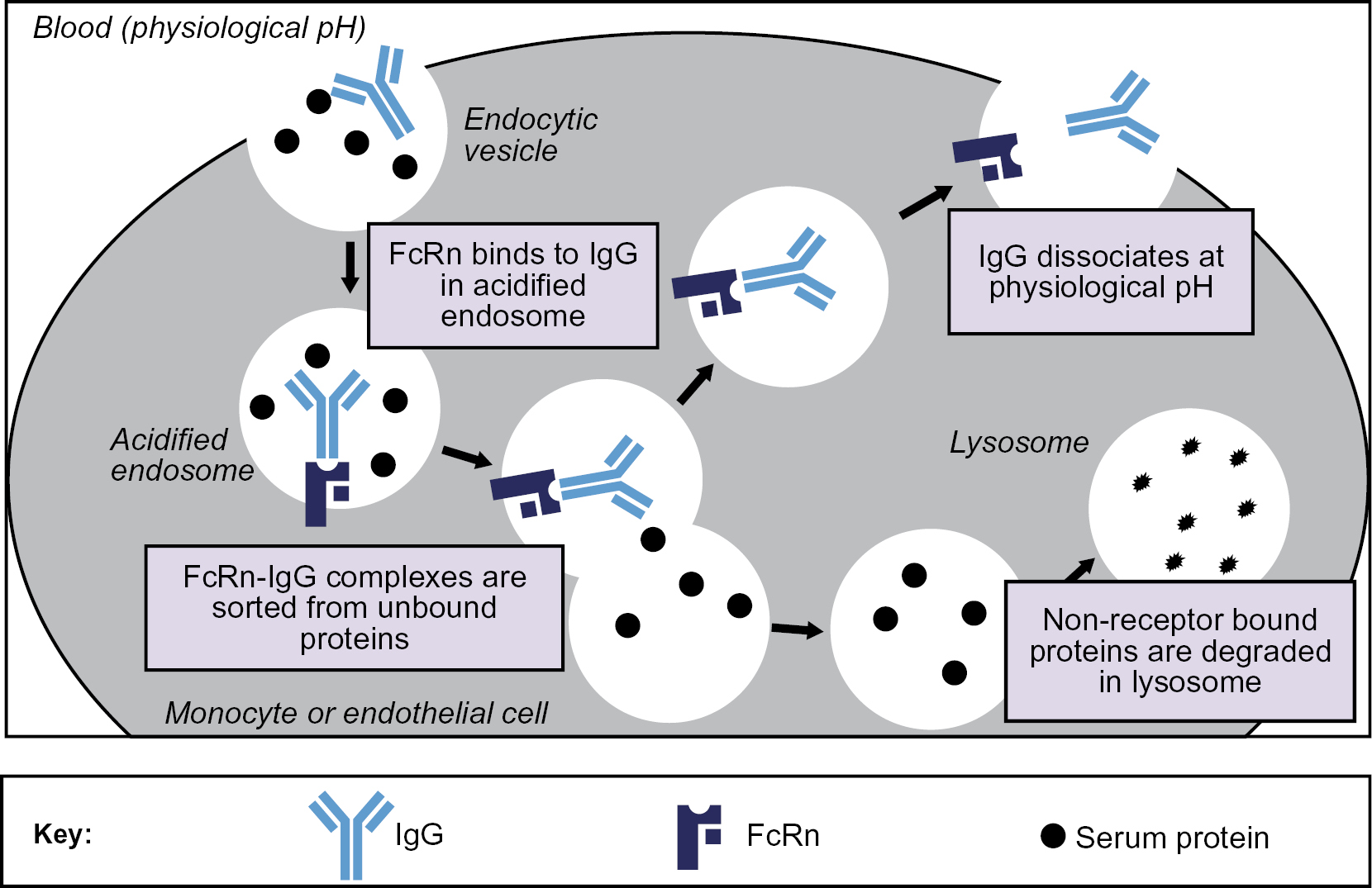

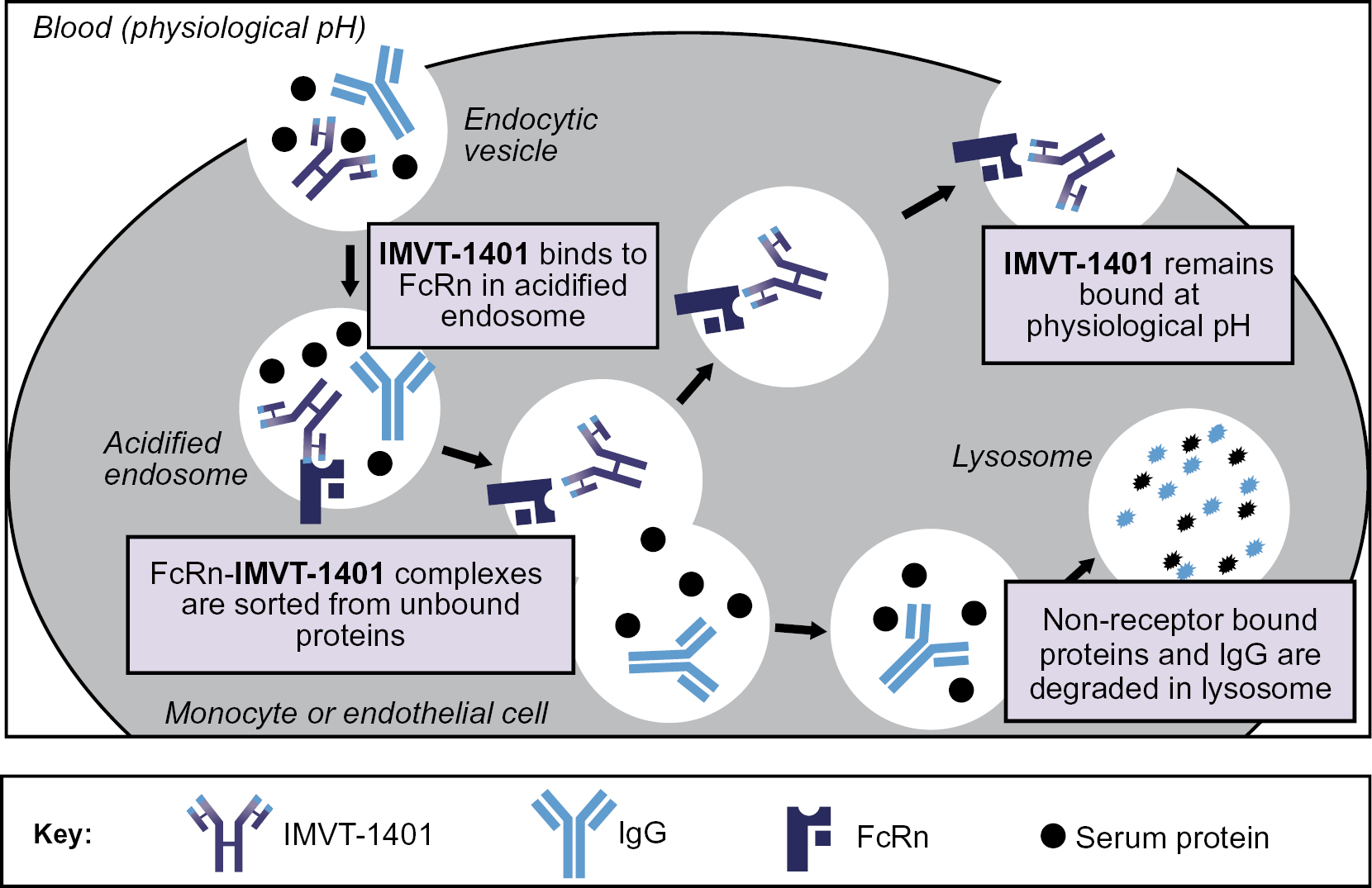

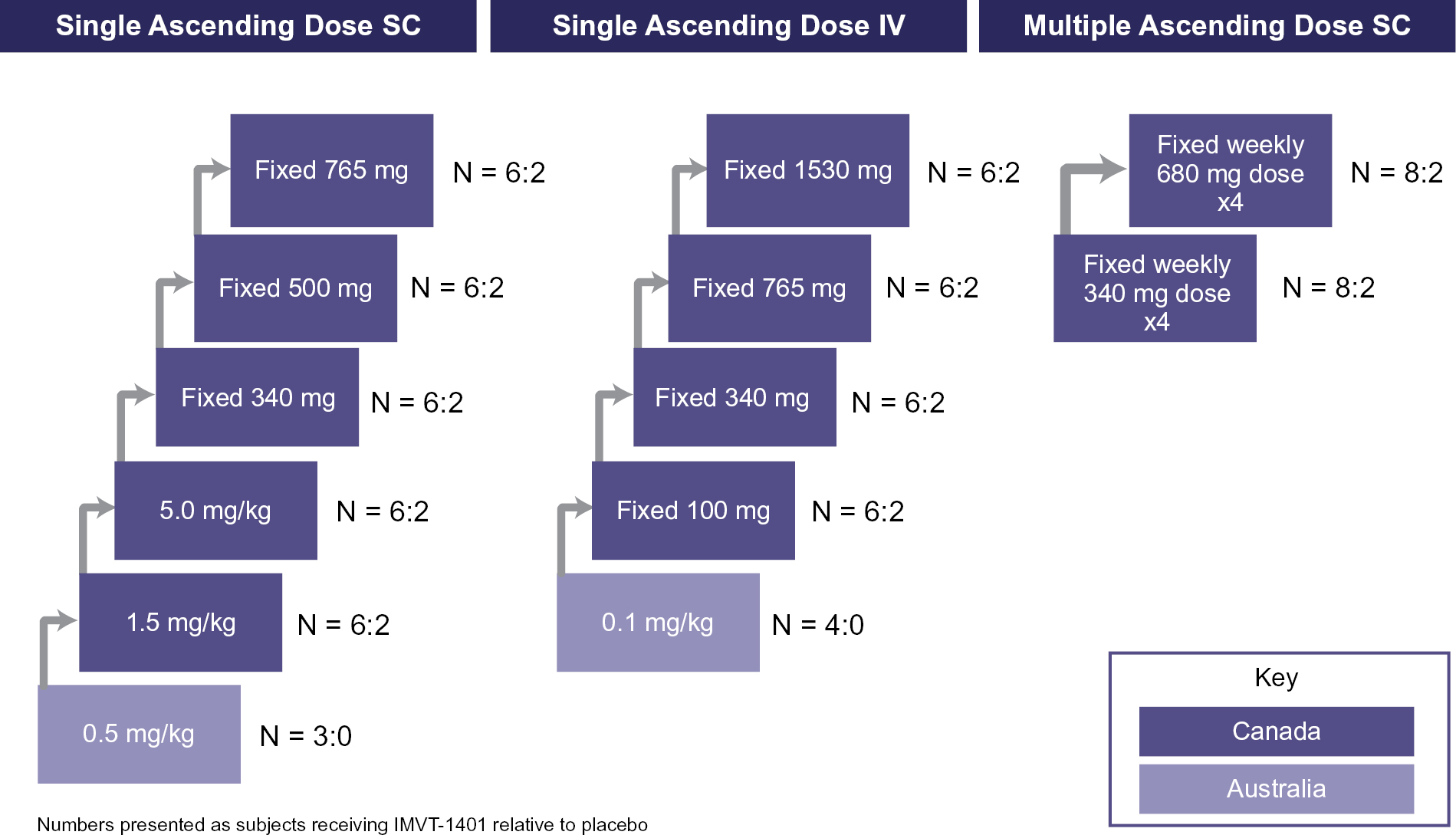

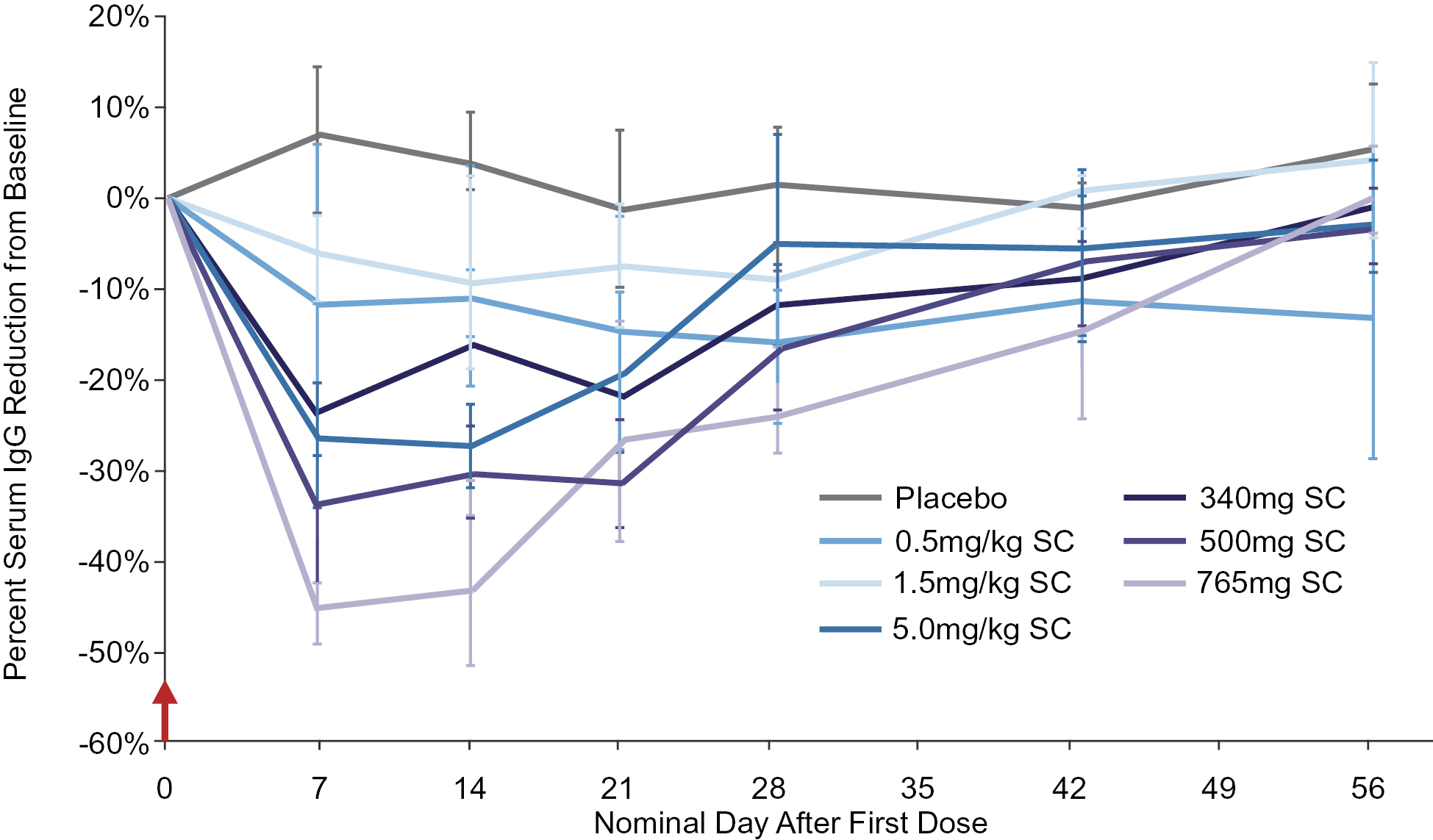

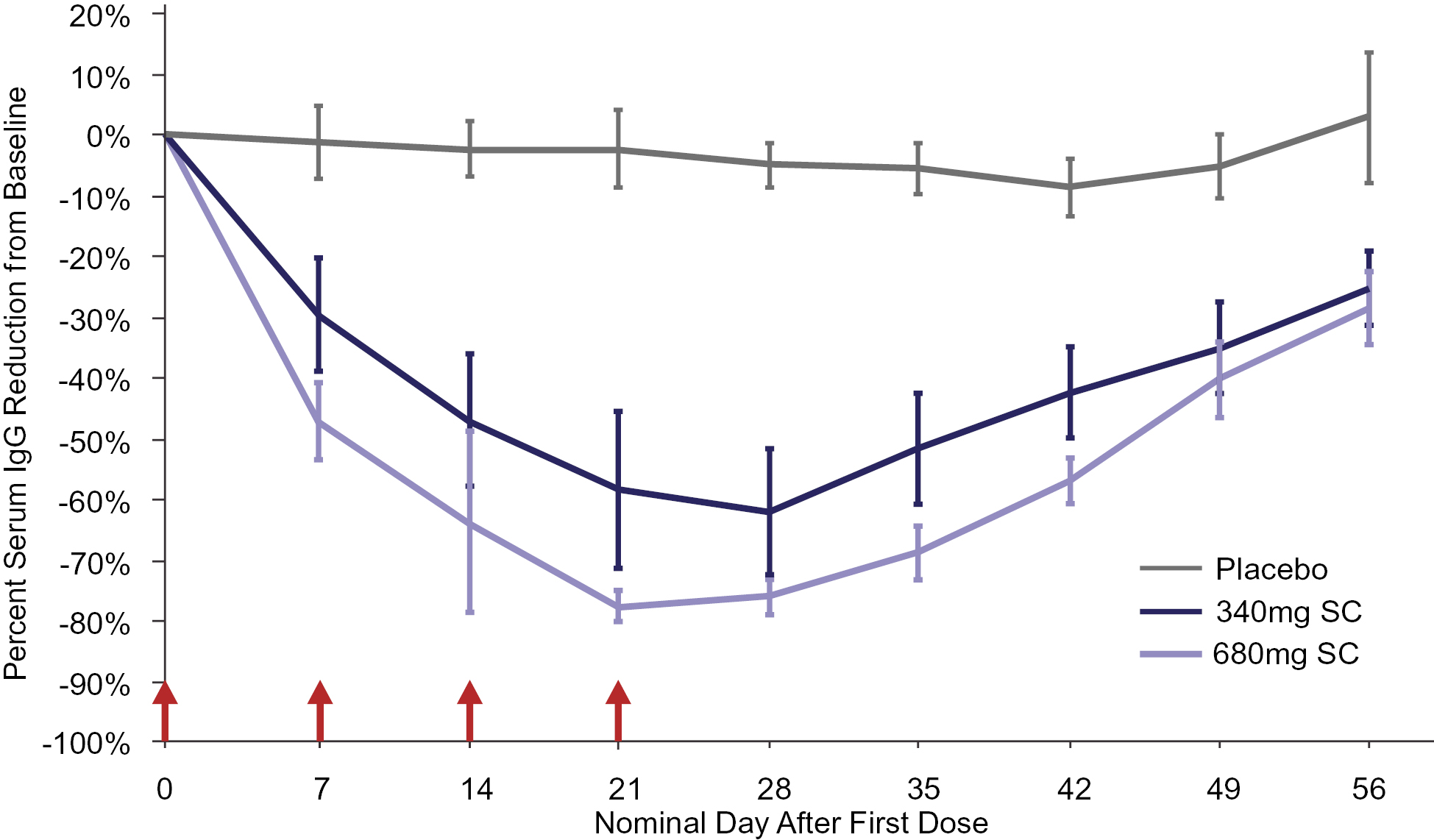

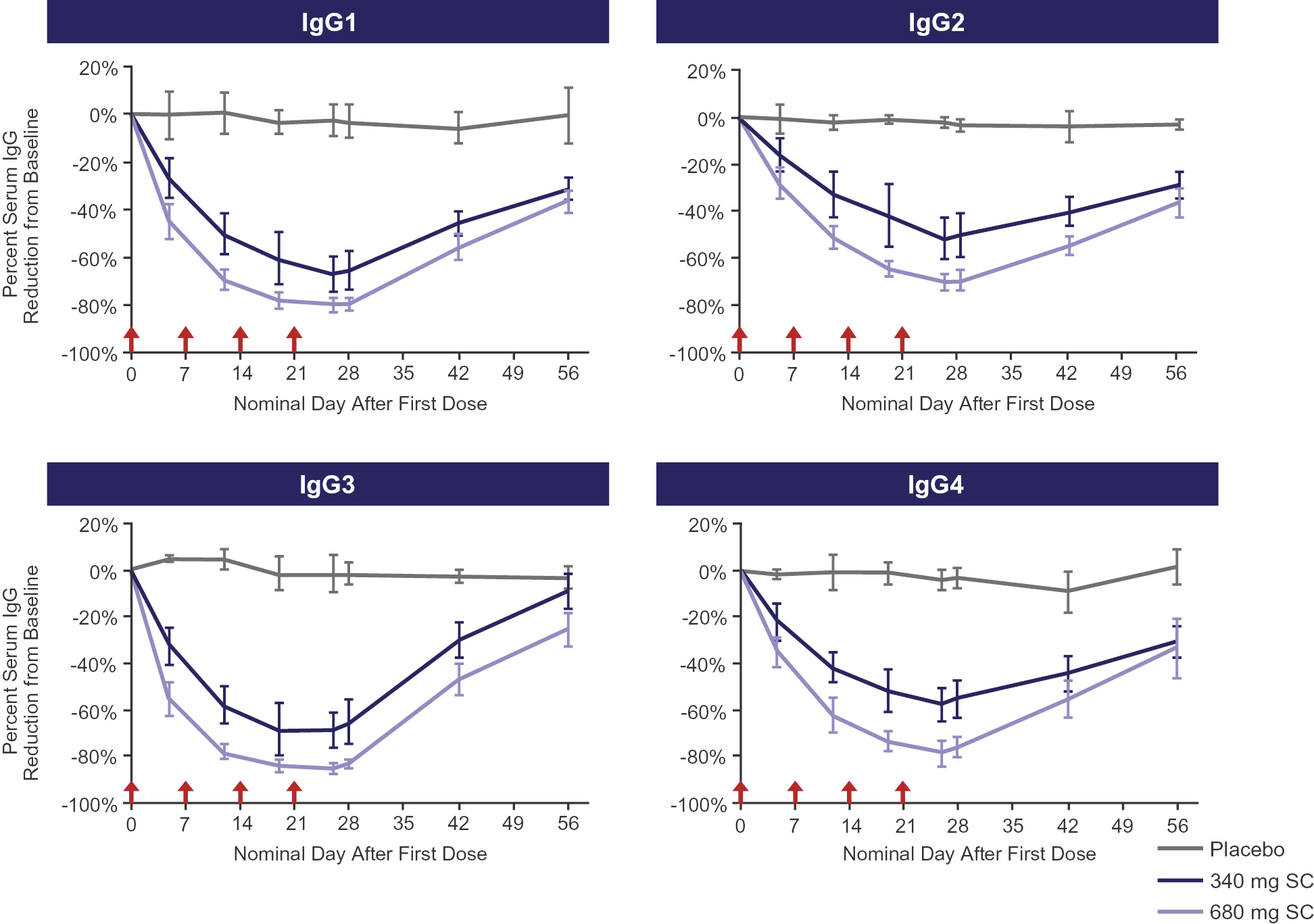

Immunovant is a clinical-stage biopharmaceutical company focused on enabling normal lives for patients with autoimmune diseases. Immunovant is developing a novel, fully human monoclonal antibody, IMVT-1401 (formerly referred to as RVT-1401), that selectively binds to and inhibits the neonatal fragment crystallizable receptor (“FcRn”). IMVT-1401 is the product of a multi-step, multi-year research program to design a highly potent FcRn antibody optimized for subcutaneous delivery. These efforts have resulted in a product candidate that has been dosed at small volumes and with a small gauge needle, while still generating therapeutically relevant pharmacodynamic activity, important attributes that Immunovant believes will drive patient preference and market adoption. In preclinical studies and in clinical trials conducted to date, IMVT-1401 has been observed to reduce immunoglobulin G (“IgG”) antibody levels. High levels of pathogenic IgG antibodies drive a variety of autoimmune diseases and, as a result, Immunovant believes IMVT-1401 has the potential for broad application in these disease areas. Immunovant intends to develop IMVT-1401 for debilitating autoimmune diseases in which there is robust evidence that pathogenic IgG antibodies drive disease manifestation and in which reduction of IgG antibodies should lead to clinical benefit.

Autoimmune diseases are conditions where an immune response is inappropriately directed against the body’s own healthy cells and tissues. Approximately 50 million people in the United States suffer from one of more than 100 diagnosed autoimmune diseases according to the American Autoimmune Related Diseases Association, Inc. Predisposing factors may include genetic susceptibility, environmental triggers and other factors not yet known. Many of these diseases are associated with high levels of pathogenic IgG antibodies, which are the most abundant type of antibody produced by the human immune system, accounting for approximately 75% of antibodies in the plasma of healthy people. IgG antibodies are important in the defense against pathogens, such as viruses and bacteria. In many autoimmune diseases, IgG antibodies inappropriately develop against normal proteins found in the body, directing the immune system to attack specific organs or organ systems. Current treatment regimens for IgG-mediated autoimmune diseases include corticosteroids and immunosuppressants in early stage disease, followed by more invasive treatments, such as intravenous immunoglobulin (“IVIg”), and plasma exchange, as the disease progresses. Such treatments are often limited by delayed onset of action, waning therapeutic benefit over time and unfavorable safety profiles.

Immunovant intends to develop IMVT-1401 as a fixed-dose, self-administered subcutaneous injection on a convenient weekly, or less frequent, dosing schedule. As a result of Immunovant’s rational design, it believes that IMVT-1401, if approved for commercial sale, would be differentiated from currently available, more invasive treatments for advanced IgG-mediated autoimmune diseases, (e.g., myasthenia gravis (“MG”), Graves’ ophthalmopathy (“GO”), warm autoimmune hemolytic anemia (“WAIHA”), idiopathic thrombocytopenic purpura, pemphigus vulgaris, chronic inflammatory demyelinating polyneuropathy, bullous pemphigoid, neuromyelitis optica, pemphigus foliaceus, Guillain-Barré syndrome and PLA2R+ membranous nephropathy). In 2017, these diseases had an aggregate prevalence of over 240,000 patients in the United States and 380,000 patients in Europe. To the extent Immunovant chooses to develop IMVT-1401 for certain of these rare diseases, Immunovant plans to seek orphan designation in the United States and Europe. Such designations would primarily provide financial and exclusivity incentives intended to make the development of orphan drugs financially viable. However, Immunovant has not yet sought such designation for any of its three target indications, and there is no certainty that it would obtain such designation, or maintain the benefits associated with such designation, if or when it does.

Immunovant’s first target indication for IMVT-1401 is MG, an autoimmune disease associated with muscle weakness with an estimated prevalence of one in 5,000, with up to 65,000 cases in the United States. In MG, patients develop pathogenic IgG antibodies that attack critical signaling proteins at the junction between nerve and muscle cells. The majority of MG patients suffer from progressive muscle weakness, with maximum weakness occurring within six months of disease onset in most patients. In severe cases, MG patients can experience myasthenic crisis, in which respiratory function is weakened to the point where it becomes life-threatening, requiring intubation and mechanical ventilation.

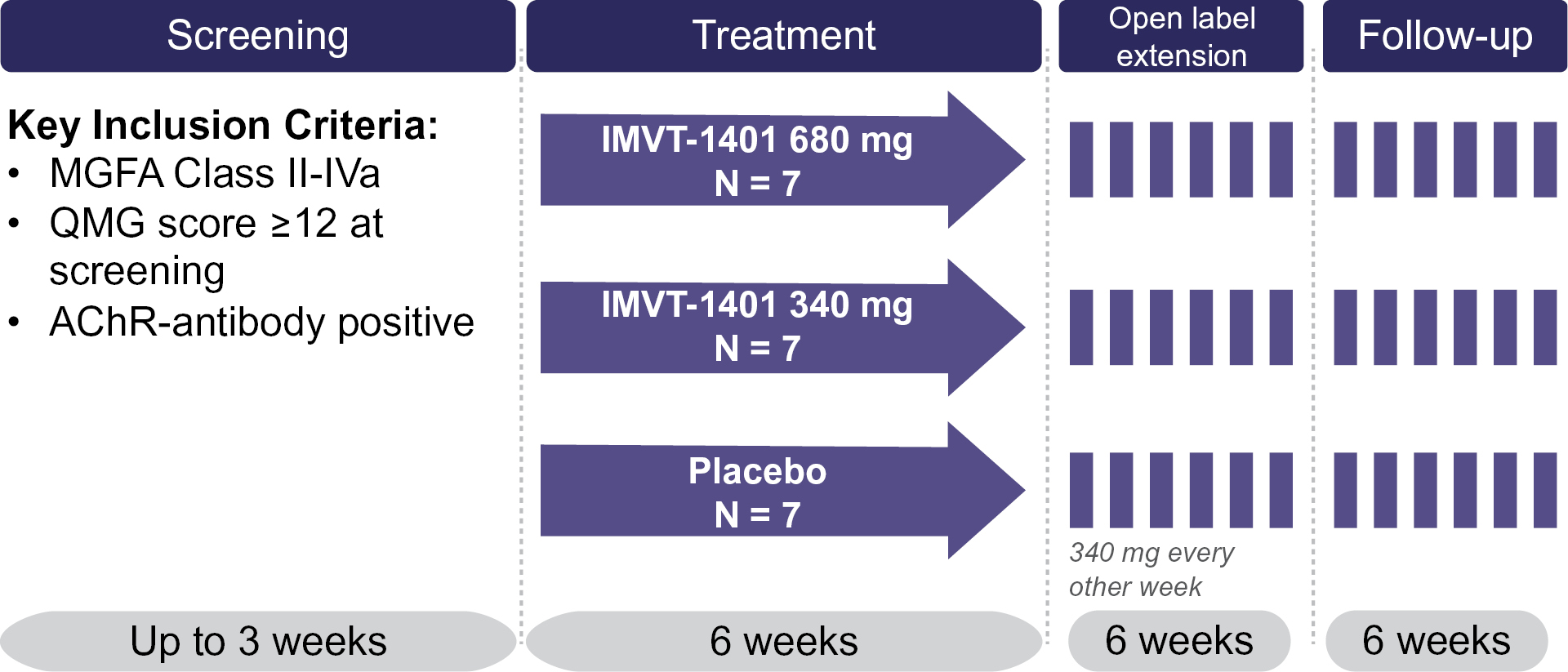

In August 2019, Immunovant initiated dosing in its ASCEND-MG trial, a Phase 2a clinical trial in patients with MG. Immunovant plans to report top-line results from this trial in the first half of 2020.

10

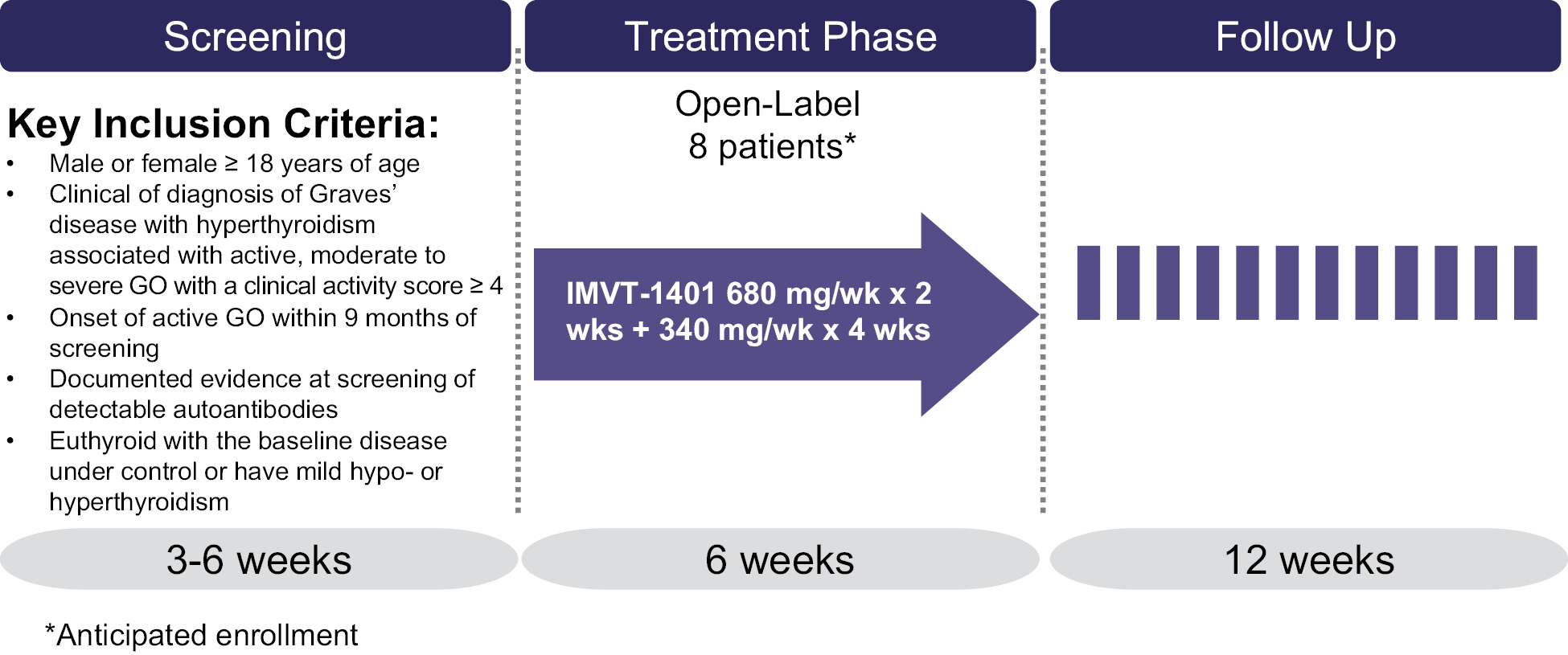

Immunovant’s second target indication for IMVT-1401 is GO, an autoimmune inflammatory disorder that affects the muscles and other tissues around the eyes, which can be sight-threatening. GO has an estimated annual incidence of 16 in 100,000 women and 2.9 in 100,000 men in North America and Europe. Initial symptoms may include a dry and gritty ocular sensation, sensitivity to light, excessive tearing, double vision and a sensation of pressure behind the eyes.

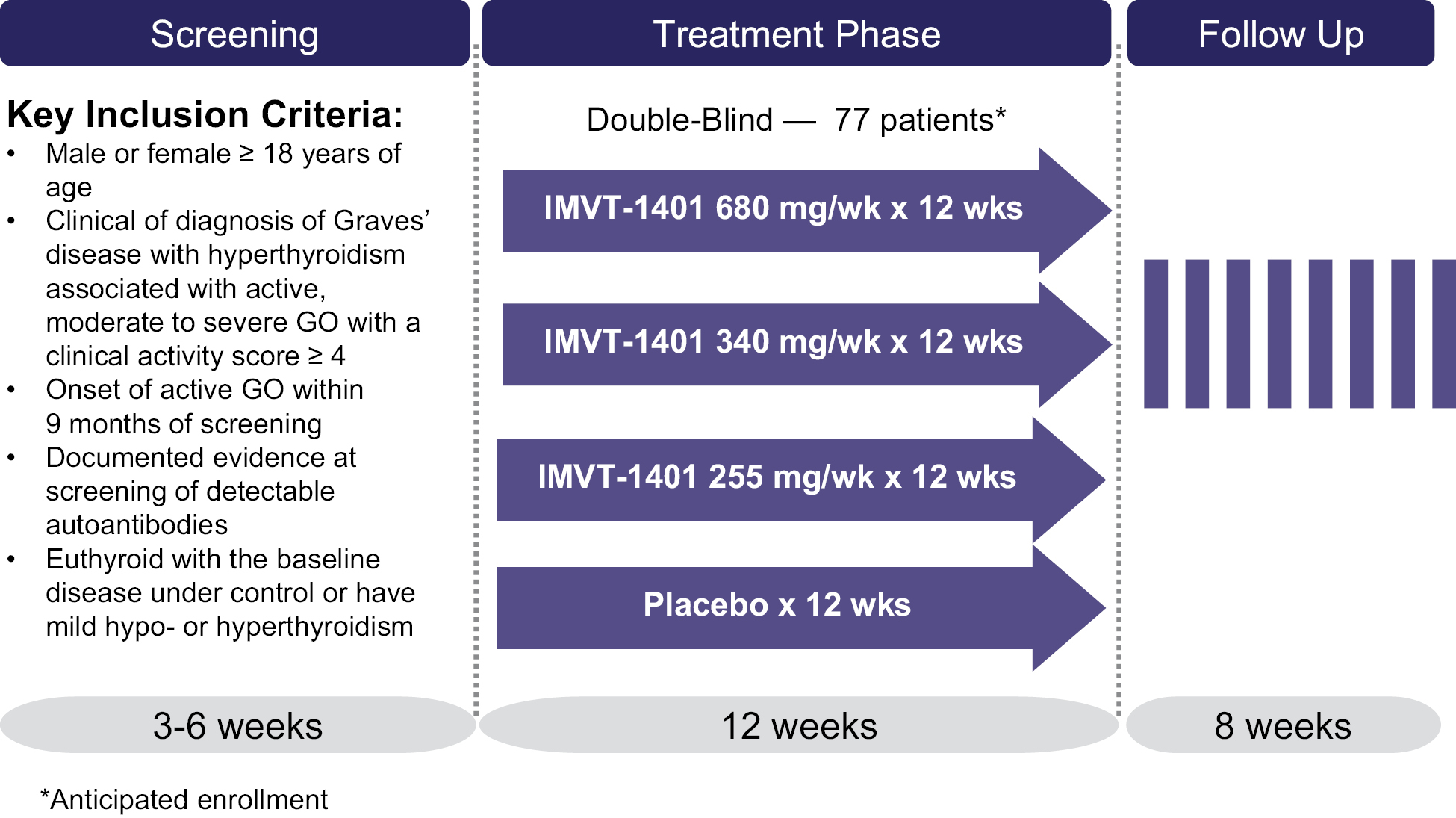

In May 2019, Immunovant initiated dosing in its ASCEND-GO 1 trial, a Phase 2a clinical trial in Canada in patients with GO. Immunovant anticipates reporting initial results from this trial in the first quarter of 2020. In October 2019, Immunovant initiated dosing in its ASCEND-GO 2 trial, a Phase 2b clinical trial for GO in the United States, Canada and Europe. Immunovant plans to report initial results from this trial in early 2021.

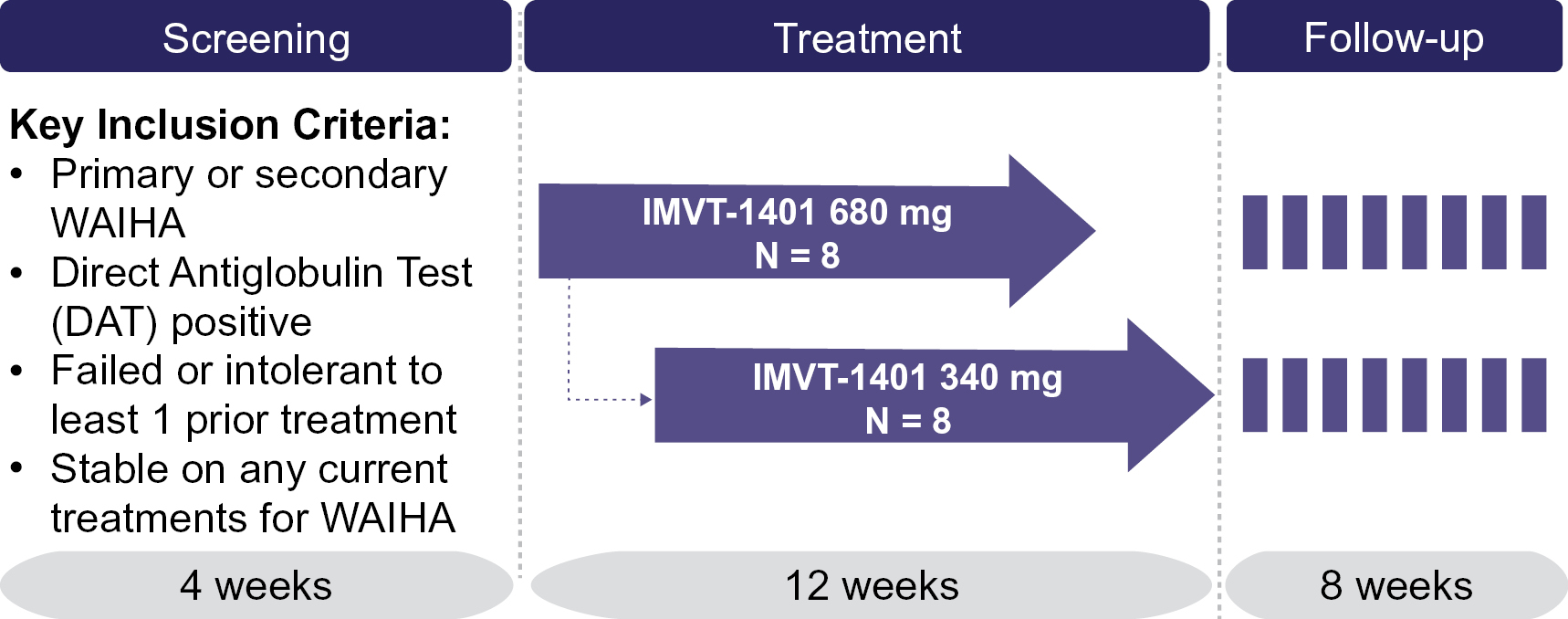

Immunovant is also developing IMVT-1401 for the treatment of WAIHA, a rare hematologic disease in which autoantibodies mediate hemolysis, or the destruction of red blood cells (“RBCs”). Based on published estimates, Immunovant believes that there are approximately 42,000 patients in the United States and 66,000 patients in Europe living with WAIHA. The clinical presentation is variable and most commonly includes symptoms of anemia, such as fatigue, weakness, skin paleness and shortness of breath. In severe cases, hemoglobin levels are unable to meet the body’s oxygen demand, which can lead to heart attacks, heart failure and even death.

In November 2019, Immunovant submitted its investigational new drug application (“IND”) to the U.S. Food and Drug Administration (“FDA”) for WAIHA and plans to report initial results from the Phase 2a WAIHA study in the fourth quarter of 2020.

Immunovant obtained rights to IMVT-1401 pursuant to its license agreement (the “HanAll Agreement”) with HanAll Biopharma Co., Ltd. (“HanAll”). Pursuant to the HanAll Agreement, Immunovant will be responsible for future contingent payments and royalties, including up to an aggregate of $452.5 million upon the achievement of certain development, regulatory and sales milestone events. Immunovant is also obligated to pay HanAll tiered royalties ranging from the mid-single digits to mid-teens on net sales of licensed products, subject to standard offsets and reductions as set forth in the HanAll Agreement.

For more information on Immunovant, please see the sections titled “Immunovant Sciences Ltd.’s Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Immunovant Sciences Ltd.”

Relationships with Roivant Sciences Ltd., Roivant Sciences, Inc. and Roivant Sciences GmbH

Immunovant is a Vant within the Roivant Family of Companies

Immunovant is a majority-owned subsidiary of Roivant and has benefited from its ability to leverage the Roivant model and the greater Roivant platform. The period of time between Immunovant’s formation and its operational maturation was shortened based on the support from centralized Roivant functions available since its creation. This includes operational functions as well as access to Roivant’s proprietary technology and digital innovation platforms. Consistent with its model, Roivant has also provided Immunovant with access to an embedded team of scientific experts, physicians and technologists to help optimize clinical development and commercial strategies. In the future, Immunovant may have the ability to benefit from Roivant’s economies of scale and scope.

Immunovant’s Controlling Shareholder

Roivant is currently Immunovant’s majority shareholder. Upon the closing of the Business Combination, assuming there are no redemptions of HSAC Shares for cash, Roivant will own approximately 67.6% of the HSAC Shares, and assuming redemption by holders of 4,578,600 outstanding HSAC Shares, the maximum number of shares that may be redeemed, Roivant will own approximately 73.8% of the HSAC Shares. As a result, after the closing of the Business Combination, the Combined Company will be a “controlled company” within the meaning of the listing rules of Nasdaq. The Combined Company will remain a “controlled company” so long as either more than 50% of the voting power for the election of directors is held by Roivant. As such, the Combined Company intends to avail itself of the controlled company exemptions under the Nasdaq listing rules. As a controlled company, the Combined Company will not be required to have a majority of “independent directors” on its board of directors, as defined under the Nasdaq listing rules, or to have a compensation committee or a committee of the Combined Company’s board of directors performing the director nominating function composed entirely of independent directors.

11

Roivant will be able to exercise control over all matters requiring shareholder approval, including the election of our directors and approval of significant corporate transactions. In addition, Roivant, as the holder of Series A Preferred Stock, will have the right to appoint Series A Preferred Directors in accordance with the provisions of the proposed Amended Charter. See “The Amendment Proposal” for additional information.

Services Agreements with Roivant Sciences, Inc. and Roivant Sciences GmbH

Immunovant has received, and will continue to receive, various services provided by its affiliates, Roivant Sciences, Inc. (“RSI”) and Roivant Sciences GmbH (“RSG”), each a wholly owned subsidiary of Roivant. These services include, but are not limited to, services related to development, administrative and financial activities. Following the closing of the Business Combination, Immunovant expects that its reliance on RSI and RSG will decrease over time as it continues to hire the necessary personnel to manage the development and potential commercialization of IMVT-1401 and any future product candidate. For a description of the services agreements pursuant to which these services are provided, see “Certain Transactions — Certain Transactions of Immunovant — Affiliate Services Agreements.”

The Share Exchange Agreement

Business Combination with Immunovant; Business Combination Consideration

On September 29, 2019, HSAC entered into a Share Exchange Agreement with Immunovant, the Sellers and the Sellers’ Representative. As of the date of the Share Exchange Agreement, the Sellers owned 100% of the issued and outstanding Immunovant Shares. Upon the closing of the transactions contemplated in the Share Exchange Agreement, HSAC will acquire all of the Sellers’ Immunovant Shares for the consideration described below, and Immunovant will become a wholly owned subsidiary of HSAC. Upon the closing of the transactions, HSAC will change its name to “Immunovant, Inc.”

Upon the closing of the Business Combination, the Sellers will sell to HSAC, and HSAC will purchase from the Sellers, all of the issued and outstanding Immunovant Shares and other equity interests in and of Immunovant, and HSAC will issue 42,180,277 HSAC Shares to the Sellers, including 10,000 shares of Series A Preferred Stock of HSAC issued to RSL, subject to pre-closing adjustment for certain indebtedness of Immunovant (other than indebtedness convertible into Immunovant capital stock). The issuance of HSAC Shares to the Sellers is being consummated on a private placement basis, pursuant to Section 4(a)(2) of the Securities Act. The aggregate value of the consideration to be paid by HSAC in the Business Combination is $421,802,770 (calculated as follows: 42,180,277 HSAC Shares to be issued to the Sellers, multiplied by $10.00 (the deemed value of the shares in the Share Exchange Agreement).

The Sellers are entitled to receive up to an additional 20,000,000 Earnout Shares after the closing of the Business Combination if the volume-weighted average price of the HSAC Shares equals or exceeds the following prices for any Trading Period following the closing: (1) during any Trading Period prior to March 31, 2023, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $17.50 per share; and (2) during any Trading Period prior to March 31, 2025, 10,000,000 Earnout Shares upon achievement of a volume-weighted average price of at least $31.50 per share (each, a “Milestone”). In the event that after closing of the Business Combination and prior to March 31, 2025, (i) there is a change of control of HSAC, (ii) any liquidation, dissolution or winding up of HSAC is initiated, (iii) any bankruptcy, dissolution or liquidation proceeding is instituted by or against HSAC, or (iv) HSAC makes an assignment for the benefit of creditors or consents to the appointment of a custodian, receiver or trustee for all or substantial part of its assets or properties (each, an “Acceleration Event”), then any Earnout Shares that have not been previously issued by HSAC (whether or not previously earned) shall be deemed earned and due by HSAC to the Sellers, unless in a change of control, the value of the consideration to be received in exchange for a HSAC Share is lower than the applicable Milestone share price thresholds described above.

For more information about the Business Combination, please see the section titled “The Business Combination Proposal” and for more information about the Share Exchange Agreement and the related agreements entered or to be entered into connection therewith, please see the section titled “The Share Exchange Agreement.” A copy of the Share Exchange Agreement is attached to this proxy statement as Annex A.

12

Representation and Warranty Insurance

In conjunction with entering into the Share Exchange Agreement, HSAC bound a representation and warranty insurance policy concurrently with executing the Share Exchange Agreement. The insurance policy is being provided by Indian Harbor Insurance Company with a policy limit of $10 million and an initial retention amount equal to approximately $0.9 million.

Management

Immediately after the closing of the Business Combination, the Board will consist of seven directors, six of whom will be initially designated by the Sellers and one of whom will be initially designated by the Sponsor. See “Directors, Executive Officers, Executive Compensation and Corporate Governance — Directors and Executive Officers after the Business Combination” for additional information.

Other Agreements Relating to the Business Combination

Sponsor Restricted Stock Agreement

In accordance with the restricted stock agreement (the “Sponsor Restricted Stock Agreement”), by and between HSAC and the Sponsor, the Sponsor has agreed that, concurrently with the closing of the Business Combination (the “Closing”), the Sponsor will (a) forfeit a number of HSAC Shares equal to: (A) 1,800,000, multiplied by (B) (i) the number of HSAC Shares validly redeemed by holders thereof in connection with the Business Combination as reflected in the records of the Company’s transfer agent, divided by (ii) 11,500,000 (such number of shares, the “Cancelled Shares”), and (b) subject a number of HSAC shares equal to 1,800,000 minus the Cancelled Shares (the “Sponsor Earnout Shares”) to potential forfeiture in the event that the Milestones are not achieved. In the event of an Acceleration Event, all of the Sponsor Earnout Shares shall vest and no longer be subject to forfeiture, unless in a change of control, the value of the consideration to be received in exchange for a HSAC Share is lower than the applicable Milestone share price thresholds described above. Any Sponsor Earnout Shares that have not vested on or prior to March 31, 2025 will be forfeited by the Sponsor after such date.

Lock-Up Agreements

Each Immunovant stockholder has entered into a Lock-up Agreement with HSAC, in substantially the form attached to the Share Exchange Agreement, with respect to their HSAC Shares (or any securities convertible into, or exchangeable for, or representing the rights to receive HSAC Shares) to be received by it in the Business Combination or during the Lock-up Period (as defined below) (such shares, the “Lock-up Shares”). In such Lock-up Agreement, each Immunovant stockholder has agreed that during the Lock-up Period, it will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any Lock-up Shares), enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of Lock-up Shares, whether any of these transactions are to be settled by delivery of any Lock-up Shares, in cash or otherwise, publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, or engage in any short sales with respect to any security of HSAC.

The “Lock-up Period” means: (i) with respect to 50% of the Lock-up Shares, the shorter of (A) the period commencing on the date of Closing and ending on the date that is six months thereafter; and (B) the period commencing on the date of Closing and ending on the date on which the last reported closing price of the HSAC Shares on the Nasdaq Capital Market (or such other exchange on which the HSAC Shares are then listed) equals or exceeds $12.50 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations) for any 20 trading days during any 30 trading day period thereafter; and (ii) with respect to the remaining 50% of the Lock-up Shares, the period commencing on the date of Closing and ending on the date that is six months thereafter. In addition, if within six months after the date of Closing, there is a Change of Control (as defined in the Share Exchange Agreement), then upon the consummation of such Change of Control, all Lock-up Shares shall be released from the foregoing restrictions.

Notwithstanding these restrictions, Immunovant stockholders will be permitted to make transfers or distributions to current or former general or limited partners, managers or members, stockholders, other equity holders or direct or indirect affiliates or to the estates of any of the foregoing; by bona fide gift to a member of such shareholder’s immediate family or to a trust, the beneficiary of which is the stockholder or a member of the shareholder’s immediate family for estate planning purposes; by virtue of the laws of descent and distribution upon death of the Holder; or pursuant to a qualified domestic relations order, in each case where such transferee agrees to be bound by the terms of a Lock-up Agreement.

13

Registration Rights Agreement

HSAC and Immunovant stockholders and the Sponsor have entered into an amended and restated registration rights agreement, in substantially the form attached to the Share Exchange Agreement (the “Registration Rights Agreement”). Under the Registration Rights Agreement, the Immunovant stockholders and the Sponsor will hold registration rights that obligate HSAC to register for resale under the Securities Act, all or any portion of the HSAC Shares issued under the Share Exchange Agreement, including any Earnout Payments, as well as HSAC Shares held by the Sponsor. Each of the Sponsor and Sellers’ Representative, as well as the stockholders holding a majority-in-interest of all such registrable securities will be entitled to make a written demand for registration under the Securities Act of all or part of the their registrable securities, so long as such shares are not then restricted under the Lock-Up Agreement. Subject to certain exceptions, if any time after the closing of the Business Combination, the Combined Company proposes to file a registration statement under the Securities Act with respect to its securities, under the Registration Rights Agreement, the Combined Company shall give notice to the Immunovant stockholders and the Sponsor as to the proposed filing and offer such stockholders an opportunity to register the sale of such number of their registrable securities as they request in writing. In addition, subject to certain exceptions, such stockholders will be entitled under the Registration Rights Agreement to request in writing that HSAC register the resale of any or all of their registrable securities on Form S-3 and any similar short-form registration statement that may be available at such time.

Under the Registration Rights Agreement, HSAC has agreed to indemnify such stockholders and certain persons or entities related to such stockholders against any losses or damages resulting from any untrue statement or omission of a material fact in any registration statement or prospectus pursuant to which they sell registrable securities, unless such liability arose from their misstatement or omission, and such stockholders including registrable securities in any registration statement or prospectus will agree to indemnify the Combined Company and certain persons or entities related to HSAC against all losses caused by their misstatements or omissions in those documents.

Other Agreements

As of the Record Date, HSAC had entered into voting agreements with holders of 4,547,000 HSAC Shares pursuant to which such stockholders, including but not limited to the RTW Entities, Perceptive Advisors, Adage Capital Management, Cormorant Asset Management, and Eventide Asset Management, LLC, agreed to vote in favor of the transactions contemplated by the Share Exchange Agreement and to not redeem or sell their shares.

In addition, as of the Record Date, HSAC had entered into agreements with other investors that agreed to purchase up to 2,374,400 HSAC Shares at HSAC’s request and not to redeem such HSAC Shares in connection with the closing of the Business Combination.

Recommendations of the Board of Directors and Reasons for the Business Combination

After careful consideration of the terms and conditions of the Share Exchange Agreement, the Board has determined that Business Combination and the transactions contemplated thereby are fair to, and in the best interests of, HSAC and its stockholders. In reaching its decision with respect to the Business Combination and the transactions contemplated thereby, the Board reviewed various industry and financial data and the evaluation of materials provided by Immunovant. The financial data and materials evaluated included patient population data sourced from disease advocacy groups and public databases, public data disclosed by competitors in the anti-FcRn space and publicly disclosed pre-clinical and clinical data and timing of upcoming catalysts provided by Immunovant. The Board did not obtain a fairness opinion on which to base its assessment. The Board recommends that HSAC stockholders vote:

• FOR the Business Combination Proposal;

• FOR the Amendment Proposal;

• FOR the Nasdaq Proposal;

• FOR the Equity Incentive Plan Proposal; and

• FOR the Business Combination Adjournment Proposal.

14

Interests of Certain Persons in the Business Combination

When you consider the recommendation of the Board in favor of adoption of the Business Combination Proposal and other proposals, you should keep in mind that HSAC’s directors and officers have interests in the Business Combination that are different from, or in addition to, your interests as a shareholder, including:

• If a proposed business combination is not completed by the date that is 24 months from the closing of the IPO, HSAC will be required to liquidate. In such event, the 2,875,000 HSAC Shares held by the Sponsor, which were acquired prior to the IPO for an aggregate purchase price of $25,000, will be worthless. Such HSAC Shares had an aggregate market value of approximately $29,756,250 based on the closing price of the HSAC Shares of $10.35 on the Nasdaq Stock Market as of November 20, 2019.