Exhibit 99.1

Corporate Overview November 2019

This presentation has been prepared by Immunovant Sciences Ltd. (“we,” “us,” “our,” “Immunovant” or the “Company”) and contai ns forward - looking statements. In some cases, you can identify forward - looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expec t,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” and “would,” or the negative of these terms, or other co mparable terminology intended to identify statements about the future. These statements are based on management’s current beliefs and expectations. These statements in clu de but are not limited to statements regarding our business strategy, our plans to develop and commercialize our product candidates, our plans to enter into comme rci al transactions or strategic partnerships, the safety and efficacy of our product candidates, our expectations regarding timing, the design and results of clinical tria ls of our product candidates, our plans and expected timing with respect to regulatory filings and approvals, the size and growth potential of the markets for our produc t c andidates, and our ability to serve those markets, and our plans and expected timing with respect to regulatory filings and approvals. These statements involve substan tia l known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the informat ion expressed or implied by these forward - looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward - looking statement s, and you should not place undue reliance on our forward - looking statements. Actual results or events could differ materially from the plans, intentions and expe ctations disclosed in the forward - looking statements we make as a result of various important factors, including, without limitation, those inherent in the preclinical an d clinical development process and the regulatory approval process, the risks and uncertainties in commercialization and gaining market acceptance, the risks associ ate d with protecting and defending our intellectual property rights, our reliance on third - parties to conduct clinical and preclinical trials, our reliance on third - pa rty suppliers to manufacture clinical, preclinical and any future commercial supplies of our product candidates, increased regulatory requirements, our ability to provide the finan cia l support and resources necessary to develop our product candidate on the expected timeline, our ability to identify and acquire or in - license new product candidates and competition from others developing products for similar uses. These statements are subject to the risk that clinical study data are subject to differing interpr eta tions, and regulatory agencies, medical and scientific experts and others may not share our view of the clinical study data. There can be no assurance that the clinical pro grams for our product candidate will be successful in demonstrating safety and/or efficacy, that we will not encounter problems or delays in clinical development, or th at any of our product candidates will ever receive regulatory approval or be successfully commercialized. The forward - looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. While we may elect to update these forw ard - looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward - looking statements as representing our views as of any date subsequent to the date of this presentation. HSAC, Immunovant , and their respective directors, executive officers and employees and other persons may be deemed to be participants in the sol icitation of proxies from the holders of HSAC common stock in respect of the proposed transaction. Information about HSAC’s directors and executive off ice rs and their ownership of HSAC’s common stock is set forth in HSAC’s Registration Statement filed on Form S - 1 filed with the SEC on May 3, 2019, as modified or s upplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solici tat ion will be included in the proxy statement pertaining to the proposed transaction when it becomes available. These documents can be obtained free of charge from the sou rce s indicated below. In connection with the transaction described herein, HSAC has filed and will file relevant materials with the SEC, including a p roxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, HSAC will mail the definitive proxy statement and a proxy card to e ach stockholder entitled to vote at the special meeting relating to the transaction. Investors and security holders of HSAC are urged to read these materials (including any ame ndments or supplements thereto) and any other relevant documents in connection with the transaction that HSAC will file with the SEC when they become available becau se they will contain important information about HSAC, Immunovant and the transaction. The preliminary proxy statement, the definitive proxy statement and other relevant materials in connecti on with the transaction (when they become available), and any other documents filed by HSAC with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or by writing to HSAC at 412 West 15th Street, Floor 9. New York, NY 10011. By attending or receiving this presentation you acknowledge that you will be solely responsible for your own assessment of th e m arket and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of ou r business and the transactions. The information herein does not purport to be all - inclusive. The data and estimates contained herein was derived from various intern al and external sources, and involves a number of assumptions and limitations. You are cautioned not to give undue weight to such data or estimates. Neither HSAC n or Immunovant nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the da te of this presentation. This presentation does not constitute an offer to sell or the solicitation of an offer buy securities, nor is it a solicitation of any vote or app roval of the transactions, nor will there be any sale of these securities in, any state or jurisdiction in which such offer, solicitation or sale would be unlawful. Any offering of s ecu rities or solicitation to vote regarding the proposed transactions described herein will be made only by means of a proxy statement on Schedule 14A filed with the SEC. 2

Transaction

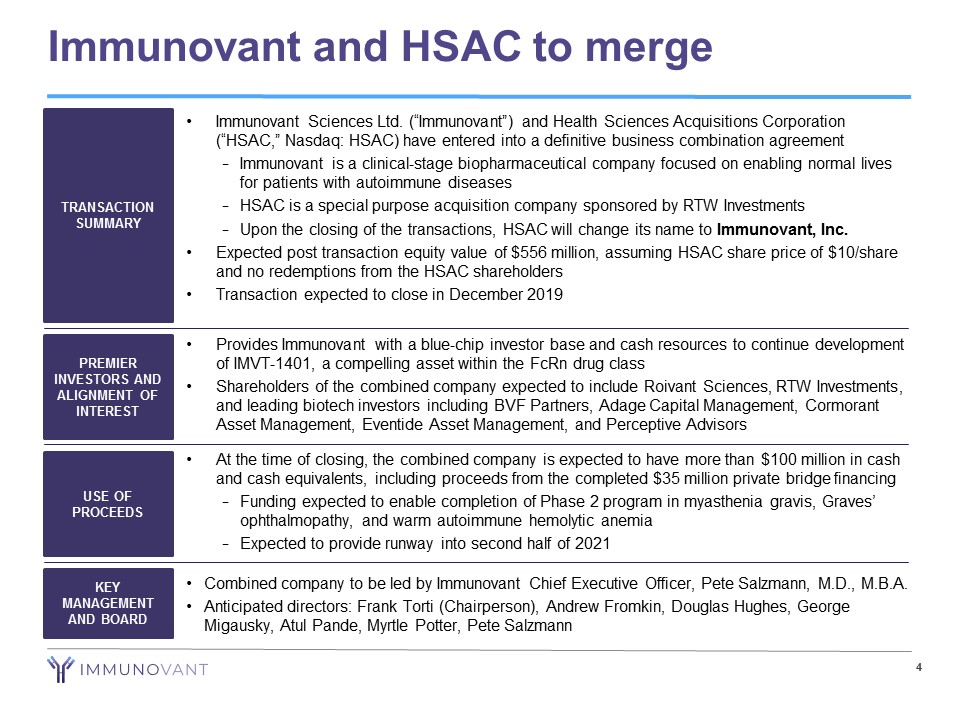

4 Immunovant and HSAC to merge • Immunovant Sciences Ltd. (“Immunovant”) and Health Sciences Acquisitions Corporation (“HSAC,” Nasdaq: HSAC) have entered into a definitive business combination agreement − Immunovant is a clinical - stage biopharmaceutical company focused on enabling normal lives for patients with autoimmune diseases − HSAC is a special purpose acquisition company sponsored by RTW Investments − Upon the closing of the transactions, HSAC will change its name to Immunovant, Inc. • Expected post transaction equity value of $556 million, assuming HSAC share price of $10/share and no redemptions from the HSAC shareholders • Transaction expected to close in December 2019 TRANSACTION SUMMARY PREMIER INVESTORS AND ALIGNMENT OF INTEREST USE OF PROCEEDS KEY MANAGEMENT AND BOARD • Provides Immunovant with a blue - chip investor base and cash resources to continue development of IMVT - 1401, a compelling asset within the FcRn drug class • Shareholders of the combined company expected to include Roivant Sciences, RTW Investments, and leading biotech investors including BVF Partners, Adage Capital Management, Cormorant Asset Management, Eventide Asset Management, and Perceptive Advisors • At the time of closing, the combined company is expected to have more than $100 million in cash and cash equivalents, including proceeds from the completed $35 million private bridge financing − Funding expected to enable completion of Phase 2 program in myasthenia gravis, Graves’ ophthalmopathy , and warm autoimmune hemolytic anemia − Expected to provide runway into second half of 2021 • Combined company to be led by Immunovant Chief Executive Officer, Pete Salzmann, M.D., M.B.A. • Anticipated directors: Frank Torti (Chairperson), Andrew Fromkin , Douglas Hughes, George Migausky, Atul Pande , Myrtle Potter, Pete Salzmann

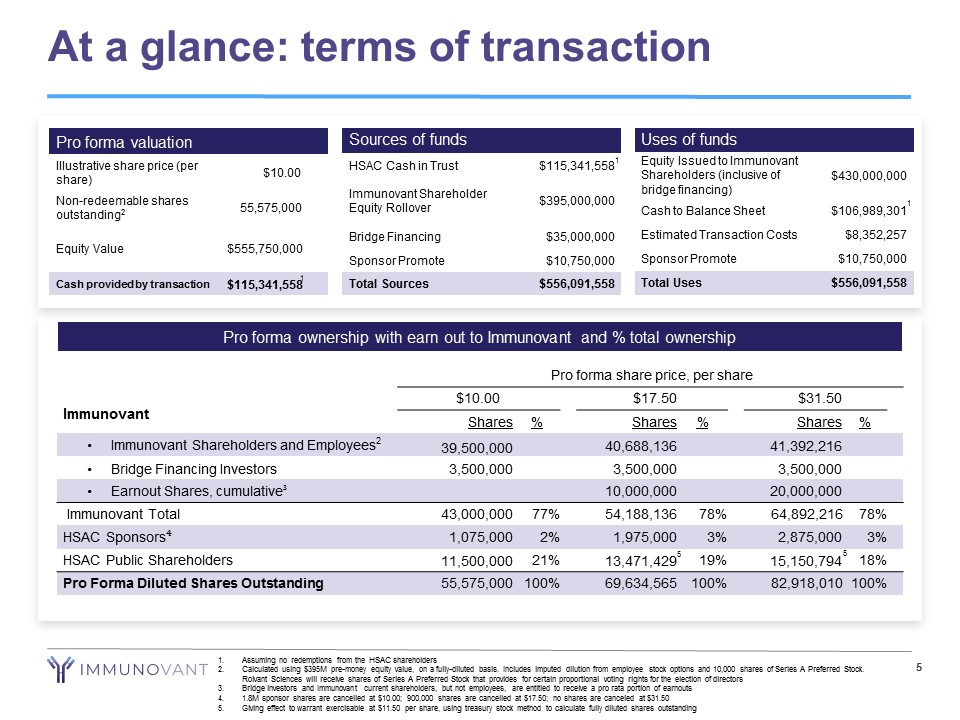

At a glance: terms of transaction 5 Sources of funds HSAC Cash in Trust $115,341,558 Immunovant Shareholder Equity Rollover $395,000,000 Bridge Financing $35,000,000 Sponsor Promote $10,750,000 Total Sources $556,091,558 Uses of funds Equity Issued to Immunovant Shareholders (inclusive of bridge financing) $430,000,000 Cash to Balance Sheet $106,989,301 Estimated Transaction Costs $8,352,257 Sponsor Promote $10,750,000 Total Uses $556,091,558 Pro forma valuation Illustrative share price (per share) $10.00 Non - redeemable shares outstanding 2 55,575,000 Equity Value $555,750,000 Cash provided by transaction $115,341,558 Pro forma ownership with earn out to Immunovant and % total ownership Pro forma share price, per share $10.00 $17.50 $31.50 Shares % Shares % Shares % • Immunovant Shareholders and Employees 2 39,500,000 40,688,136 41,392,216 • Bridge Financing Investors 3,500,000 3,500,000 3,500,000 • Earnout Shares, cumulative ³ 10,000,000 20,000,000 Immunovant Total 43,000,000 77% 54,188,136 78% 64,892,216 78% HSAC Sponsors ⁴ 1,075,000 2% 1,975,000 3% 2,875,000 3% HSAC Public Shareholders 11,500,000 21% 13,471,429 19% 15,150,794 18% Pro Forma Diluted Shares Outstanding 55,575,000 100% 69,634,565 100% 82,918,010 100% Immunovant 1. Assuming no redemptions from the HSAC shareholders 2. Calculated using $395M pre - money equity value, on a fully - diluted basis. Includes imputed dilution from employee stock options a nd 10,000 shares of Series A Preferred Stock. Roivant Sciences will receive shares of Series A Preferred Stock that provides for certain proportional voting rights for the el ection of directors 3. Bridge investors and Immunovant current shareholders, but not employees, are entitled to receive a pro rata portion of earnouts 4. 1.8M sponsor shares are cancelled at $10.00; 900,000 shares are cancelled at $17.50; no shares are canceled at $31.50 5. Giving effect to warrant exercisable at $11.50 per share, using treasury stock method to calculate fully diluted shares outst and ing 1 5 1 1 5

Immunovant

7 Our vision: Normal lives for patients with autoimmune diseases Our asset: IMVT - 1401, a novel, fully human monoclonal antibody inhibiting FcRn - mediated recycling of IgG Our strategy for IMVT - 1401: • Be best - in - class in target indications where anti - FcRn mechanism has already established clinical proof - of - concept • Be first to study FcRn inhibition in target indications with clear biologic rationale and no known in - class competition Our near - term value drivers: Four anticipated data readouts over the next 20 months

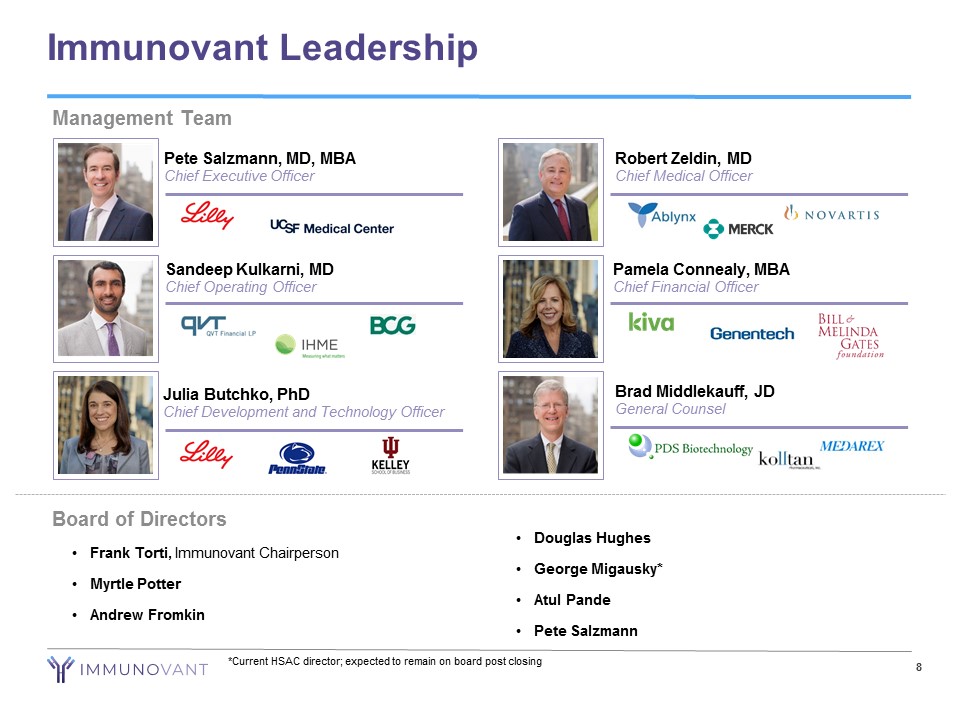

8 Immunovant Leadership Management Team • Frank Torti , Immunovant Chairperson • Myrtle Potter • Andrew Fromkin Board of Directors • Douglas Hughes • George Migausky * • Atul Pande • Pete Salzmann *Current HSAC director; expected to remain on board post closing Sandeep Kulkarni, MD Chief Operating Officer Pete Salzmann, MD, MBA Chief Executive Officer Robert Zeldin, MD Chief Medical Officer Brad Middlekauff, JD General Counsel Pamela Connealy, MBA Chief Financial Officer Julia Butchko, PhD Chief Development and Technology Officer

9 IMVT - 1401: Program Highlights IMVT - 1401: A novel, fully human monoclonal antibody inhibiting FcRn • Early evidence suggests that anti - FcRn agents could transform the treatment of autoimmune diseases mediated by pathogenic IgG antibodies In Phase 1, IMVT - 1401 generated compelling pharmacodynamic activity • Clinically meaningful IgG reductions observed (78% IgG reduction at 680mg dose level) • No difference observed between intravenous and subcutaneous formulations at equivalent doses IMVT - 1401 has been well tolerated to date • No headaches reported in the highest dose multiple dose cohort tested • No treatment - related serious adverse events (SAEs) or dose limiting toxicities reported • No confirmed cases of anti - drug antibodies in any subject in multiple dose cohorts IMVT - 1401 was designed from inception for subcutaneous (SC) injection • Requirement during development process • Phase 1 data suggest every other week or less frequent dosing achievable for chronic use

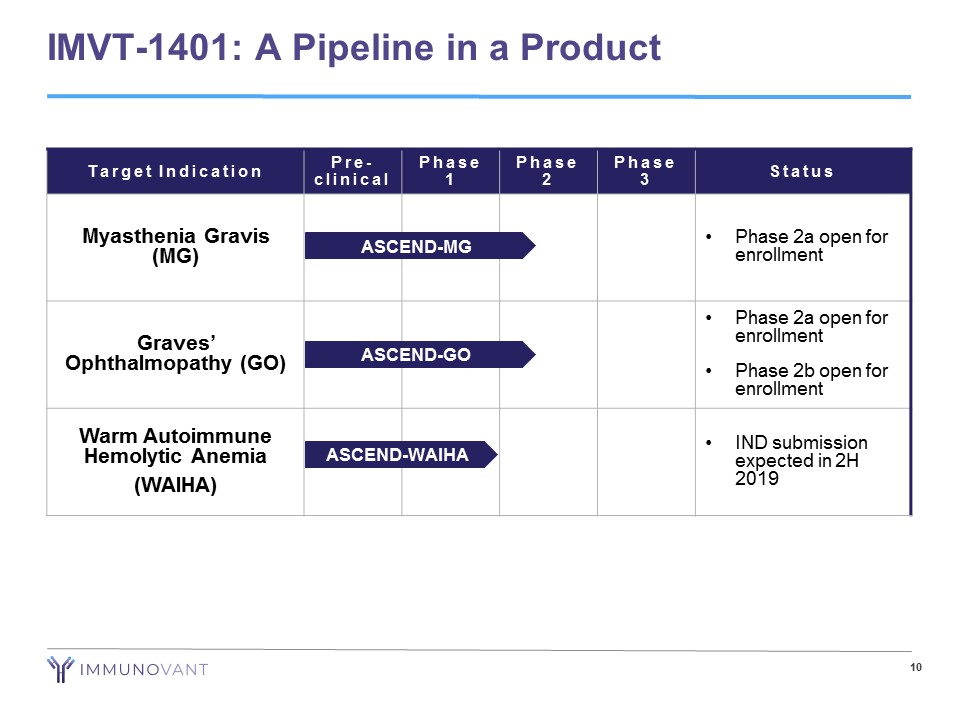

10 IMVT - 1401: A Pipeline in a Product Target Indication Pre - clinical Phase 1 Phase 2 Phase 3 Status Myasthenia Gravis (MG) • Phase 2a open for enrollment Graves’ Ophthalmopathy (GO) • Phase 2a open for enrollment • Phase 2b open for enrollment Warm Autoimmune Hemolytic Anemia (WAIHA) • IND submission expected in 2H 2019 ASCEND - GO ASCEND - WAIHA ASCEND - MG

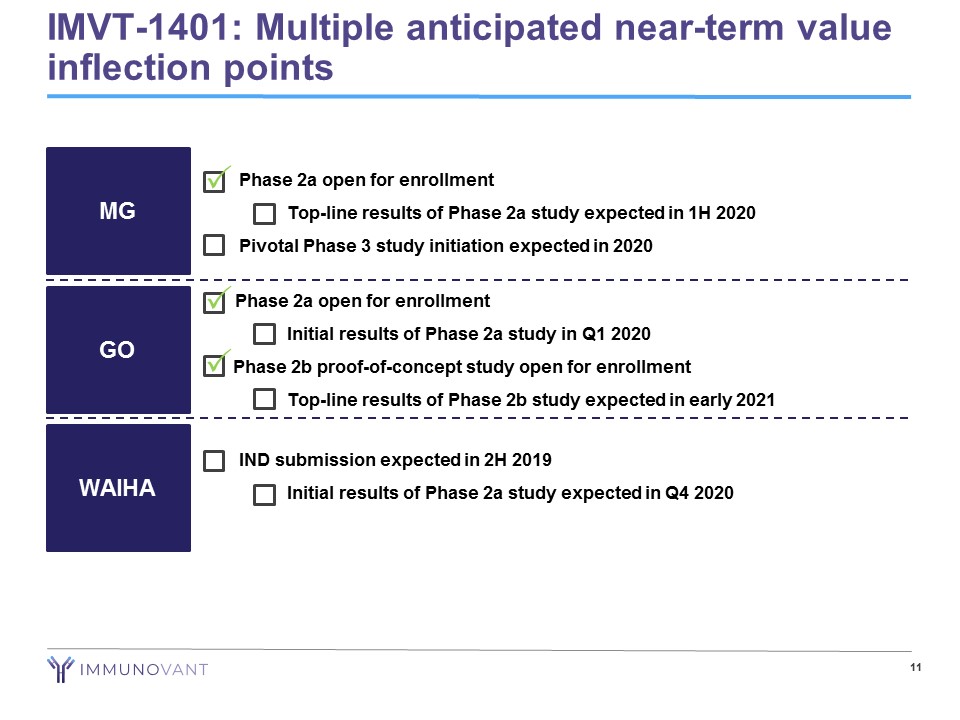

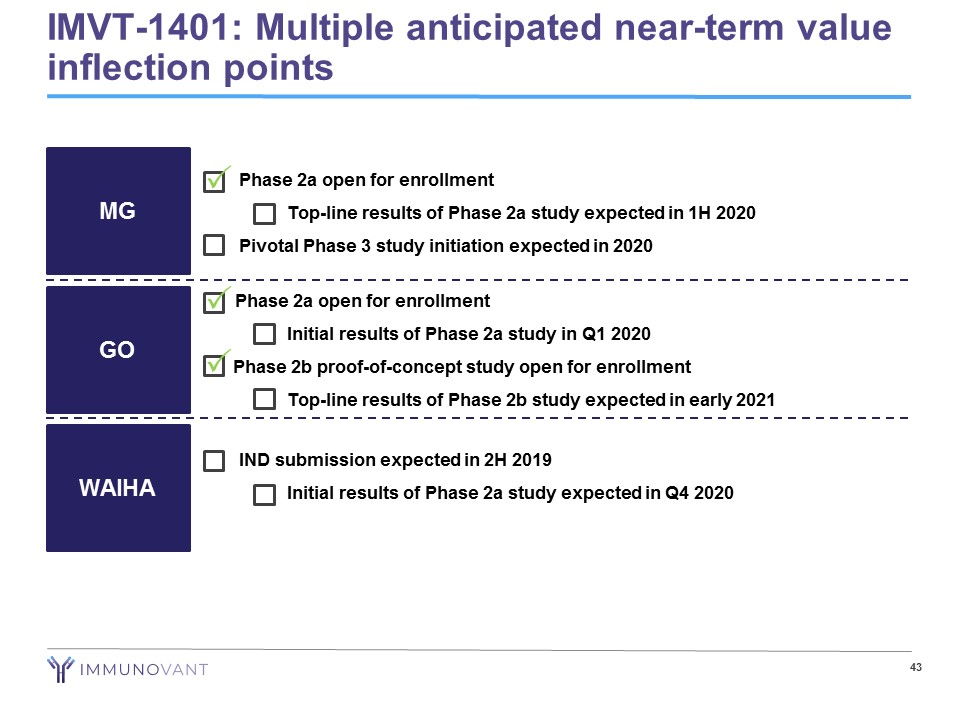

• Phase 2a open for enrollment − Top - line results of Phase 2a study expected in 1H 2020 • Pivotal Phase 3 study initiation expected in 2020 11 MG GO WAIHA • IND submission expected in 2H 2019 − Initial results of Phase 2a study expected in Q4 2020 Phase 2a open for enrollment − Initial results of Phase 2a study in Q1 2020 Phase 2b proof - of - concept study open for enrollment − Top - line results of Phase 2b study expected in early 2021 IMVT - 1401: Multiple anticipated near - term value inflection points P P P

IMVT - 1401

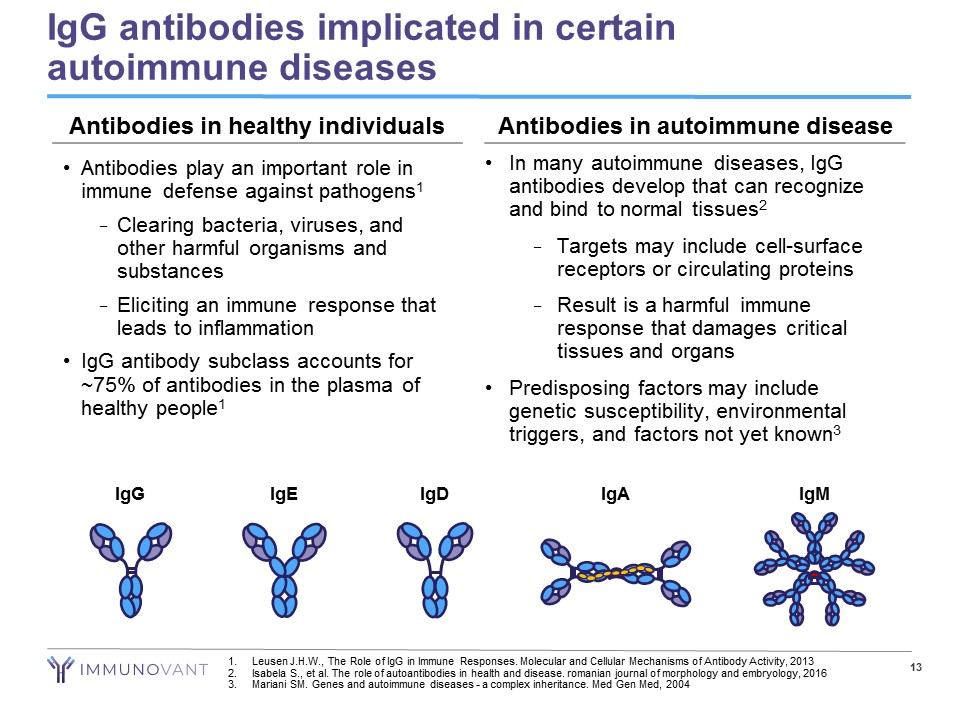

13 IgG antibodies implicated in certain autoimmune diseases • Antibodies play an important role in immune defense against pathogens 1 − Clearing bacteria, viruses, and other harmful organisms and substances − Eliciting an immune response that leads to inflammation • IgG antibody subclass accounts for ~75% of antibodies in the plasma of healthy people 1 • In many autoimmune diseases, IgG antibodies develop that can recognize and bind to normal tissues 2 − Targets may include cell - surface receptors or circulating proteins − Result is a harmful immune response that damages critical tissues and organs • Predisposing factors may include genetic susceptibility, environmental triggers, and factors not yet known 3 IgG IgE IgM IgA IgD Antibodies in healthy individuals Antibodies in autoimmune disease 1. Leusen J.H.W., The Role of IgG in Immune Responses. Molecular and Cellular Mechanisms of Antibody Activity, 2013 2. Isabela S., et al. The role of autoantibodies in health and disease. romanian journal of morphology and embryology, 2016 3. Mariani SM. Genes and autoimmune diseases - a complex inheritance. Med Gen Med, 2004

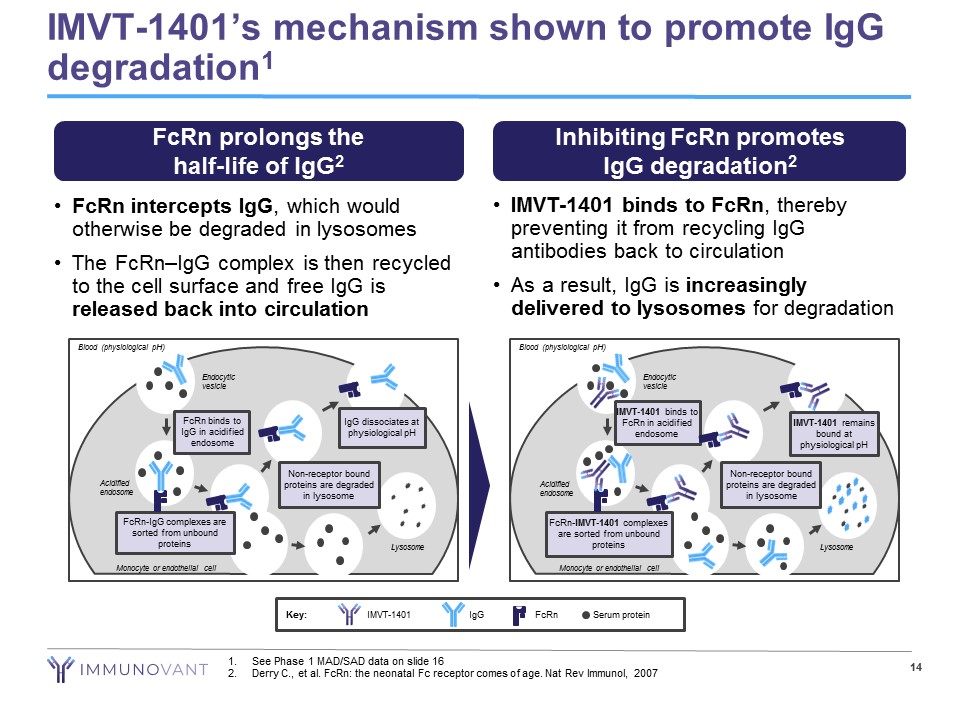

• FcRn intercepts IgG , which would otherwise be degraded in lysosomes • The FcRn – IgG complex is then recycled to the cell surface and free IgG is released back into circulation • IMVT - 1401 binds to FcRn , thereby preventing it from recycling IgG antibodies back to circulation • As a result, IgG is increasingly delivered to lysosomes for degradation IMVT - 1401’s mechanism shown to promote IgG degradation 1 14 FcRn prolongs the half - life of IgG 2 Inhibiting FcRn promotes IgG degradation 2 Blood (physiological pH) Endocytic vesicle Acidified endosome FcRn - IgG complexes are sorted from unbound proteins FcRn binds to IgG in acidified endosome Non - receptor bound proteins are degraded in lysosome IgG dissociates at physiological pH Lysosome Monocyte or endothelial cell Blood (physiological pH) Endocytic vesicle Acidified endosome FcRn - IMVT - 1401 complexes are sorted from unbound proteins IMVT - 1401 binds to FcRn in acidified endosome Non - receptor bound proteins are degraded in lysosome Lysosome Monocyte or endothelial cell IMVT - 1401 remains bound at physiological pH Key: Serum protein IgG IMVT - 1401 FcRn 1. See Phase 1 MAD/SAD data on slide 16 2. Derry C., et al. FcRn : the neonatal Fc receptor comes of age. Nat Rev Immunol, 2007

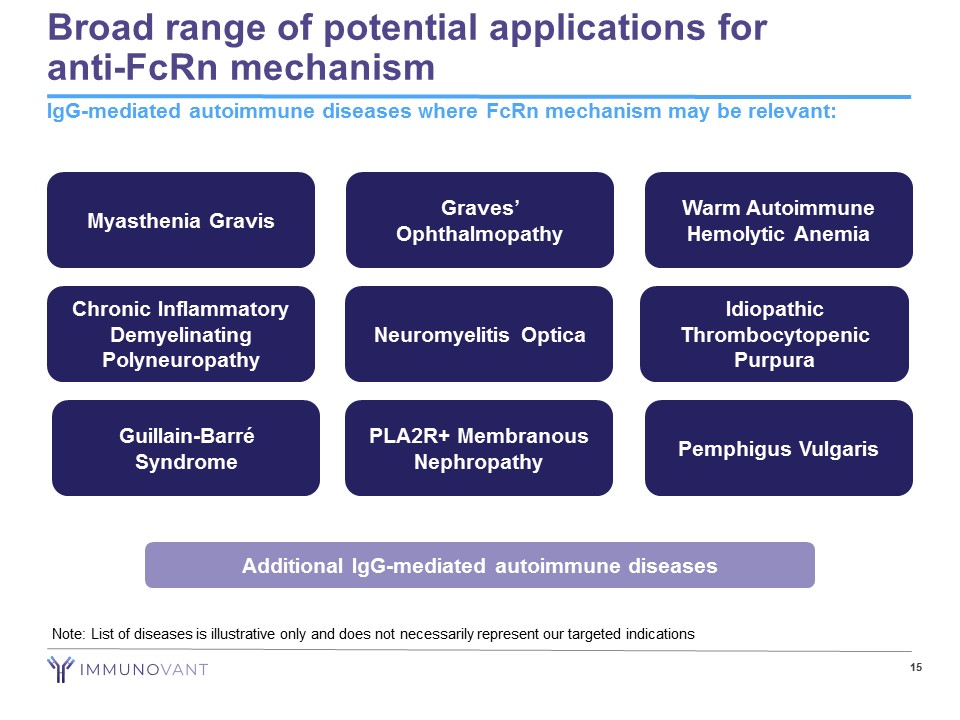

Broad range of potential applications for anti - FcRn mechanism IgG - mediated autoimmune diseases where FcRn mechanism may be relevant: Note: List of diseases is illustrative only and does not necessarily represent our targeted indications 15 Guillain - Barré Syndrome Neuromyelitis Optica Warm Autoimmune Hemolytic Anemia Myasthenia Gravis Idiopathic Thrombocytopenic Purpura Chronic Inflammatory Demyelinating Polyneuropathy Pemphigus Vulgaris PLA2R+ Membranous Nephropathy Graves’ Ophthalmopathy Additional IgG - mediated autoimmune diseases

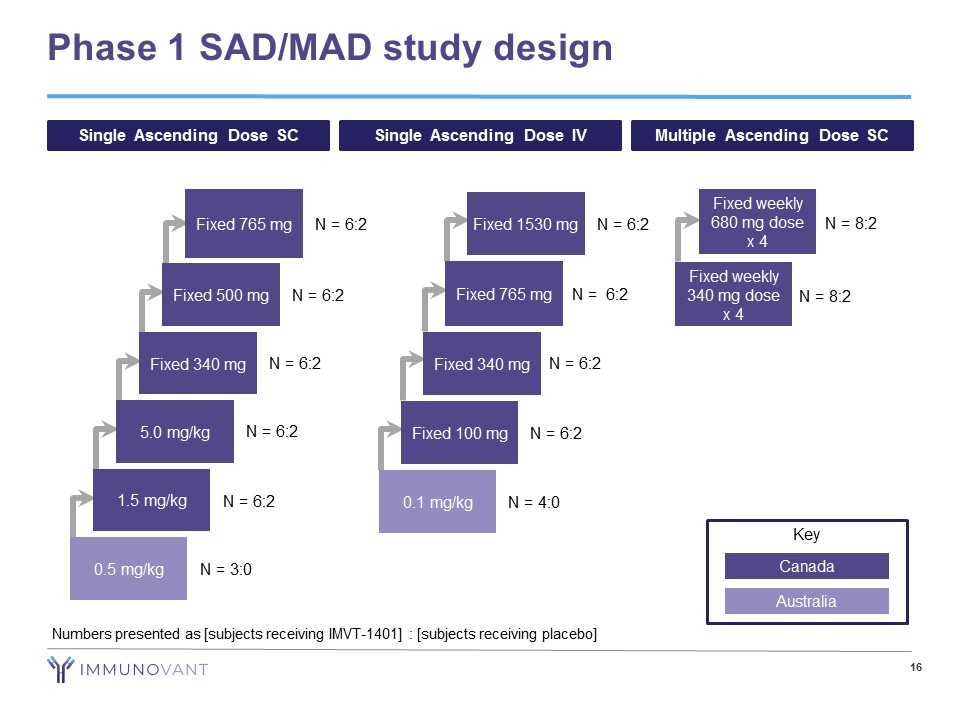

Phase 1 SAD/MAD study design 16 Single Ascending Dose SC Single Ascending Dose IV Multiple Ascending Dose SC 0.5 mg/kg N = 3:0 1.5 mg/kg N = 6:2 5.0 mg/kg N = 6:2 Fixed 340 mg N = 6:2 Fixed 500 mg N = 6:2 Fixed 765 mg N = 6:2 Fixed 100 mg N = 6:2 Fixed 340 mg N = 6:2 Fixed 765 mg N = 6:2 Fixed 1530 mg N = 6:2 0.1 mg/kg N = 4:0 Fixed weekly 680 mg dose x 4 N = 8:2 Fixed weekly 340 mg dose x 4 N = 8:2 Key Canada Australia Numbers presented as [subjects receiving IMVT - 1401] : [subjects receiving placebo]

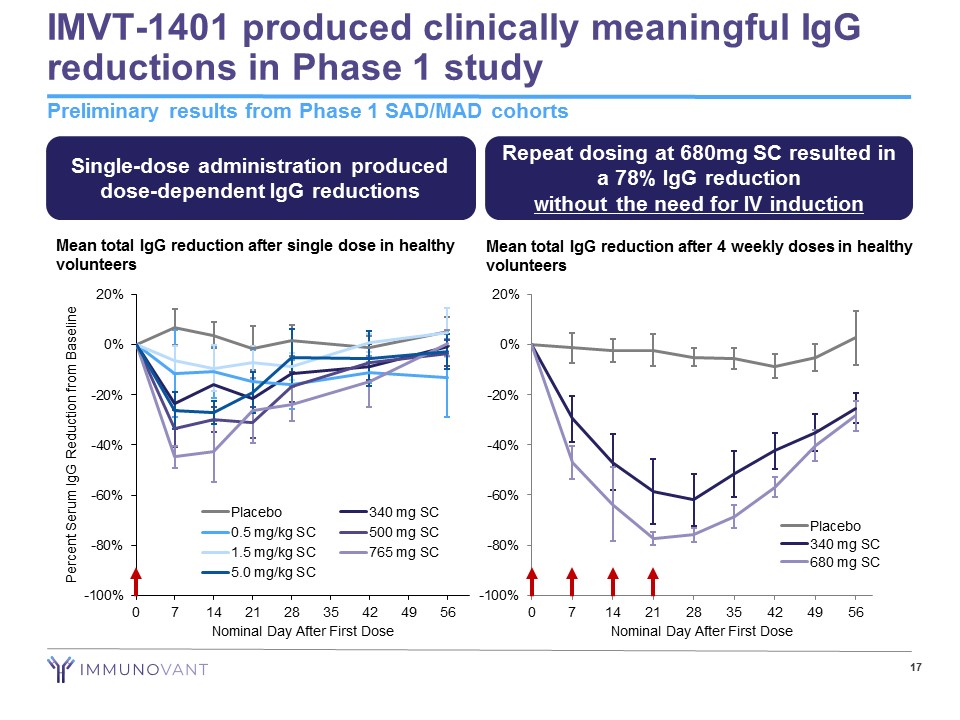

-100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Nominal Day After First Dose Placebo 340 mg SC 680 mg SC IMVT - 1401 produced clinically meaningful IgG reductions in Phase 1 study Preliminary results from Phase 1 SAD/MAD cohorts 17 Mean total IgG reduction after single dose in healthy volunteers Mean total IgG reduction after 4 weekly doses in healthy volunteers Single - dose administration produced dose - dependent IgG reductions Repeat dosing at 680mg SC resulted in a 78% IgG reduction without the need for IV induction -100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Percent Serum IgG Reduction from Baseline Nominal Day After First Dose Placebo 340 mg SC 0.5 mg/kg SC 500 mg SC 1.5 mg/kg SC 765 mg SC 5.0 mg/kg SC

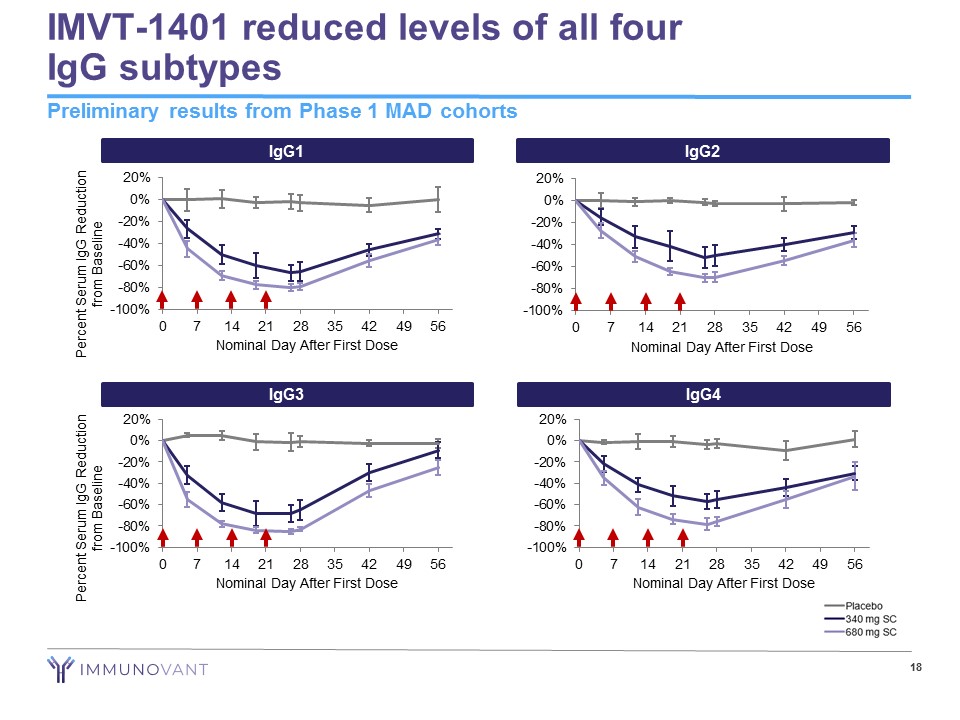

IMVT - 1401 reduced levels of all four IgG subtypes 18 Preliminary results from Phase 1 MAD cohorts IgG2 -100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Nominal Day After First Dose IgG4 -100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Nominal Day After First Dose IgG1 -100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Nominal Day After First Dose Percent Serum IgG Reduction from Baseline IgG3 -100% -80% -60% -40% -20% 0% 20% 0 7 14 21 28 35 42 49 56 Nominal Day After First Dose Percent Serum IgG Reduction from Baseline

Generally well - tolerated in Phase 1 study • 99 subjects dosed to date through SAD and MAD portions of Phase 1 − IMVT - 1401: 77 subjects − Placebo: 22 subjects • Most common AEs were mild erythema and swelling at injection site − Injection site reactions were not dose or frequency related − Occurred at similar incidence for drug and placebo treated subjects • No headaches observed in 680mg SC MAD cohort • Albumin changes: − Dose - dependent, reversible, and asymptomatic albumin reductions observed − At day 28, mean albumin levels were 37.5 g/L in the 340 mg cohort, and 32.4 g/L in 680mg cohort (normal range 36 - 51 g/L) • 2 SAEs observed in two separate SAD cohorts, both ruled unrelated to treatment by study investigator (cancer, appendicitis) • Treatment - emergent ADA confirmed in 8% of IMVT - 1401 - treated subjects and 6% of placebo - treated subjects − No subject in MAD cohorts has developed a confirmed ADA response to IMVT - 1401 Preliminary results from Phase 1 SAD/MAD cohorts 19

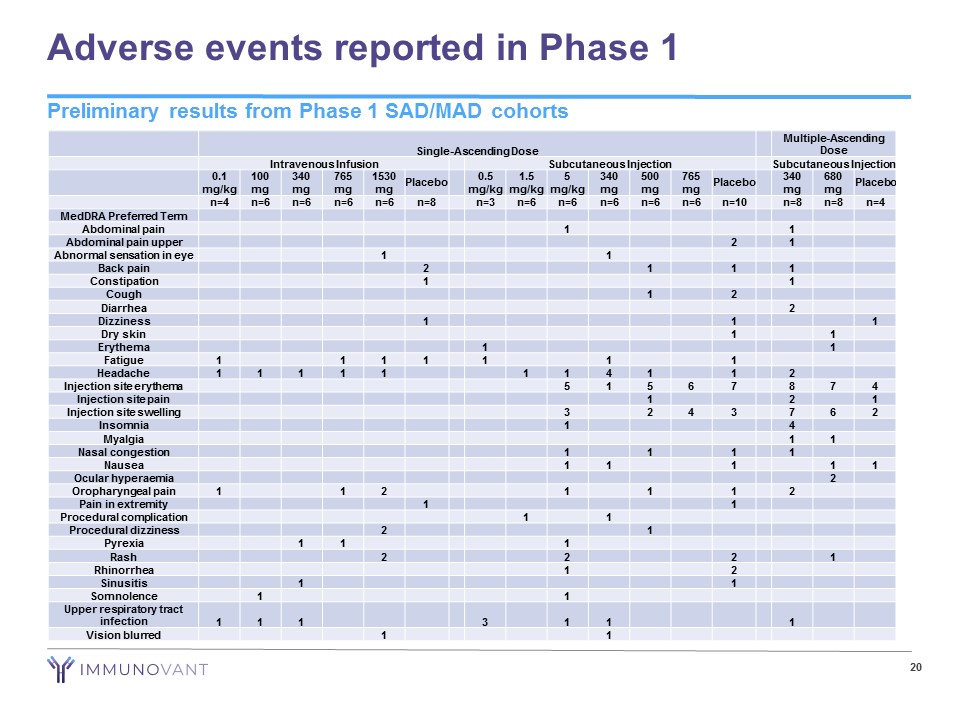

Adverse events reported in Phase 1 20 Single - Ascending Dose Multiple - Ascending Dose Intravenous Infusion Subcutaneous Injection Subcutaneous Injection 0.1 mg/kg 100 mg 340 mg 765 mg 1530 mg Placebo 0.5 mg/kg 1.5 mg/kg 5 mg/kg 340 mg 500 mg 765 mg Placebo 340 mg 680 mg Placebo n=4 n=6 n=6 n=6 n=6 n=8 n=3 n=6 n=6 n=6 n=6 n=6 n=10 n=8 n=8 n=4 MedDRA Preferred Term Abdominal pain 1 1 Abdominal pain upper 2 1 Abnormal sensation in eye 1 1 Back pain 2 1 1 1 Constipation 1 1 Cough 1 2 Diarrhea 2 Dizziness 1 1 1 Dry skin 1 1 Erythema 1 1 Fatigue 1 1 1 1 1 1 1 Headache 1 1 1 1 1 1 1 4 1 1 2 Injection site erythema 5 1 5 6 7 8 7 4 Injection site pain 1 2 1 Injection site swelling 3 2 4 3 7 6 2 Insomnia 1 4 Myalgia 1 1 Nasal congestion 1 1 1 1 Nausea 1 1 1 1 1 Ocular hyperaemia 2 Oropharyngeal pain 1 1 2 1 1 1 2 Pain in extremity 1 1 Procedural complication 1 1 Procedural dizziness 2 1 Pyrexia 1 1 1 Rash 2 2 2 1 Rhinorrhea 1 2 Sinusitis 1 1 Somnolence 1 1 Upper respiratory tract infection 1 1 1 3 1 1 1 Vision blurred 1 1 Preliminary results from Phase 1 SAD/MAD cohorts

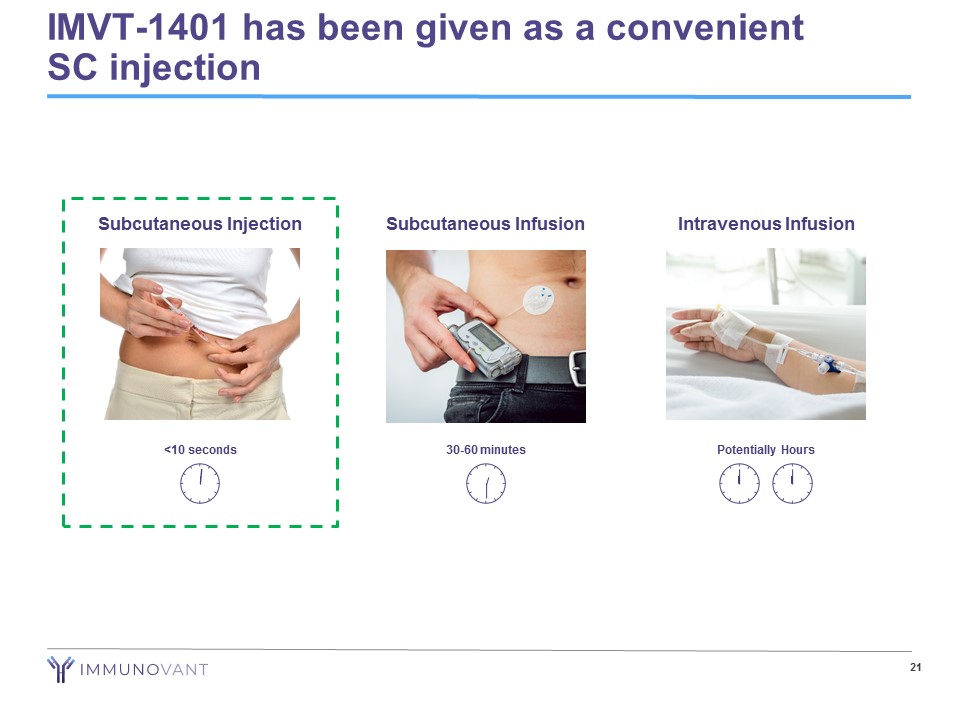

IMVT - 1401 has been given as a convenient SC injection 21 Intravenous Infusion Potentially Hours Subcutaneous Injection <10 seconds Subcutaneous Infusion 30 - 60 minutes

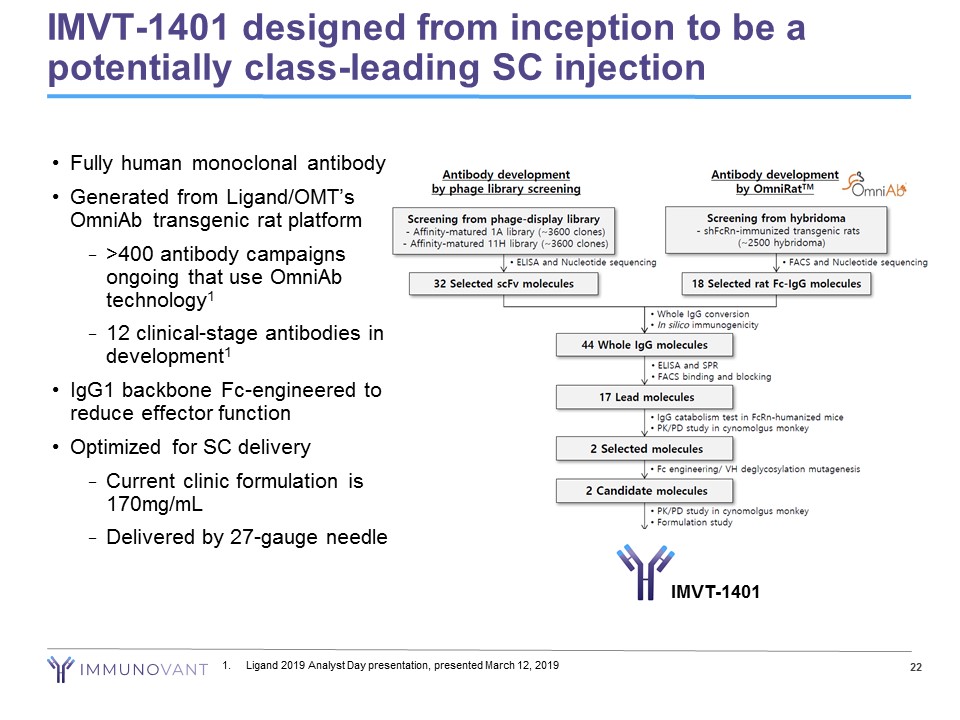

22 IMVT - 1401 designed from inception to be a potentially class - leading SC injection 1. Ligand 2019 Analyst Day presentation, presented March 12, 2019 • Fully human monoclonal antibody • Generated from Ligand/OMT’s OmniAb transgenic rat platform − >400 antibody campaigns ongoing that use OmniAb technology 1 − 12 clinical - stage antibodies in development 1 • IgG1 backbone Fc - engineered to reduce effector function • Optimized for SC delivery − Current clinic formulation is 170mg/mL − Delivered by 27 - gauge needle IMVT - 1401

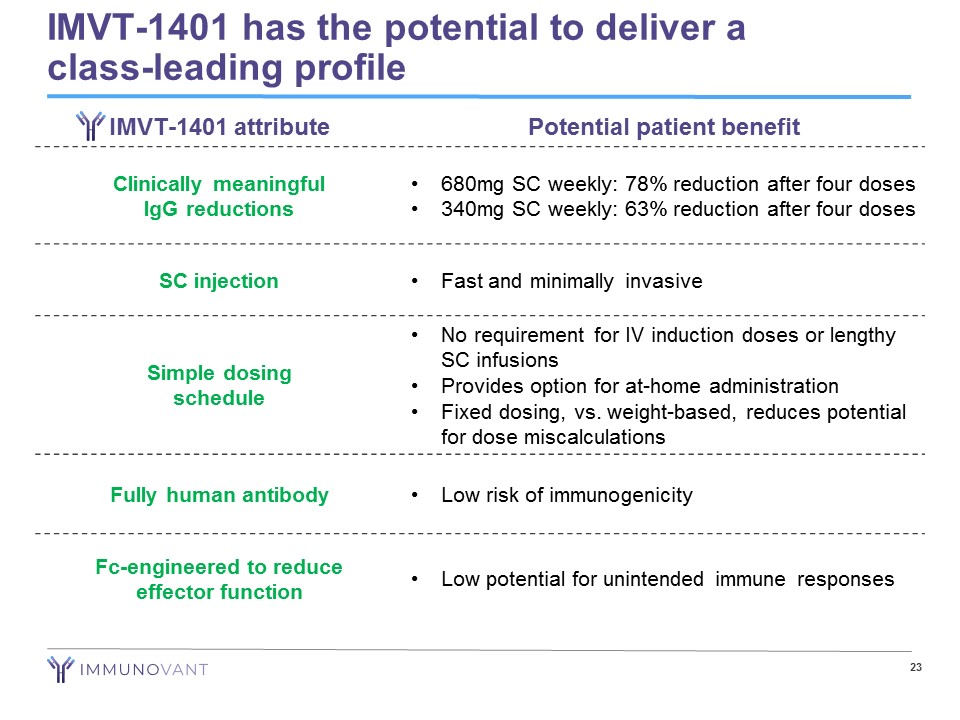

IMVT - 1401 has the potential to deliver a class - leading profile 23 IMVT - 1401 attribute Potential patient benefit Clinically meaningful IgG reductions • 680mg SC weekly: 78% reduction after four doses • 340mg SC weekly: 63% reduction after four doses SC injection • Fast and minimally invasive Simple dosing schedule • No requirement for IV induction doses or lengthy SC infusions • Provides option for at - home administration • Fixed dosing, vs. weight - based, reduces potential for dose miscalculations Fully human antibody • Low risk of immunogenicity Fc - engineered to reduce effector function • Low potential for unintended immune responses

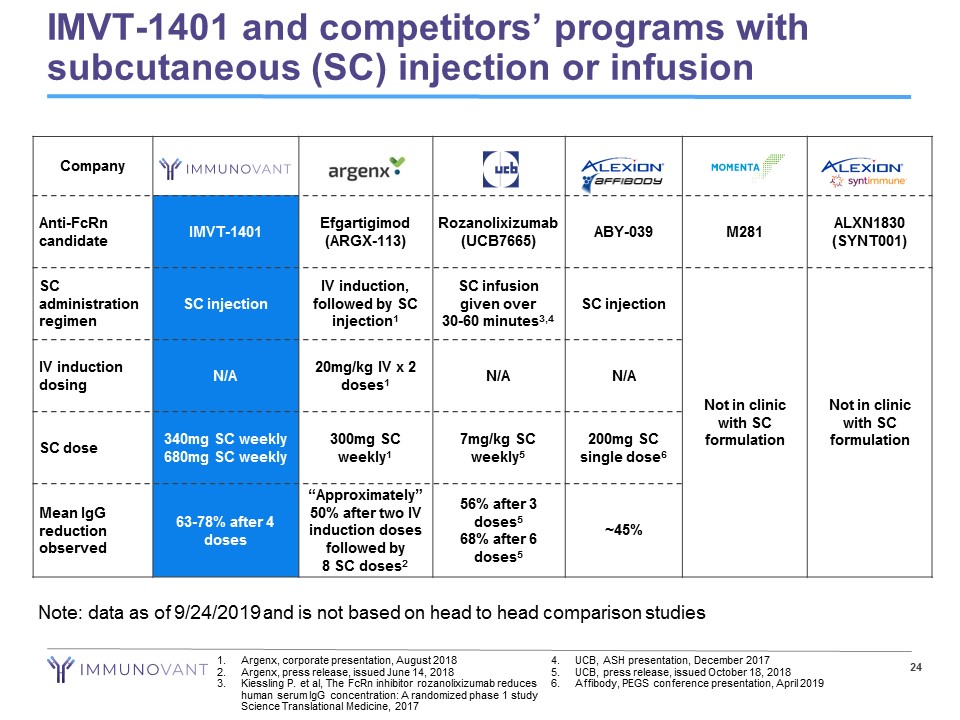

IMVT - 1401 and competitors’ programs with subcutaneous (SC) injection or infusion 24 1. Argenx , corporate presentation, August 2018 2. Argenx , press release, issued June 14, 2018 3. Kiessling P. et al, The FcRn inhibitor rozanolixizumab reduces human serum IgG concentration: A randomized phase 1 study Science Translational Medicine, 2017 4. UCB, ASH presentation, December 2017 5. UCB, press release, issued October 18, 2018 6. Affibody, PEGS conference presentation, April 2019 Company Anti - FcRn candidate IMVT - 1401 Efgartigimod (ARGX - 113) Rozanolixizumab (UCB7665) ABY - 039 M281 ALXN1830 (SYNT001) SC administration regimen SC injection IV induction, followed by SC injection 1 SC infusion given over 30 - 60 minutes 3,4 SC injection Not in clinic with SC formulation Not in clinic with SC formulation IV induction dosing N/A 20mg/kg IV x 2 doses 1 N/A N/A SC dose 340mg SC weekly 680mg SC weekly 300mg SC weekly 1 7mg/kg SC weekly 5 200mg SC single dose 6 Mean IgG reduction observed 63 - 78% after 4 doses “Approximately” 50% after two IV induction doses followed by 8 SC doses 2 56% after 3 doses 5 68% after 6 doses 5 ~45% Note: data as of 9/24/2019 and is not based on head to head comparison studies

IMVT - 1401 for Myasthenia Gravis

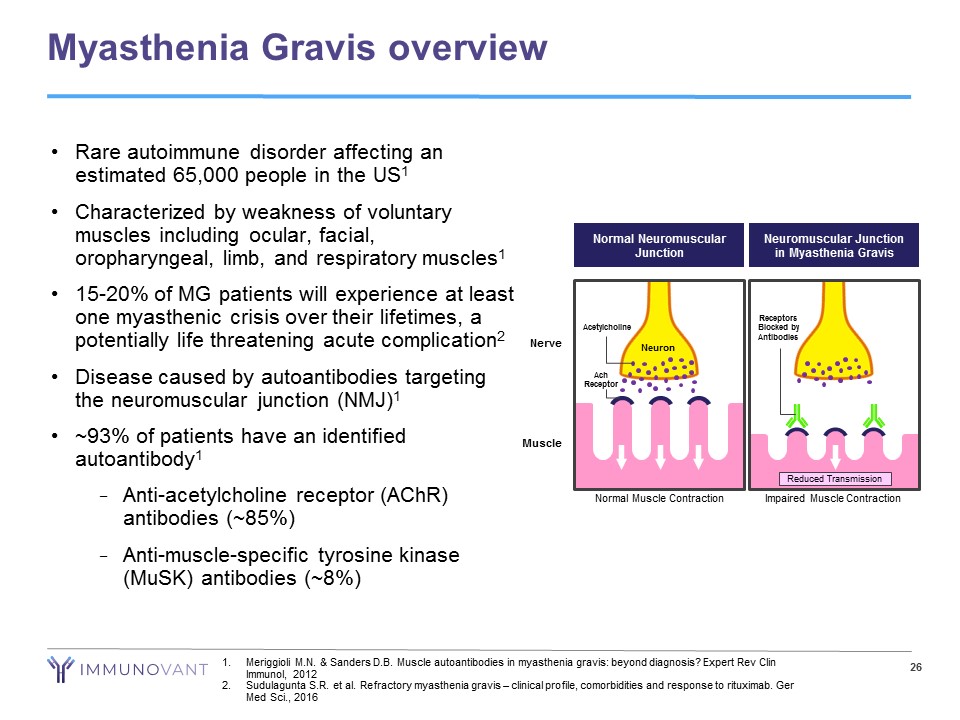

Myasthenia Gravis overview 26 1. Meriggioli M.N. & Sanders D.B. Muscle autoantibodies in myasthenia gravis: beyond diagnosis? Expert Rev Clin Immunol, 2012 2. Sudulagunta S.R. et al. Refractory myasthenia gravis – clinical profile, comorbidities and response to rituximab. Ger Med Sci., 2016 • Rare autoimmune disorder affecting an estimated 65,000 people in the US 1 • Characterized by weakness of voluntary muscles including ocular, facial, oropharyngeal, limb, and respiratory muscles 1 • 15 - 20% of MG patients will experience at least one myasthenic crisis over their lifetimes, a potentially life threatening acute complication 2 • Disease caused by autoantibodies targeting the neuromuscular junction (NMJ) 1 • ~93% of patients have an identified autoantibody 1 − Anti - acetylcholine receptor ( AChR ) antibodies (~85%) − Anti - muscle - specific tyrosine kinase ( MuSK ) antibodies (~8%) Muscle Neuromuscular Junction in Myasthenia Gravis Reduced Transmission Impaired Muscle Contraction Receptors Blocked by Antibodies Neuron Nerve Acetylcholine Ach Receptor Normal Muscle Contraction Normal Neuromuscular Junction

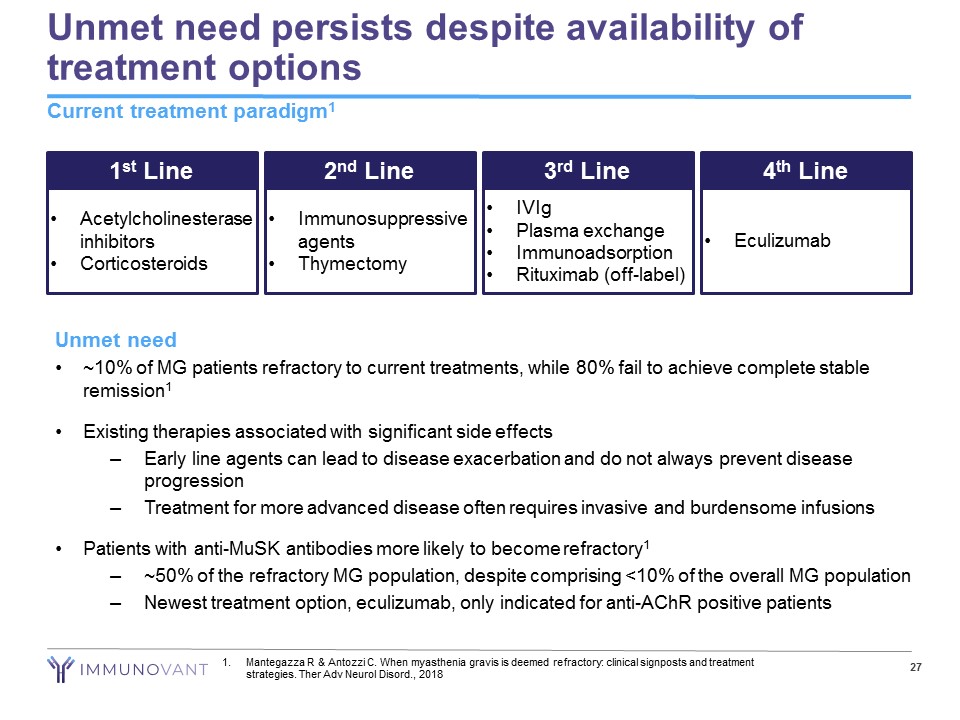

Unmet need persists despite availability of treatment options Current treatment paradigm 1 27 1 st Line • Acetylcholinesterase inhibitors • Corticosteroids 2 nd Line • Immunosuppressive agents • Thymectomy 3 rd Line • IVIg • Plasma exchange • Immunoadsorption • Rituximab (off - label) 4 th Line • Eculizumab Unmet need • ~10% of MG patients refractory to current treatments, while 80% fail to achieve complete stable remission 1 • Existing therapies associated with significant side effects – Early line agents can lead to disease exacerbation and do not always prevent disease progression – Treatment for more advanced disease often requires invasive and burdensome infusions • Patients with anti - MuSK antibodies more likely to become refractory 1 – ~50% of the refractory MG population, despite comprising <10% of the overall MG population – Newest treatment option, eculizumab, only indicated for anti - AChR positive patients 1. Mantegazza R & Antozzi C. When myasthenia gravis is deemed refractory: clinical signposts and treatment strategies. Ther Adv Neurol Disord ., 2018

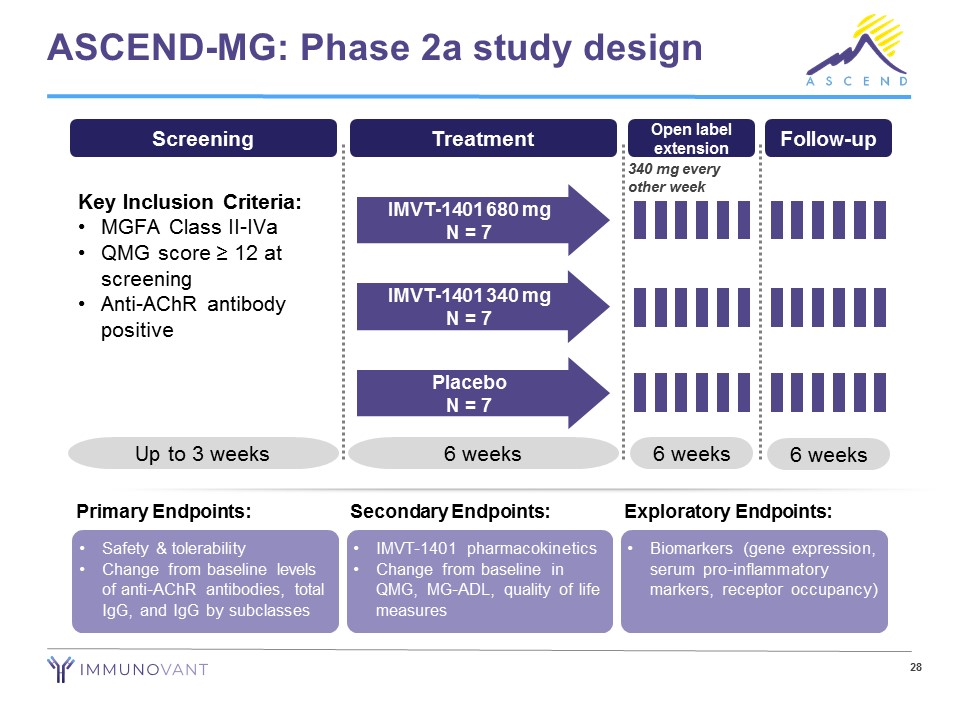

28 ASCEND - MG: Phase 2a study design • Safety & tolerability • Change from baseline levels of anti - AChR antibodies, total IgG, and IgG by subclasses Primary Endpoints: • IMVT - 1401 pharmacokinetics • Change from baseline in QMG, MG - ADL, quality of life measures Secondary Endpoints: • Biomarkers (gene expression, serum pro - inflammatory markers, receptor occupancy) Exploratory Endpoints: Screening Key Inclusion Criteria: • MGFA Class II - IVa • QMG score ≥ 12 at screening • Anti - AChR antibody positive Up to 3 weeks Treatment 6 weeks IMVT - 1401 680 mg N = 7 IMVT - 1401 340 mg N = 7 Placebo N = 7 6 weeks Follow - up Open label extension 6 weeks 340 mg every other week

IMVT - 1401 for Graves’ Ophthalmopathy

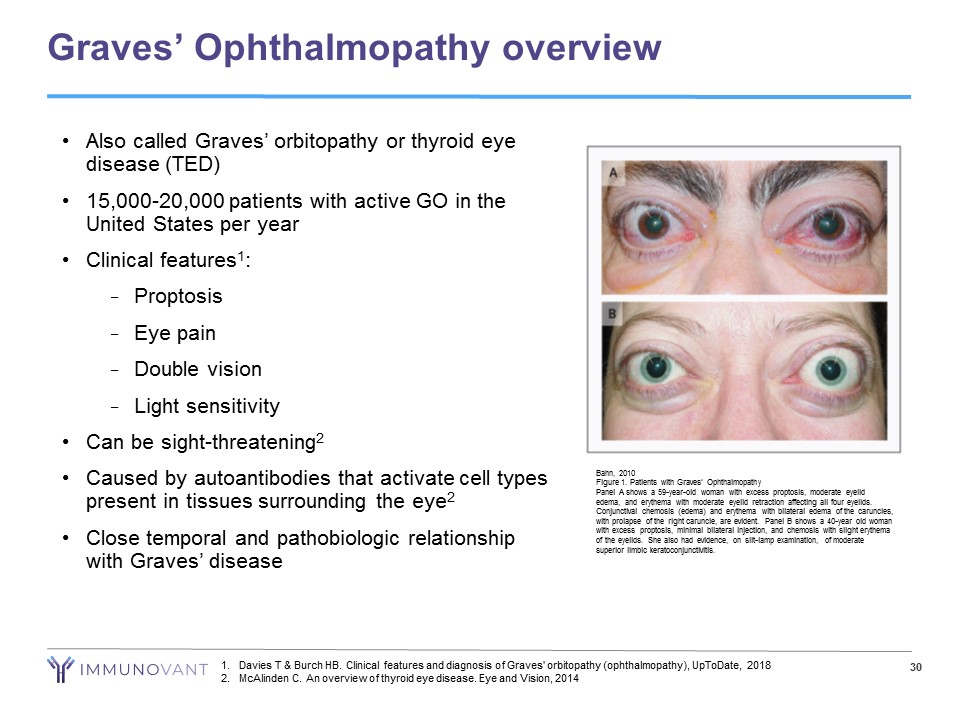

Graves’ Ophthalmopathy overview Bahn, 2010 Figure 1. Patients with Graves’ Ophthalmopathy Panel A shows a 59 - year - old woman with excess proptosis, moderate eyelid edema, and erythema with moderate eyelid retraction affecting all four eyelids. Conjunctival chemosis (edema) and erythema with bilateral edema of the caruncles, with prolapse of the right caruncle, are evident. Panel B shows a 40 - year old woman with excess proptosis, minimal bilateral injection, and chemosis with slight erythema of the eyelids. She also had evidence, on slit - lamp examination, of moderate superior limbic keratoconjunctivitis. • Also called Graves’ orbitopathy or thyroid eye disease (TED) • 15,000 - 20,000 patients with active GO in the United States per year • Clinical features 1 : − Proptosis − Eye pain − Double vision − Light sensitivity • Can be sight - threatening 2 • Caused by autoantibodies that activate cell types present in tissues surrounding the eye 2 • Close temporal and pathobiologic relationship with Graves’ disease 1. Davies T & Burch HB. Clinical features and diagnosis of Graves' orbitopathy (ophthalmopathy), UpToDate, 2018 2. McAlinden C. An overview of thyroid eye disease. Eye and Vision, 2014 30

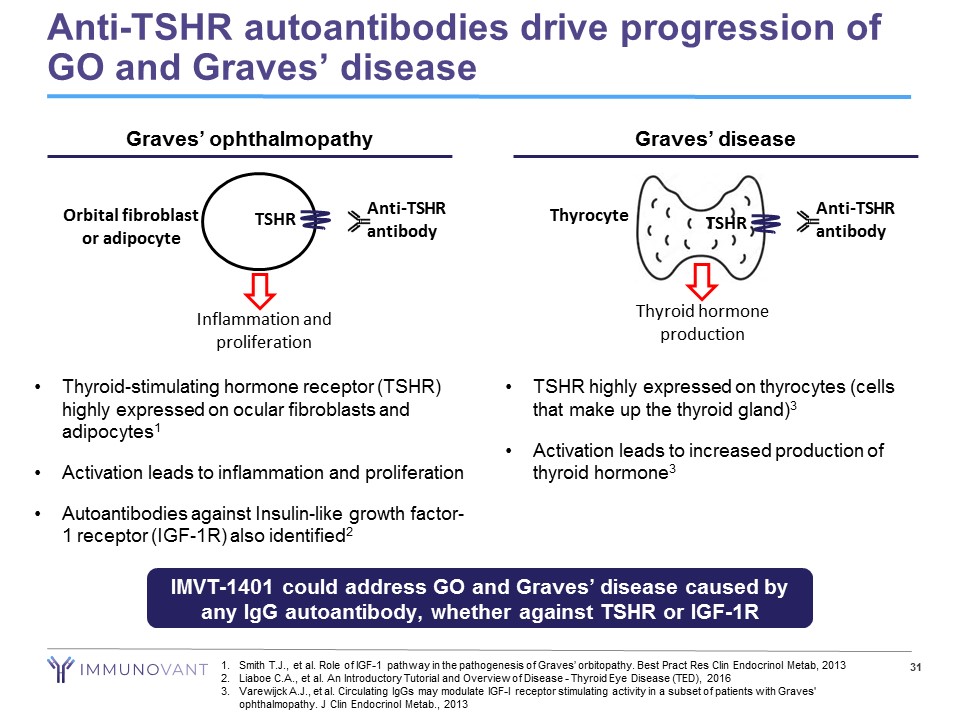

Anti - TSHR autoantibodies drive progression of GO and Graves’ disease IMVT - 1401 could address GO and Graves’ disease caused by any IgG autoantibody, whether against TSHR or IGF - 1R • Thyroid - stimulating hormone receptor (TSHR) highly expressed on ocular fibroblasts and adipocytes 1 • Activation leads to inflammation and proliferation • Autoantibodies against Insulin - like growth factor - 1 receptor (IGF - 1R) also identified 2 Graves’ ophthalmopathy Inflammation and proliferation Orbital fibroblast or adipocyte TSHR Anti - TSHR antibody • TSHR highly expressed on thyrocytes (cells that make up the thyroid gland) 3 • Activation leads to increased production of thyroid hormone 3 Graves’ disease Thyrocyte TSHR Thyroid hormone production 31 1. Smith T.J., et al. Role of IGF - 1 pathway in the pathogenesis of Graves’ orbitopathy. Best Pract Res Clin Endocrinol Metab , 2013 2. Liaboe C.A., et al. An Introductory Tutorial and Overview of Disease - Thyroid Eye Disease (TED), 2016 3. Varewijck A.J., et al. Circulating IgGs may modulate IGF - I receptor stimulating activity in a subset of patients with Graves' ophthalmopathy. J Clin Endocrinol Metab ., 2013 Anti - TSHR antibody

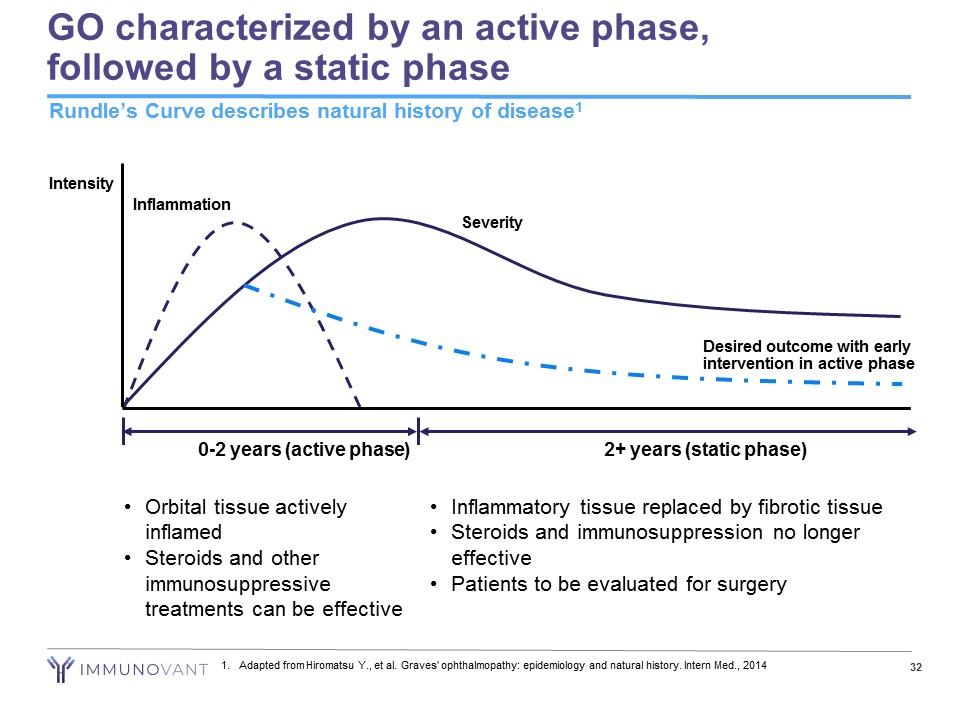

GO characterized by an active phase, followed by a static phase 32 Rundle’s Curve describes natural history of disease 1 0 - 2 years (active phase) 2+ years (static phase) Intensity Severity Inflammation • Orbital tissue actively inflamed • Steroids and other immunosuppressive treatments can be effective Desired outcome with early intervention in active phase • Inflammatory tissue replaced by fibrotic tissue • Steroids and immunosuppression no longer effective • Patients to be evaluated for surgery 1. Adapted from Hiromatsu Y., et al. Graves' ophthalmopathy: epidemiology and natural history. Intern Med., 2014

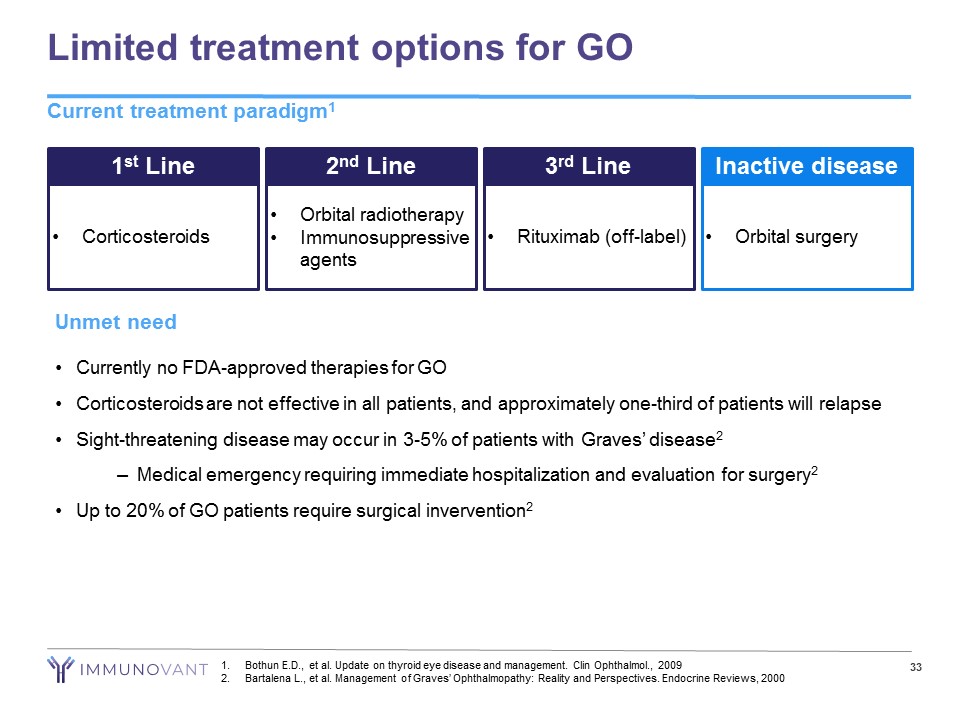

Limited treatment options for GO Current treatment paradigm 1 33 1 st Line • Corticosteroids 2 nd Line • Orbital radiotherapy • Immunosuppressive agents 3 rd Line • Rituximab (off - label) Inactive disease • Orbital surgery Unmet need • Currently no FDA - approved therapies for GO • Corticosteroids are not effective in all patients, and approximately one - third of patients will relapse • Sight - threatening disease may occur in 3 - 5% of patients with Graves’ disease 2 – Medical emergency requiring immediate hospitalization and evaluation for surgery 2 • Up to 20% of GO patients require surgical invervention 2 1. Bothun E.D., et al. Update on thyroid eye disease and management. Clin Ophthalmol ., 2009 2. Bartalena L., et al. Management of Graves’ Ophthalmopathy: Reality and Perspectives. Endocrine Reviews, 2000

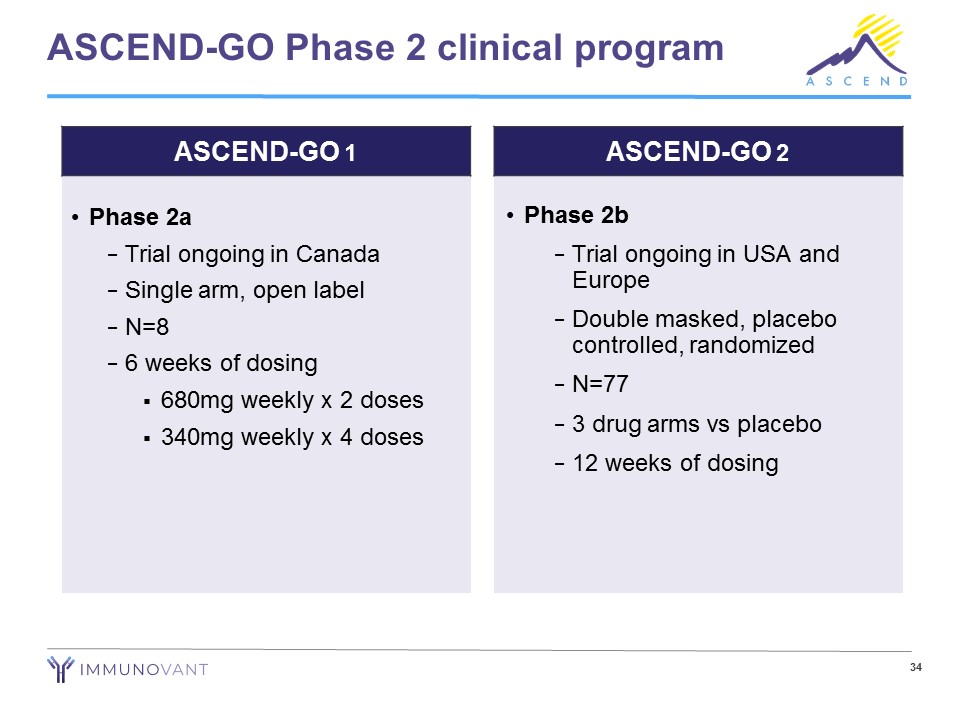

34 ASCEND - GO Phase 2 clinical program • Phase 2a − Trial ongoing in Canada − Single arm, open label − N=8 − 6 weeks of dosing ▪ 680mg weekly x 2 doses ▪ 340mg weekly x 4 doses • Phase 2b − Trial ongoing in USA and Europe − Double masked, placebo controlled, randomized − N=77 − 3 drug arms vs placebo − 12 weeks of dosing ASCEND - GO 1 ASCEND - GO 2

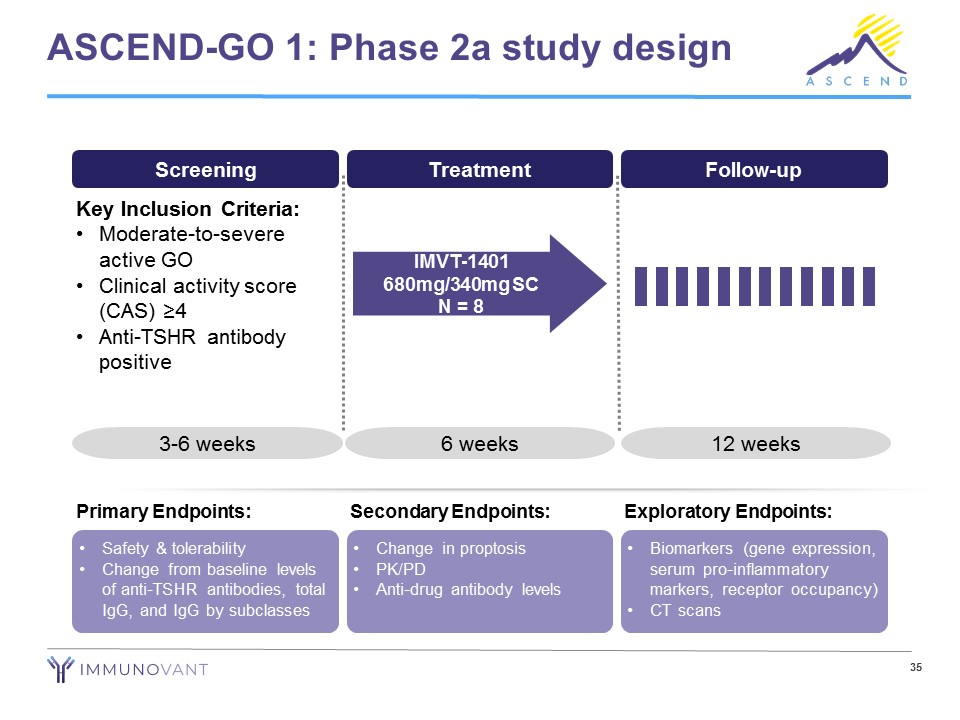

ASCEND - GO 1: Phase 2a study design Screening Treatment Follow - up Key Inclusion Criteria: • Moderate - to - severe active GO • Clinical activity score (CAS) ≥4 • Anti - TSHR antibody positive 3 - 6 weeks 6 weeks 12 weeks IMVT - 1401 680mg/340mg SC N = 8 • Safety & tolerability • Change from baseline levels of anti - TSHR antibodies, total IgG, and IgG by subclasses Primary Endpoints: • Change in proptosis • PK/PD • Anti - drug antibody levels Secondary Endpoints: • Biomarkers (gene expression, serum pro - inflammatory markers, receptor occupancy) • CT scans Exploratory Endpoints: 35

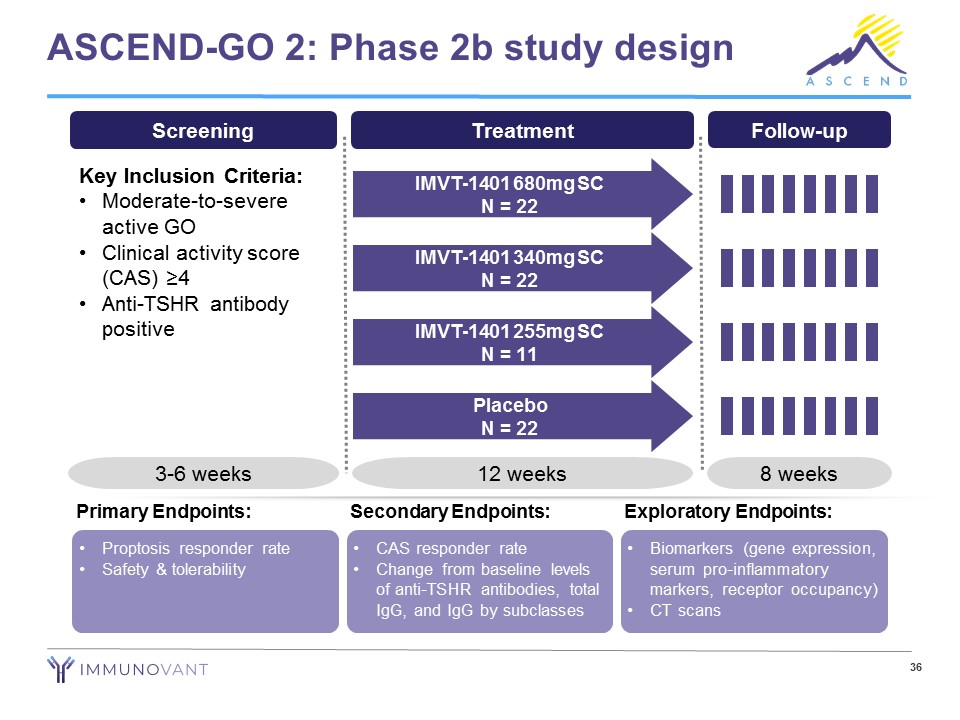

ASCEND - GO 2: Phase 2b study design Screening Key Inclusion Criteria: • Moderate - to - severe active GO • Clinical activity score (CAS) ≥4 • Anti - TSHR antibody positive 3 - 6 weeks Treatment 12 weeks IMVT - 1401 680mg SC N = 22 IMVT - 1401 340mg SC N = 22 IMVT - 1401 255mg SC N = 11 Placebo N = 22 Follow - up 8 weeks • Proptosis responder rate • Safety & tolerability Primary Endpoints: • CAS responder rate • Change from baseline levels of anti - TSHR antibodies, total IgG, and IgG by subclasses Secondary Endpoints: • Biomarkers (gene expression, serum pro - inflammatory markers, receptor occupancy) • CT scans Exploratory Endpoints: 36

IMVT - 1401 for Warm Autoimmune Hemolytic Anemia

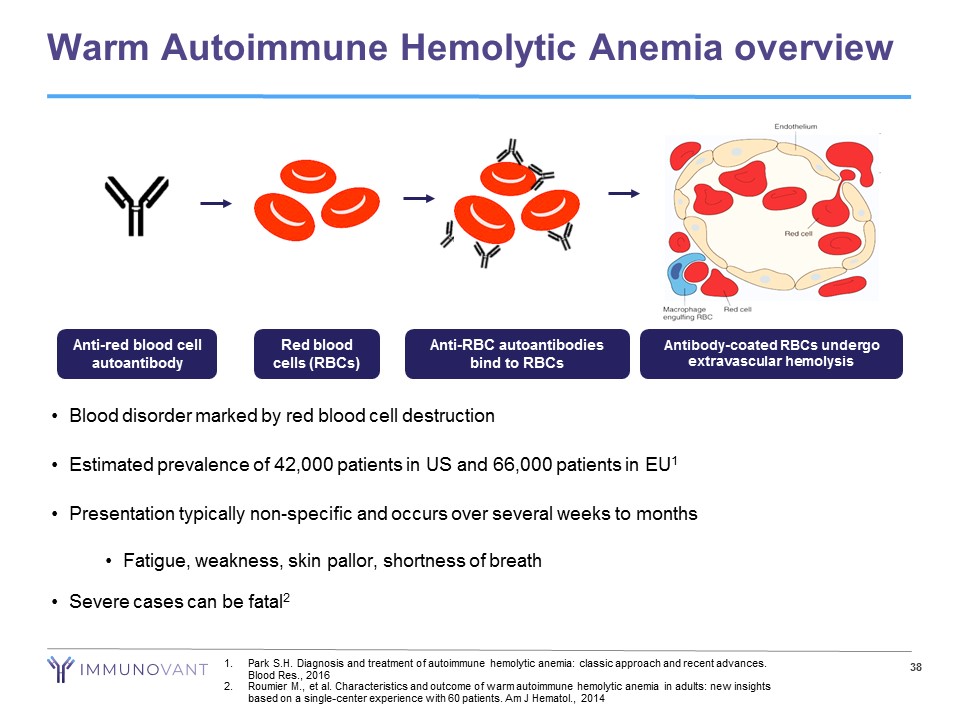

Warm Autoimmune Hemolytic Anemia overview 38 • Blood disorder marked by red blood cell destruction • Estimated prevalence of 42,000 patients in US and 66,000 patients in EU 1 • Presentation typically non - specific and occurs over several weeks to months • Fatigue, weakness, skin pallor, shortness of breath • Severe cases can be fatal 2 Anti - RBC autoantibodies bind to RBCs Anti - red blood cell autoantibody Red blood cells (RBCs) Antibody - coated RBCs undergo extravascular hemolysis 1. Park S.H. Diagnosis and treatment of autoimmune hemolytic anemia: classic approach and recent advances. Blood Res., 2016 2. Roumier M., et al. Characteristics and outcome of warm autoimmune hemolytic anemia in adults: new insights based on a single - center experience with 60 patients. Am J Hematol ., 2014

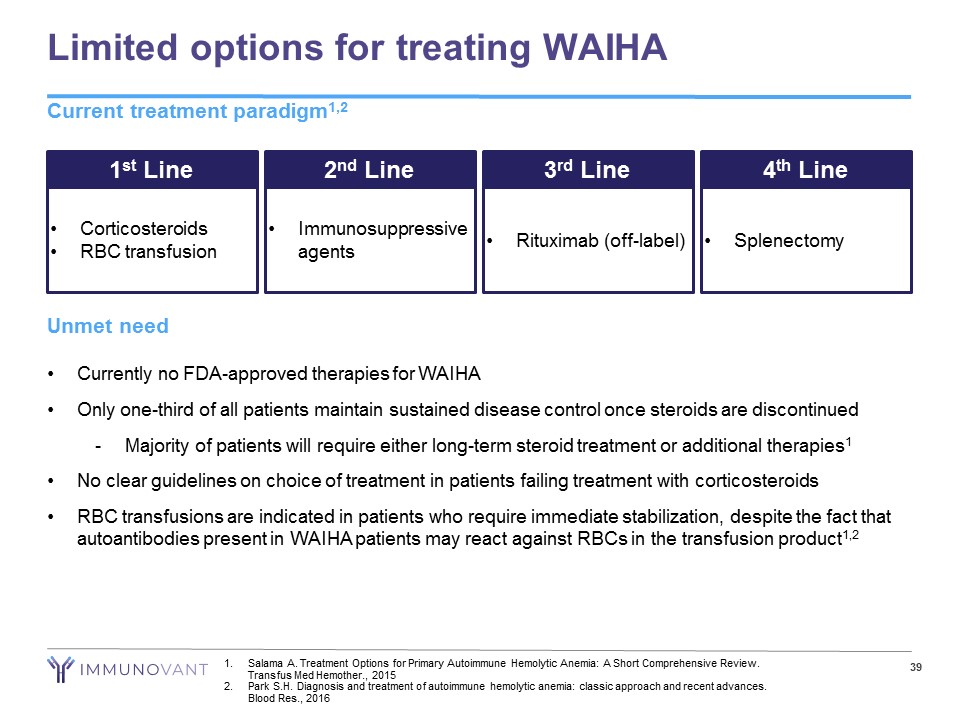

Limited options for treating WAIHA Current treatment paradigm 1,2 39 1 st Line • Corticosteroids • RBC transfusion 2 nd Line • Immunosuppressive agents 3 rd Line • Rituximab (off - label) 4 th Line • Splenectomy Unmet need • Currently no FDA - approved therapies for WAIHA • Only one - third of all patients maintain sustained disease control once steroids are discontinued - Majority of patients will require either long - term steroid treatment or additional therapies 1 • No clear guidelines on choice of treatment in patients failing treatment with corticosteroids • RBC transfusions are indicated in patients who require immediate stabilization, despite the fact that autoantibodies present in WAIHA patients may react against RBCs in the transfusion product 1,2 1. Salama A. Treatment Options for Primary Autoimmune Hemolytic Anemia: A Short Comprehensive Review. Transfus Med Hemother ., 2015 2. Park S.H. Diagnosis and treatment of autoimmune hemolytic anemia: classic approach and recent advances. Blood Res., 2016

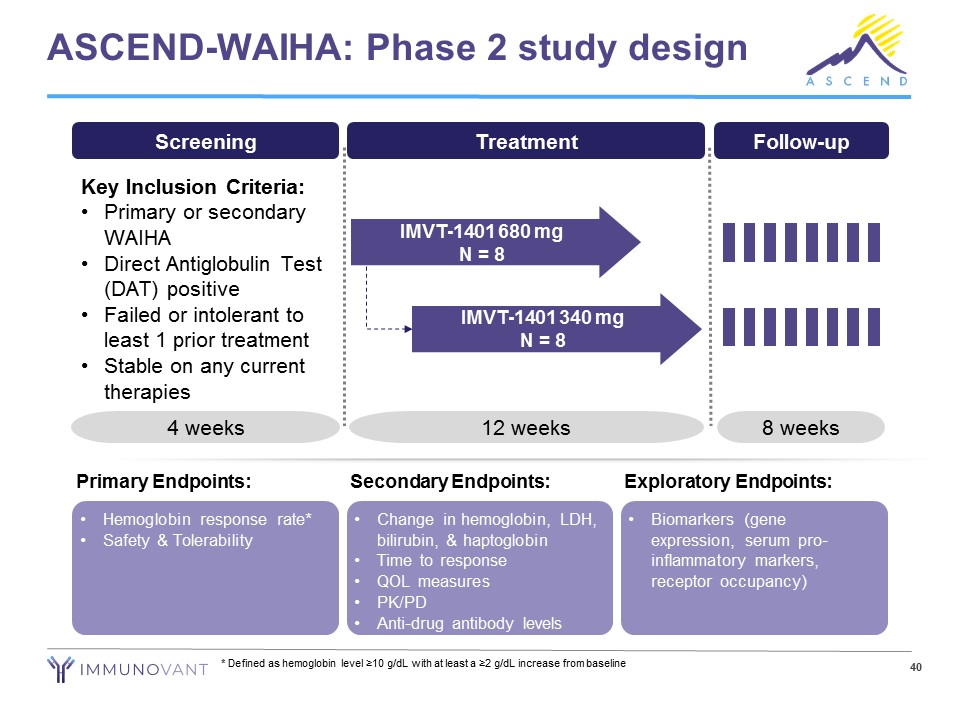

ASCEND - WAIHA: Phase 2 study design • Hemoglobin response rate* • Safety & Tolerability Primary Endpoints: • Change in hemoglobin, LDH, bilirubin, & haptoglobin • Time to response • QOL measures • PK/PD • Anti - drug antibody levels Secondary Endpoints: • Biomarkers (gene expression, serum pro - inflammatory markers, receptor occupancy) Exploratory Endpoints: 40 * Defined as hemoglobin level ≥10 g/dL with at least a ≥2 g/dL increase from baseline Screening Key Inclusion Criteria: • Primary or secondary WAIHA • Direct Antiglobulin Test (DAT) positive • Failed or intolerant to least 1 prior treatment • Stable on any current therapies 4 weeks Follow - up 8 weeks Treatment IMVT - 1401 680 mg N = 8 IMVT - 1401 340 mg N = 8 12 weeks

Immunovant Recap

42 Our vision: Normal lives for patients with autoimmune diseases Our asset: IMVT - 1401, a novel, fully human monoclonal antibody inhibiting FcRn - mediated recycling of IgG Our strategy for IMVT - 1401: • Be best - in - class in target indications where anti - FcRn mechanism has already established clinical proof - of - concept • Be first to study FcRn inhibition in target indications with clear biologic rationale and no known in - class competition Our near - term value drivers: Four anticipated data readouts over the next 20 months

• Phase 2a open for enrollment − Top - line results of Phase 2a study expected in 1H 2020 • Pivotal Phase 3 study initiation expected in 2020 43 MG GO WAIHA • IND submission expected in 2H 2019 − Initial results of Phase 2a study expected in Q4 2020 Phase 2a open for enrollment − Initial results of Phase 2a study in Q1 2020 Phase 2b proof - of - concept study open for enrollment − Top - line results of Phase 2b study expected in early 2021 IMVT - 1401: Multiple anticipated near - term value inflection points P P P